Coming from a family of farmers, I learned from an early age how important it is to do more with less.

This mantra has stuck with the American farmer for decades.

Now technology is lending a helping hand.

Farmers are able to incorporate artificial intelligence (AI), sensors and data analytics to work harder and smarter.

This has created a boom in precision agriculture — where farmers use technology and data analysis to increase crop production and reduce labor on farms all over the world.

Market researcher Imarc Group projects the precision agriculture market will reach $14.4 billion by 2027 — a 113.6% increase from 2021.

Using our proprietary Stock Power Ratings system, I found a company that manufactures specialized products used in precision agriculture.

Today’s Power Stock is Lindsay Corp. (NYSE: LNN).

LNN manufactures irrigation systems that incorporate technology to water crops more effectively and with less waste.

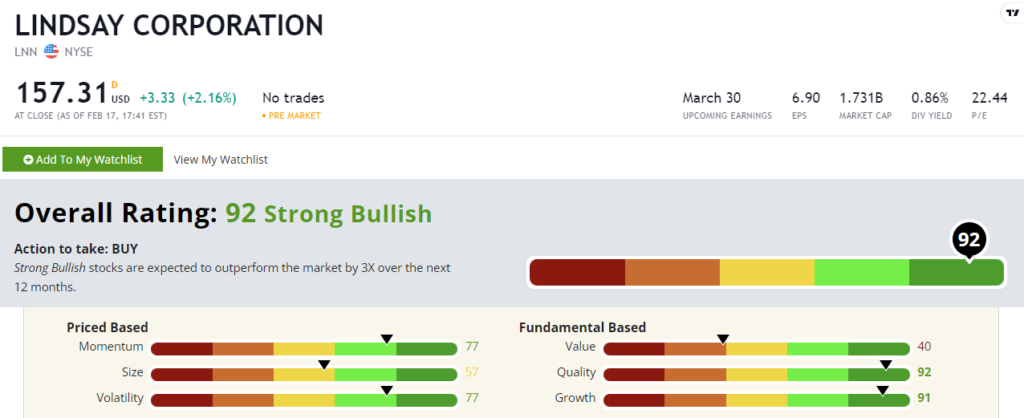

Lindsay stock scores a “Strong Bullish” 92 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

Lindsay Stock: High Marks on Quality and Growth

Omaha, Nebraska-based Lindsay recently notched an outstanding quarter.

Highlights include:

- Quarterly net earnings of $18.2 million was a 130.4% increase over net earnings a year ago!

- Total revenue for the quarter was $176.2 million — up 6% from the same quarter a year ago.

Lindsay stock scores a 91 on our growth factor thanks in part to these strong quarterly numbers.

The stock is also strong on our quality factor, scoring a 92.

Its returns on assets, equity and investment are all higher than peer averages… and its operating margin is 13.6%, compared to its industry peer average of negative 2.2%.

This all tells us that LNN is a better growth and quality stock than its machinery manufacturing peers.

But the stock's momentum is also worth noting.

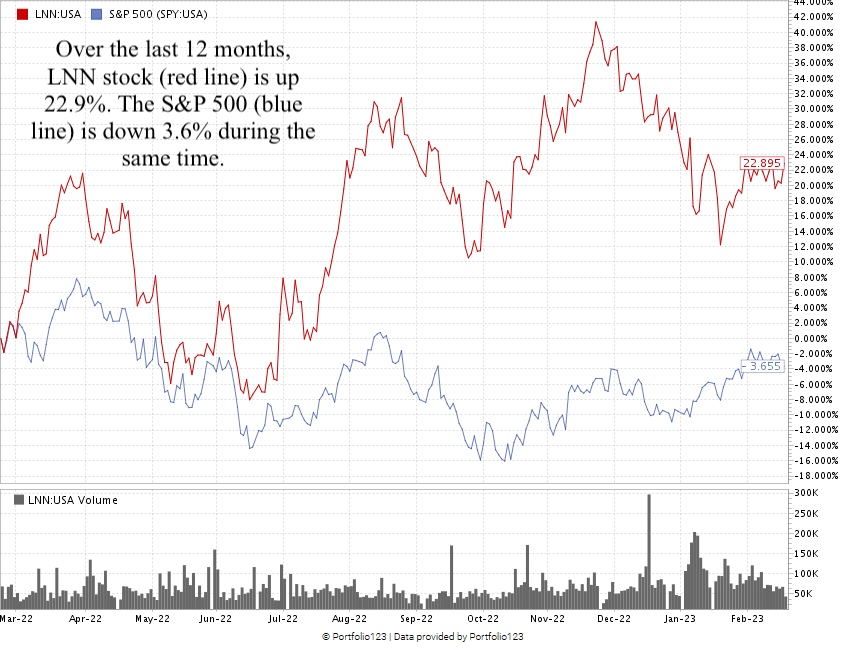

Just look at the chart below:

Created in February 2023.

Over the last 12 months, LNN has climbed — earning it a 77 on our momentum factor.

LNN scores a 92 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by 3X in the next 12 months.

Farmers around the world have been used to doing more with less.

Now, technology is helping make that process easier… allowing farmers to be more productive with less labor.

As a producer of products helping farmers get water to their crops effectively and with little waste, Lindsay stock is one to consider for your portfolio.

Bonus: The company’s 0.87% dividend is an annual payout of $1.36 per share that you own.

Stay Tuned: Housing Boom South of the Border

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Tomorrow, I’ll share all the details on a company that is leading the construction charge in Mexico as demand booms.

Until then.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets