“Higher for longer.”

We’ve been hearing it for several months now.

It’s the Federal Reserve’s rallying cry to keep interest rates steady.

At the turn of 2024, the expectation was cooling inflation would prompt the Fed to start cutting rates again.

To me, cutting rates in early 2024 was too soon. The data didn’t support that kind of a move.

Markets seemed to pay heed to that thought, as the three major U.S. indexes started the year flat and turned down in April.

And now, after the Fed decided to keep rates steady in its May meeting, markets stopped caring.

Today, I’ll show you why higher for longer is the new normal and why the market shows little sign of slowing down from here.

Bullish Investors Have a New Appetite for Risk

Under normal circumstances, investors would be uneasy about the third Fed meeting without a rate cut — especially after the central bank had signaled potential rate cuts were in the works.

Yet, here we are.

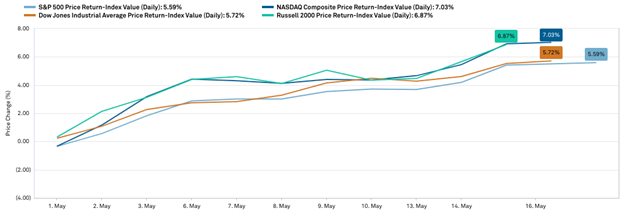

Last week, the three major indexes (Dow, S&P 500 and Nasdaq) reached all-time highs, reversing a lackluster April.

U.S. Indexes Race Higher In May

Since the start of the month, those three indexes (and the Russell 2000 small-cap index) have risen at least 5.5%.

One of the big reasons why…

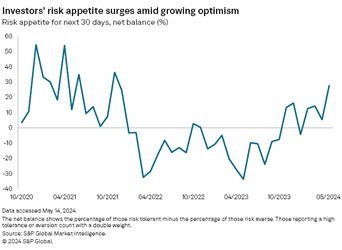

Investors’ appetite for risk has reached the highest level since 2021:

S&P Global’s Investment Manager Index is a survey of investment managers to determine investment risk tolerance.

Risk appetite grew to 28% in May — a five percentage-point bump from April — which is a complete reversal from the same time last year when the reading was -34%.

But what’s the rationale behind this shift?

Investors are confident stronger earnings will continue and that the U.S. and global economies will avoid a recession.

Do you know what’s not mentioned very much in the survey? Interest rates.

That’s because higher for longer is the new normal.

Investors provided another indication that bullish trading should continue. It’s something we haven’t seen this year…

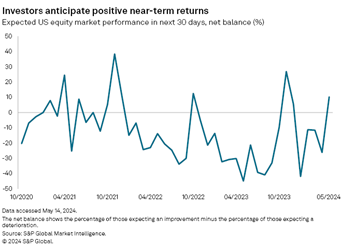

Investors Flip on Near-Term Returns

For the first time in 2024, investors shared positive expectations for short-term stock market returns:

The Equity Returns Index — a sentiment reading for investors — went from negative (bearish) in April to positive (bullish) in May. What’s more, investors expecting the market to lose value fell to a six-month low of just 23% this month.

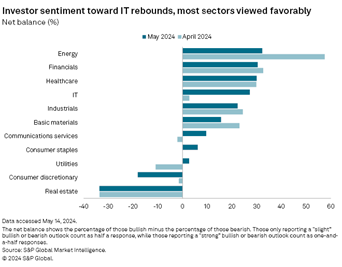

The bullish sentiment for positive stock returns extended to a vast majority of S&P 500 sectors:

Positive sentiment for the information technology sector increased significantly, while investors were bearish on consumer discretionary and real estate stocks.

Bottom line: Fed interest rate decisions still hold some sway over investors, but rather than staring forlornly into a dark tunnel, investors are looking for any sliver of light at the end.

As long as there is any glimmer of hope that the Fed won’t raise rates, I believe investors will continue to be bullish in the near term.

While higher for longer rates would yield flat to lower returns under normal circumstances, we are in anything but now.

Higher for longer is the new norm, and investors are fine with that … for the time being.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets