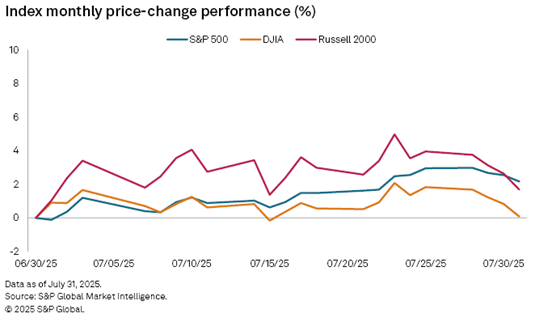

In July, the S&P 500 jumped 2.2%, capping three straight months of rallies.

While financial media has focused on the benchmark index, performance in another index has me optimistic about a different basket of stocks.

Coverage has been relative to size and volatility.

However, this stock group outperformed the S&P 500 for most of July.

That performance, along with other factors, tells me to watch for more positive momentum over the rest of the year and into 2026.

Let me explain…

Small-Cap Stocks Poised for a Comeback

Since the start of 2025, the iShares Russell 2000 ETF’s (IWM) performance looks lackluster … down 0.4%.

On the other hand, the SPDR S&P 500 ETF (SPY) is up nearly 8% for the year.

However, after months of sinking lower to start the year, President Trump’s Liberation Day reciprocal tariff announcement in April sparked a rally, and the small-cap ETF is up 21.6% since then, compared to SPY’s 25% gain.

What’s more telling of this rally by small stocks is performance in July:

The S&P 500 gained 2.2% for the month; however, the Russell 2000 was up 1.7%, with the small-cap fund outpacing the benchmark for most of that time.

Not quite the same, I know, but for an index that’s been relatively flat for the year, nearly matching the gain of the benchmark is something to keep an eye on.

I dove a little deeper and found something else that could signify a sustained rally in small-cap stocks:

IWM Hovers Above SMA

Since February, IWM has been trading below its 200-day moving average (the gray line in the chart above).

You can also see that IWM flashed a bullish signal on Adam’s Kinetic Profits Indicator toward the end of June. For more information on this indicator, click here.

Notice that the moving average has played both support (January 2025) and resistance (June 2025) for the ETF.

However, since July, IWM has moved above that moving average, tested support, and moved back above to start August.

So, we have upward momentum and a breakthrough at support.

To wrap up today’s analysis, let’s run IWM through Adam’s Green Zone Power Rating system.

IWM Shows Better Overall and Consistent Momentum

The Green Zone Power Rating system is focused on individual stocks, but I can still gauge the performance of an ETF by running individual holdings through an X-ray … similar to what Adam does in our Tuesday edition of What My System Says Today.

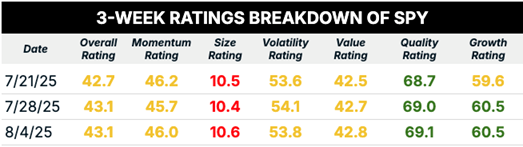

I’ll start with the average ratings of SPY.

I went out by one decimal point, as we are talking about 500 stocks:

Overall, the index hasn’t moved much … holding steady over the last two weeks.

While the index’s Value, Quality and Growth ratings have grown, Momentum went from 46.2 three weeks ago to 46 last week… showing a slight slowdown.

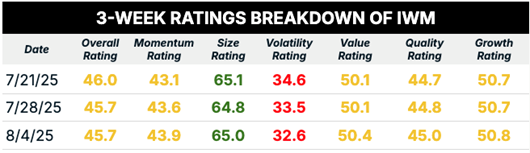

Now, let’s look at IWM:

Value, Quality and Growth have expanded over the last three weeks. Momentum went from 43.1 three weeks ago to 43.9 last week.

IWM’s overall ratings average declined by 0.3, but it remains more than 2 points higher than SPY.

Technically, IWM is rated better than the benchmark SPY, and IWM’s Momentum average is also growing faster.

There’s one last thing to consider regarding a potential small-cap rally…

Fed Decision Looms Large

Last week, the Federal Reserve voted to hold benchmark interest rates steady for the fifth straight meeting; however, clouds are swirling to indicate that might change.

An important side note to that decision is that, for the first time since 1993, more than one Fed governor dissented and voted against the majority.

This means that two voting members wanted a rate cut.

Since then, the Labor Department reported that payrolls had grown by just 73,000 in July. The three-month average for job growth is just 35,000.

It suggests the labor market in the U.S. is not nearly as strong as we might’ve thought.

One thing to keep in mind is that inflation is only half of the Fed’s mandate. The other half relates to a healthy labor market.

With inflation still above the 2% threshold for the Fed and the labor market not looking as rosy as once believed, we may see a rate cut in the coming months.

Any cut opens a big door for small-cap stocks because it reduces borrowing costs, opens up funding channels and boosts investor sentiment.

Small-cap stocks are simmering right now … poised for a breakout. A pending rate cut from the Fed would be just the thing to push those stocks into a sustained uptrend.

That’s all from me today.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

P.S. If you want to run any individual small-cap stocks (or large caps for that matter) through our Green Zone Power Rating system, click here to learn how you can join our flagship Green Zone Fortunes investing service now. By joining, you’ll gain unlimited access to the system, as well as many other benefits to help you along on your investing journey.