Let’s brush aside some financial noise today, as I’d like to show you the best retirement investment you can make.

I’m talking about secure dividends that will grow every year, fund your regular expenses today, plus grow your capital so you don’t have to ever worry about running out of money.

You won’t have to worry about what the Fed says, either, because this worry-free strategy is ahead of Jay Powell and his crew. In fact, this “one-click” indicator not only tells you what to buy, but it nails the “when” better than any armchair (or professional) Fed watcher.

We’re going to use real estate investment trusts (REITs) as our vehicles of choice.

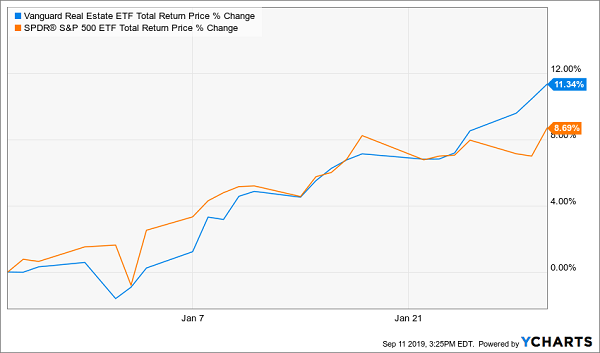

Why REITs? For starters, they’re pullback-proof. For most of the late 2018 downturn, REITs actually rose. And even when they did get caught in the downdraft, they only fell half as much as the rest of the market:

REITs Show Their “Pullback-Proof” Chops

What’s more, by simply watching REITs, you can tell where the Fed will go next. Consider last January: As the Fed chief stubbornly stuck to his rate-hike plans throughout the month, investors in REITs — which are an ideal play on falling rates, as we’ll dive into in a moment — saw right through him.

They piled in.

Before poor Powell could find his way to a microphone to swear off his rate hikes, savvy REIT buyers had pounded these trusts a lot higher than the market — even though REITs were starting from a higher base, thanks to their resilience in the pullback:

REITs Call Powell’s Bluff

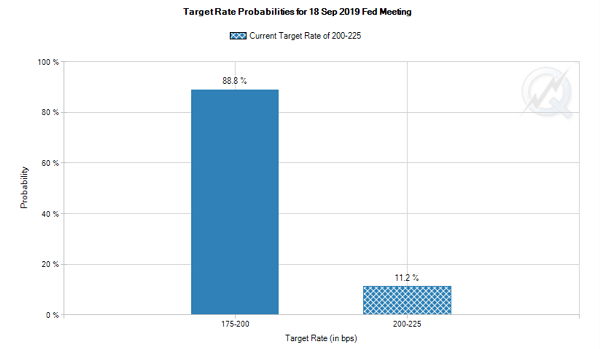

Fast forward to today and we’ve got ideal conditions for REIT investing. First off, interest rates are low and traders betting through the futures market expect them to go lower:

Source: CME Group

Second, the yield on the 10-year Treasury has collapsed, sitting at 1.75% after hitting highs above 3.2% late last year.

And some Wall Street vets, like Bob Michele, CIO and head of global fixed income at JPMorgan Asset Management, say they see the yield on the 10-year going to zero. Others see negative interest rates as a real possibility here in the U.S.

I think you’ll agree that REITs’ big dividends (roughly double, on average, what your typical S&P 500 stock pays) will be irresistible to a lot of investors if the other option is to pay the bank to hold onto their money.

You can set yourself up for bigger gains — and greater safety — if you look for REITs whose dividends are not only growing but accelerating. That’s because an accelerating dividend acts like a magnet on a company’s share price — pulling its payout higher with every single increase.

You can see this pattern in stock after stock — and not just REITs. Check out how shares of Coca-Cola (KO) rolled higher with each payout hike:

Coke’s “Dividend Magnet” in Action

It’s uncanny. And it shows that you just can’t keep a good dividend-payer down.

But we’re not going to buy shares of Coke today because, as you can see above, its dividend growth is slowing. To lock in our upside (and hedge our downside) we need stocks with payouts are, as I mentioned earlier, delivering bigger and bigger hikes every year.

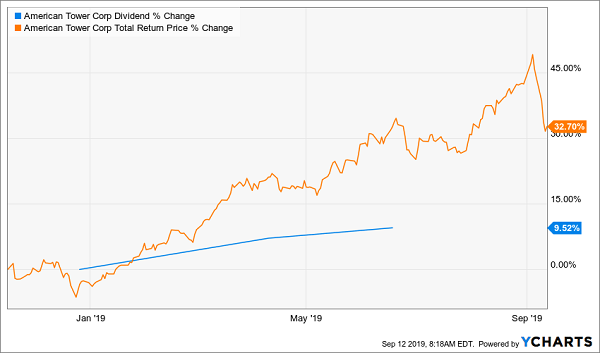

When you buy “dividend accelerators,” gains can come fast — I’m talking 32% in just 10 months fast.

