Costco is known for great prices, bulk shopping and, of course, the infamous $1.50 hot dog and soda combo.

Costco is not known for being a purveyor of precious metals.

At least, not until now…

During the last quarter, Costco reported selling more than $100 million in gold bullion.

The discount retailer’s individual 1-ounce bars are certified, packaged for retail and priced at over $2,000 per ounce.

And these bars typically sell out within just a few hours of listing on the Costco website:

This kind of ravenous demand for gold isn’t surprising.

After all — the last two years have seen the fastest rake-hiking cycle in Federal Reserve history … multiple massive bank failures … and the worst year on record for a combined portfolio of stocks and bonds.

Amid that uncertainty, investors want a safe store of value that gives some peace of mind.

That’s why gold recently set a new all-time high, clearing $2,100 on December 4. (Did you miss the memo?)

But despite gold’s success, gold stocks are lagging far behind.

And this isn’t a new problem, either…

Gold Decoupled From Gold Stocks

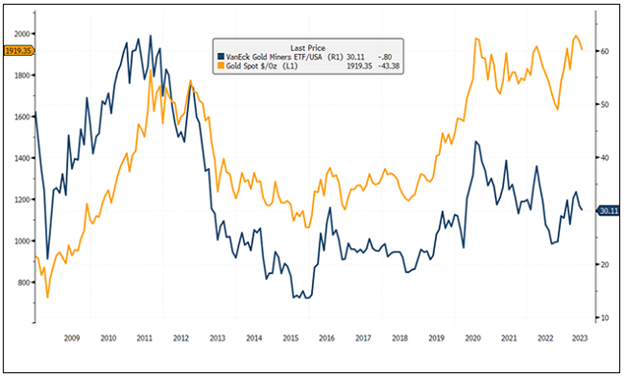

The gold market underwent a massive transformation after the financial crisis in 2008, and investors haven’t looked back since.

After years of performing in line with stocks, bonds and dollar investments, gold took off — effectively “decoupling” from the herd as investors sought a safe haven for their hard-earned savings:

Gold Took Off in 2008

Surging gold prices and demand triggered a tidal wave of investment in the sector.

Capital expenditure soared as a result — growing by 60% between 2011 and 2012, just as gold’s bull market came to a close. This massive investment turned into a massive burden for gold producers as bullion prices sank — weighing on capital returns for the next five years.

Producers were reluctant to repeat their mistakes of over-investing. So in recent years, they’ve turned to new share issuance as a means of raising funds.

In some ways, that’s safer for the business, but the resulting dilution can wreak havoc on your portfolio.

As a result, the gold analysts at Sprott nicknamed the following years (2013 to 2020) gold’s “nuclear winter.”

During this period, gold’s performance was OK, but miners vastly underperformed:

Miners Couldn’t Keep Pace

And in addition to these macroeconomic headwinds, some gold stocks have faced more acute challenges in their day-to-day operations…

Managing Unpredictable Regulatory Risks

For paid-up subscribers of Green Zone Fortunes, I recommended investing in a company called Franco-Nevada Corp. (NYSE: FNV) in April.

As I explained in that month’s issue, FNV structurally avoided some of the biggest obstacles in gold production.

FNV is not a miner, it’s a gold royalties company. So instead of spending a fortune to build new mines and contract labor, FNV simply earns a royalty from its mining partners. This allows investors to avoid the mining industry’s CapEx mess entirely and gives you a relatively safe entry into the gold market.

That doesn’t mean FNV’s operations are risk-free, though.

You see, one of FNV’s primary gold sources, the Cobre Panamá mine, is located in (you guessed it) Panama.

Cobre Panamá is a massive, 34,000-acre open-pit copper mine where FNV controls the rights for gold production with the Panamanian government. The deal costs an annual $375 million in tax and royalty revenue to the local officials, and for FNV, it’s worth every penny.

But on November 28, the Panamanian government decided $375 million wasn’t enough. The country’s Supreme Court ruled the new contract to be unconstitutional, and President Laurentino Cortizo completely shut down the mine just a few hours later.

That’s why FNV’s share prices started heading lower a few weeks ago — and why we were stopped out of the position last week — because of a practically invisible regulatory risk that didn’t even exist when we first invested in the stock.

Growing Pains in the Gold Market

Back in January, my chief research analyst, Matt Clark, wrote about the massive increase in gold production in recent years.

He pointed out that global demand and steady high prices are bringing more new mines online, with total production expected to surge by nearly 50% between 2008 and 2024:

Many of these new mines will inevitably be located in new countries and new jurisdictions — which will come with all sorts of regulatory risks for the companies involved (like those experienced by FNV).

They’ll also require massive amounts of growth capital to keep growing output as predicted.

But despite facing serious structural headwinds, miners are still eking out a growing advantage — more than doubling their growth capital since 2020.

You can see the breakdown of miner profitability below (based on BMO Capital Markets data):

Growth Capital at Highest Level Since 2013

As profit margins continue to widen, these miners will have more growth capital to help overcome the industry’s major headwinds and keep growing.

So while gold stocks have recently been outperformed by bullion, that trend might not last forever.

If and when it reverses, we’ll see a massive surge in gold stock prices — and Green Zone Fortunes readers will be the first to know.

To good profits,

Adam O’Dell

Chief Investment Strategist