Matt’s Note: This is a special series to commemorate Mike Carr’s newest trading strategy.

Yesterday, I introduced you to the man, the myth, the legend that is Mike Carr.

And today, he’s making a controversial call.

Mike believes the market you’ve known — likely for your entire life — has irreversibly changed. You cannot invest the same way you have for the last 40 years, because the market won’t act the way it has for the last 40 years.

Read on to learn why, and find out the best thing you can do today to ensure you adapt to this new environment…

The Market You Know Is Dead and Gone: Here’s What to Do

I’m a short-term trader. The reason for that is because I understand long-term risks.

Long-term investors are often too comfortable in their belief that the market of today will be there when they wake up decades from now.

The fact is, economies change drastically in that time. And passively investing through it all can severely hurt your returns.

Any student of history understands this, and that’s why I’ve been an active market trader for almost 40 years.

Looking back to when I started … The world was very different as I was preparing to leave college in 1983.

Inflation — and the universal fear of rising prices — drove most trends. This led to high interest rates, low overall stock market returns and strong bond returns.

Things changed not too long after that, fueling a generational bull market that has only just ended.

In the aftermath, we’re now in a completely different kind of economy that most are not prepared for.

And I’m going to prepare you for this new world today and rest of this week, because understanding what has changed — and what you should do — will be essential to protect and growth the wealth you have.

Right now, interest rates are climbing again and inflation is high. It’s a different market than the one we’ve enjoyed for 40 years…

The Threat to Long-Term Returns Is Here

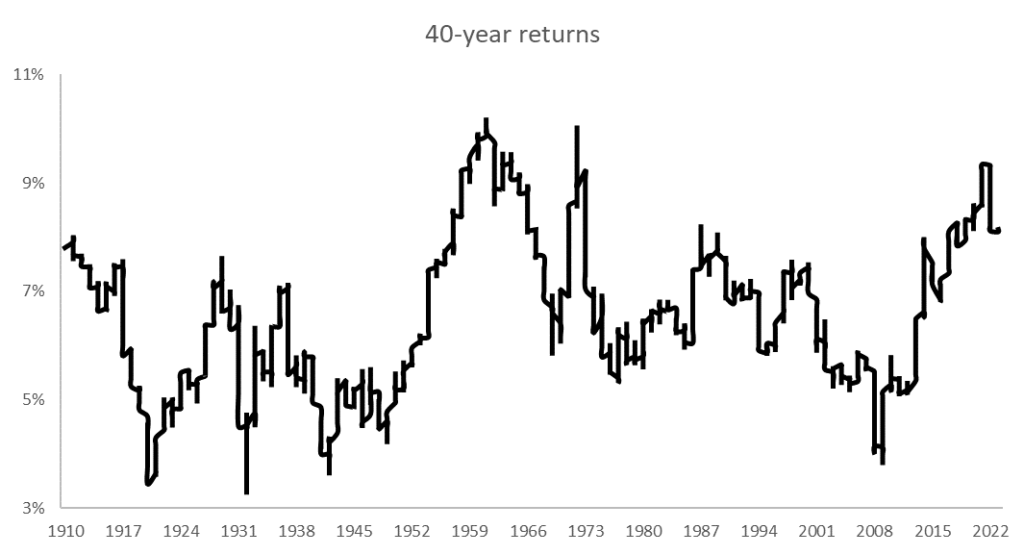

All we really need to do to understand the threat to long-term returns is look at this chart:

It shows annualized returns of the previous 40 years starting in 1910. You’ll notice there are three notable peaks in the chart — in 1961, 1973 and 2022.

Returns hit a record high in 1961. That was the same time interest rates turned higher.

Rates would rise steadily for the next 20 years alongside inflation. Interest rates on 10-year Treasurys rose from 3.7% in 1961 to 15.3% in 1981. The Consumer Price Index went from 0.8% to 14.6% over that time.

The second peak in the chart occurred in 1972. That’s because returns from the worst of the Great Depression in the 1930s dropped out of the calculation at that point. That quickly reversed, and market gains returned to their previous range in a matter of months.

What’s important to understand about this era is that it was a long period of higher interest rates, higher inflation and low stock market returns. It ended in the mid-1980s as low interest rates and low inflation drove higher stock prices.

The third and most relevant peak occurred in January 2022. The interest rate on the 10-year Treasury was at 1.5% and started to move higher. Inflation was at 7.6% but Federal Reserve officials still assured us it was transitory.

Now, the Fed admits inflation is a problem, and is raising interest rates to fix it.

The official inflation target remains at 2%. Officials project reaching that level in 2025. Consumers expect inflation to be closer to 3% until at least 2028.

As long as inflation expectations remain high, the large investors who command trillions of capital in the bond market — pension funds, life insurers, mutual funds — will demand higher interest rates.

This will weigh on the stock market, since high rates make bonds more attractive to individual investors as well.

The chart of 40-year returns shows that highs are followed by lows. With inflation and interest rates tilting against investors, there’s no reason to fight the trend. These long-term trends will weigh on stock market returns for decades.

Your High-Inflation, High-Rates Battleplan

This is why I say the stock market of the last 40 years is gone.

Investors were spoiled by a near half-century of low inflation and low interest rates, driving high stock returns. We’re now facing the opposite, and this situation will likely remain for a similar length of time.

You can’t depend on long-term, passive investing in a high-inflation environment like you could in the low-inflation environment we just left behind.

So what should you do instead?

I believe you should trade more actively. For my money, the coming decades will be volatile. Stocks might provide zero or negative returns to those who buy and hold.

Volatility is a scourge for those who invest passively. But for active traders, volatility is the greatest gift you could ask for.

We’ve seen plenty of volatility in the market this last year. And I’ve been actively exploiting that volatility for regular gains.

Yes, it’s more work. It’s also very much worth this extra effort.

You see, I’ve come up with a way to find a trade every single day at 9:46 a.m. Eastern time that targets 50% gains in no more than two hours. And we’ve hit that profit target in as little as five minutes.

In the past week, five out of eight trades were winners. If you’d traded an equal number of contracts on each position, you’d have a total return of 19%.

For reference, the S&P 500 rose 1% last week — chopping back and forth the whole way.

I’ll dive deeper into this strategy as we carry on through the week. For today, though, I want you to heed my warning about the market moving forward.

It’s not too late to adapt to this once-in-a-lifetime change. But the first step is accepting this change for what it is: an opportunity.

To start, I suggest reframing your thinking about diversification. Many people believe diversification means buying lots of different stocks in different sectors. But in a period of high inflation, high interest rates, and low stock market returns, that won’t work.

I’ll show you what will work in tomorrow’s Stock Power Daily: 9:46 Edition.

Speak to you then,

Mike Carr

Senior Technical Analyst