How ‘Dividend Magnets’ Propelled Us to a Quick 32% Gain

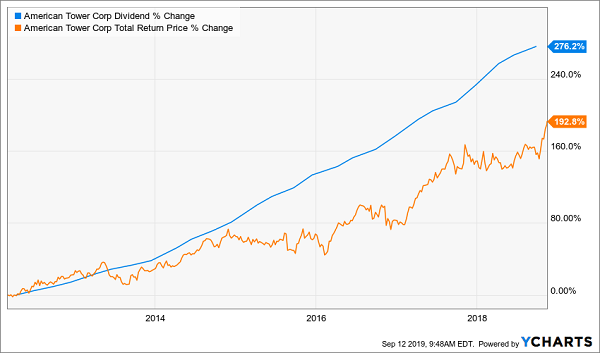

To see this dead-simple dividend-growth strategy in action, look at American Tower (AMT), a REIT I recommended in my Hidden Yields advisory in November 2018.

The REIT is a lynchpin of the world’s data networks, with 150,000-plus cellphone towers scattered around the planet.

AMT is one of four major cell-tower REITs — the others being SBA Communications (SBAC), Crown Castle International (CCI) and Uniti Group (UNIT).

The REIT yields 1.6% today. But that low current yield masks the fact that management hikes the payout every quarter, and by no small amount: The dividend has soared 338% since American Tower declared its first payout in March 2012.

But a funny thing happened: After tracking the dividend closely, AMT’s share price fell off the pace. And when that gap got particularly wide late last year, we pounced:

AMT’s Dividend Magnet (Temporarily) Loses Its Grip …

The result? In the following 10 months, we bagged three dividend hikes (a nearly 10% raise in all) and 32% in total returns as AMT’s price raced to catch up to its dividend. That’s nearly three times the S&P 500’s 11.7% gain in that time.

… Then Yanks Us to Big Gains (and Dividends)

69% Gains, 5 Payout Hikes and 107% Dividend Growth—in 3 Years.

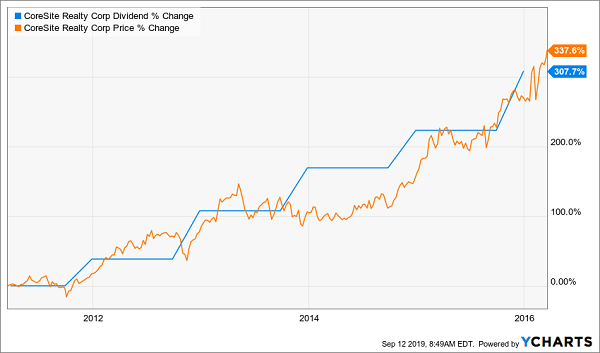

If you’re still not sold on the power of a surging payout, let me show you what happened to another data-center REIT: CoreSite Realty (COR). Before I recommended CoreSite in March 2016, it was showing the very same dividends-up, share-price-up pattern:

CoreSite Auditions for Our Hidden Yields Portfolio

It is true that, unlike with AMT, CoreSite’s dividend hadn’t fallen behind its payout. But that didn’t matter because management was flush with cash.

Driven by top-quality tenants like Microsoft (MSFT) and Verizon (VZ), CoreSite had seen its revenue grow 17% annually and funds from operations (FFO, the REIT equivalent of earnings per share) surge 24% over the preceding three years, so management had plenty of runway to grow the dividend.

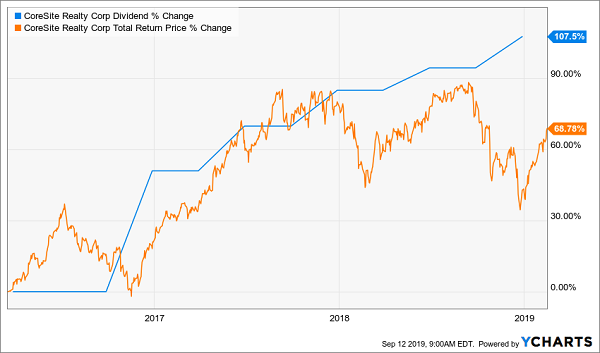

I’d seen enough — I issued a buy call on the stock in Hidden Yields on March 18, 2016.

What happened? By February 2019, when we closed our position, management had hiked the payout five times — more than doubling it in size — and driving us to a 69% total return in just under three years.

CoreSite Rolls to a Fast Dividend Double

That’s the punch a soaring dividend packs. When you combine it with plunging (and possibly even negative) interest rates, you get a setup for even bigger upside.

To learn more about generating monthly dividends as high as 8%, click here.

• This article was originally published by Contrarian Outlook. You can learn more about Brett Owens and Contrarian Income Report right here.