I’ll admit, when Editor-at-Large Matt Collins invited me to a professional wrestling match last week, I was a little skeptical…

But WWE’s Monday Night Raw blew me away!

A sold-out crowd packed the home of my Florida Panthers in Sunrise, and it was unlike anything I’ve seen at other sporting events:

13,000 fans on their feet as Sheamus makes his entrance.

Fans roared with enthusiasm as their favorite superstars strutted to the ring.

They sang along with every theme song.

They also rang down with a wall of “BOOs” when the heels (aka the “bad guys”) showed up. Gunther, the current heavyweight champion, couldn’t even get a word in over the deafening roar.

Love it or hate it, there’s no denying that professional wrestling is a spectacle to behold.

And even though I was “off-the-clock,” I couldn’t help but notice what an impressive business WWE was running…

Beyond the in-ring action, eager fans were crowding massive merchandise tables. When a match wasn’t running, the jumbotron blasted advertisements for upcoming premium events, cross-promotion with major sports leagues, and even major deals with municipalities.

WWE has no doubt distilled the magic I remember so fondly from my childhood when I watched guys like Sting and Rob Van Dam fly around the ring on TV.

But they’ve also transformed their business and refined their appeal to investors.

So I was curious to see the results reflected in the company’s Green Zone Power Ratings.

I never thought I’d say this, but … is it time to invest in wrestling stocks?

WWE Is Going BIG

WWE has gone through a sea change over the last year.

In September 2023, WWE and Endeavor Group Holdings UFC merged, creating TKO Group Holdings Inc., which trades publicly on the NYSE under the ticker symbol “TKO.”

Pairing WWE’s over-the-top theatrics with the UFC’s dominance in mixed martial arts felt like the perfect one-two punch. Both sides brought in over $1.3 billion in revenue last year.

Guiding the WWE side is Paul Levesque, better known to wrestling fans as his in-ring persona, “Triple H.”

Levesque is one of the most successful wrestlers in the company’s history, so he knows how to put a fresh and exciting spin on wrestling’s biggest show.

Earlier this year, a sell-out crowd of 62,500 (including Matt Collins) packed Lincoln Financial Field in Philadelphia for the two-day WrestleMania 40 event. As Matt describes it:

WrestleMania is the equivalent of the Super Bowl for wrestling fans. It’s a generational “bucket list” event that fans travel thousands of miles to attend with friends and family. ‘Mania lasts all weekend, takes over entire cities, and sold $38 million in tickets for 2024 (up 78% from the year before). And every step of the way, from programming to merchandising, you can tell the company is extremely well-attuned to its die-hard fanbase. There’s nothing else like it on Earth.

This weekend, WWE is doing it again with its first major event in Germany, the Bash in Berlin. They’ve also just announced that its “Big 3” events will take place at Lucas Oil Stadium in Indianapolis over the coming years, starting with the Royal Rumble in February 2025.

In addition, WWE will start airing its Monday Night Raw events in the U.S. exclusively on Netflix in January. International Netflix subscribers will gain access to the entire catalog of WWE events.

There’s clear momentum behind WWE, so let’s see what Adam O’Dell’s proprietary system says about the broader TKO stock…

Growth Is a Lag on TKO Stock

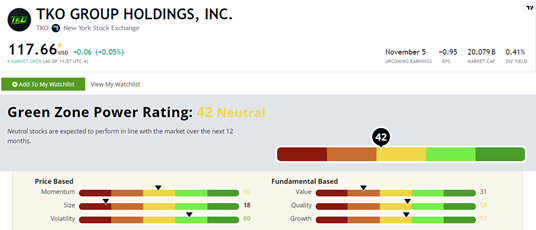

TKO Group Holdings Inc. (NYSE: TKO) rates a “Neutral” 42 out of 100 in Green Zone Power Ratings. Neutral stocks are expected to track the broader market over the next 12 months.

We dug deeper into TKO’s Growth rating of 57. Its one-year sales growth rate is strong at 47%, but its earnings are a huge drag. TKO’s trailing 12-month earnings per share is -147.2%.

Its Value rating of 31 is another key point of concern.

I asked Chief Research Analyst Matt Clark about TKO’s lack of price-to-earnings: “A negative P/E ratio would indicate the company is reporting losses. The big concern is if it’s reporting losses over a long period.”

He mentioned this could be due in part to the merger, which is still less than a year old.

So while WWE is making big moves to reach the wrestling fan masses, I’m sticking this stock on my watchlist for now.

But you know I’ll be tuning in for the Bash in Berlin tomorrow! Who needs college football?

Until next time,

Chad Stone

Managing Editor, Money & Markets