Artificial intelligence (AI) is already fueling the biggest stock market transformation we’ve seen since the early days of the internet over 20 years ago.

But things are just getting started.

According to Google CEO Sundar Pichai, the new AI era “will be the biggest technological shift we see in our lifetimes.”

And tech companies from all over the market are going all-in on this new revolution.

In a recent CNBC survey, 50% of top tech executives reported AI as their No. 1 budget item for the year ahead.

Now it’s easy to get excited about all the possibilities here, but it’s important to remember that AI is still maturing.

That means the technology, the market and even the investors are all still evolving.

Currently, we’re in what I like to call the “venture capital” phase of AI investing.

We’ve got a market that’s flush with all sorts of brand-new AI investments, and we don’t have many established frontrunners.

Information can be sparse, but enthusiasm isn’t in short supply. AI is all over the news and the financial media. So investors are pouring cash into anything that’s even remotely AI-related.

There’s plenty of opportunity investing at this early stage.

But there are also some very real risks you’ll need to keep in mind…

Survival of the Fittest

Every breakthrough technology brings with it a flood of ambitious new companies.

And it takes time to separate the real performers from the failed startups.

Back in 1919 for example, when the automobile was still a new technology, there were 2,000 different auto manufacturers in the US.

Just ten years later, only 44 of those manufacturers remained.

So it only takes a few years for the market to weed out most of the non-performers.

Which is what we’re already starting to see in the AI space.

BigBear.AI (NYSE: BBAI) famously captured media attention near the very start of the AI boom.

The company made lofty promises about developing AI solutions for military and business. But they ultimately didn’t have much to offer.

Since going public via SPAC in 2021, shares have sunk 86%.

There’s also plenty of reward to go with the risk of investing in AI this early.

Just like how some early internet investors lost money on failures like Pets.com … while others earned life-changing fortunes from Amazon and eBay.

We can expect the same will be true for early AI investors.

(Editor’s Note: Adam’s 10X Stocks subscribers had the chance to double their money in just three months from a single AI trade earlier this year.)

As a result, this kind of investing isn’t exactly for everyone.

Some investors would rather “dip their toe” into AI by sticking to big, established tech giants like Google’s parent company Alphabet Inc. (Nasdaq: GOOGL) or NVIDIA Corp. (Nasdaq: NVDA).

The logic makes sense.

After all, why waste time chasing some company that might be “The Google of AI” when you can just buy Google and be done with it?

Unfortunately, the opportunity isn’t so cut and dry…

Google & NVIDIA: It’s Complicated

I actually recommended Google to my Green Zone Fortunes subscribers in January of 2022 — based in no small part on its early AI successes.

After acquiring AI research lab DeepMind in 2014, Google proceeded to grow revenues by more than 20X in just five years!

Unfortunately, 2022’s bear market tumble triggered our stop-loss to exit the position.

Alphabet is still a great investment overall, but shares have already risen by more than 51% this year, largely thanks to the growing hype around AI investing.

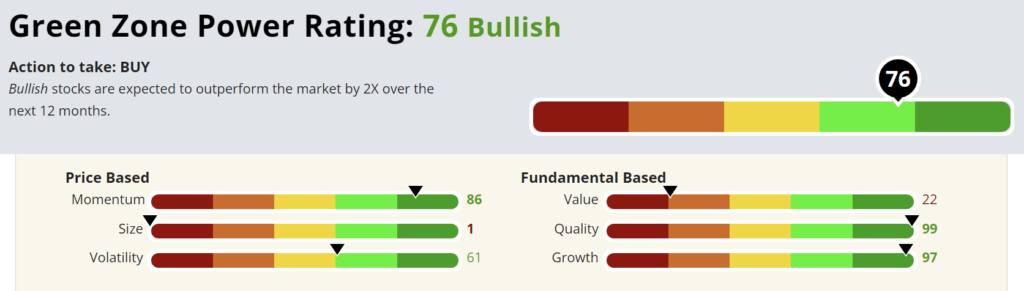

When I recommended it in January of last year, Google’s Green Zone Power Ratings sat at 91 out of 100. That’s an outstanding and “Strong Bullish” score.

But now, it’s sunk to 76:

As you can see, that’s still “Bullish.” And it’s still a great stock to have in your portfolio.

The same is true for NVIDIA.

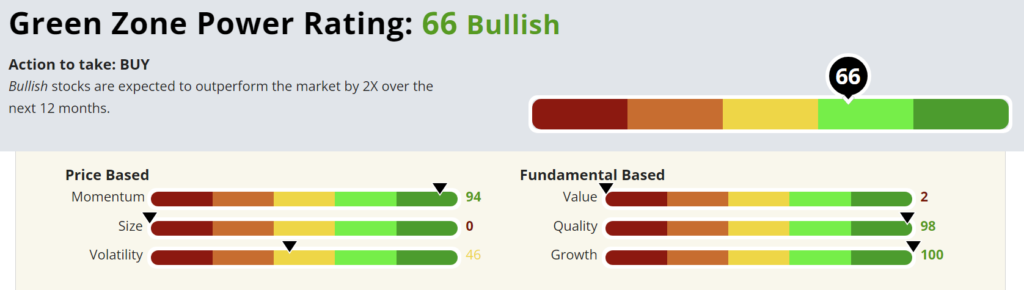

Last year’s bear market hit the world’s most valuable chipmaker hard. But this year’s AI fever has helped shares more than triple since the beginning of the year.

As a result, it’s still a great stock … but NVIDIA’s Green Zone Power Ratings are still at just 66 out of 100:

These ratings are a powerful tool to help filter out the hype and the noise — leaving you with the unbiased facts about a stock’s performance, and its potential for the future.

In both cases, we’re still bullish.

But due to the recent volatility and weak value ratings, we’re likely to find better ratings (and better opportunities) with other AI investments.

2024’s AI-Powered Profits

Between this year’s run-up in Big Tech companies and the crash of once-hot SPACs like BBAI, it’s clear that the first big wave of AI investing is already in the books.

The second wave of any new technology is typically going to be more competitive, more streamlined, and more effective.

We’re already starting to see some of those types of opportunities emerge in the market.

At the same time, AI isn’t just transforming WHAT we invest in…

It’s also changing HOW we invest…

Most of us can remember what it was like before the internet, when it would’ve been unthinkable to tap a few keys on your keyboard and call up years of stock market data.

We take our browsers for granted today, but internet access spurred a massive leap forward for Main Street investors.

A recent long-term study from the University of Chicago’s Becker Friedman Institute found that internet led large increases in both stock market participation and risk-adjusted returns.

In their words, internet access led to a “democratization of finance.”

So it wasn’t just about buying the best internet stocks.

It was about figuring out how to use the internet to find the best stocks.

Now that’s happening all over again with artificial intelligence. And the upside will dwarf what we saw in the early internet era.

Because AI gives us the power to analyze billions of data points 125,000 times faster than the human brain.

It can learn, adapt and evaluate opportunities in ways we haven’t even realized yet.

That’s why I recently began working with TradeSmith CEO Keith Kaplan.

Keith and his team have spent $18 million and over 50,000 man-hours developing the most cutting-edge financial innovations on the market.

And his latest system could be the breakthrough that sends AI-powered investing into high gear.

It’s a predictive Analytical Engine (An-E for short) that can determine where a stock is headed in the next few days, weeks, or even months.

Keith and I sat down with Chris Hurt to reveal how this system has already forecasted stock prices with remarkable accuracy … and how Main Street investors can start using it today…

See the full presentation HERE.

To good profits,

Adam O’Dell

Chief Investment Strategist, Money & Markets