One of the market’s smartest contrarian players just made a shocking move — and we dividend investors need to pay attention.

The contrarian in question? PIMCO, the company that revolutionized the humble closed-end fund (CEF). If you’re reading this, you’ve likely at least heard of CEFs, which are renowned for big dividend payouts: safe 7%+ yields are the hallmark of these (too) often-overlooked investment vehicles.

If you’ve never heard of PIMCO, all you need to know is that the company is to CEFs what Apple (Nasdaq: AAPL) is to tech.

And PIMCO’s latest move is yet another signal that now is a great time to boost our positions in the 18 buy-rated funds in the CEF Insider portfolio. The company’s little-reported shift puts a couple PIMCO funds on our radar, too. I’ll drop a specific ticker below.

PIMCO’s Not-so-Secret Weapons: Deep Connections and a Lot of Money

PIMCO’s moves are worth watching because the CEF house — which manages north of $2 trillion — has a history of riding its contrarian streak to big profits, which it hands over to investors as outsized dividends.

An impressive example came in the wake of the ’08/’09 real estate meltdown. After the crisis had passed, investors stayed well clear of anything to do with real estate, worried about a repeat of the sickening losses they’d just endured.

Of course, since the ’08/’09 mess brought in tougher regulations, stricter lending requirements and depressed real estate prices, the odds of a repeat were extremely low. PIMCO saw the opportunity and pounced, launching its PIMCO Dynamic Income Fund (NYSE: PDI) and a couple other funds to buy mortgage-backed securities by the fistful.

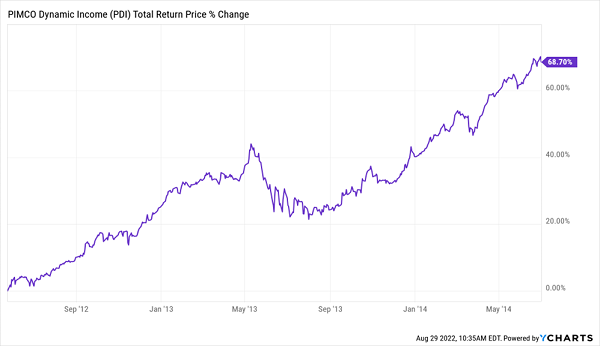

In a little more than two years, PDI had posted a superb 68% return:

PIMCO’s Contrarian Move Pays Off Big

The company pulled that off thanks to its deep research resources. Now those same resources are telling PIMCO something else: that the current doom-and-gloom narrative — that a grinding recession is around the corner — is flat-out wrong.

And PIMCO, just as they did in ’08/’09, is moving to profit.

Here’s how: The company just spent $2 billion buying leveraged debt from banks that have been desperately trying to sell it. The banks, of course, are worried that a looming recession will send defaults soaring.

PIMCO is buying these debts because they don’t think a recession — or at least a severe one — is coming. So they can buy these assets cheap, collect interest from the debtors and book a nice gain in the future, when they sell these debts back to the banks.

How to Profit Along With PIMCO

If PIMCO is right, it’ll boost all the funds in our CEF Insider portfolio. But there is a specific PIMCO fund that’s worth paying close attention to now.

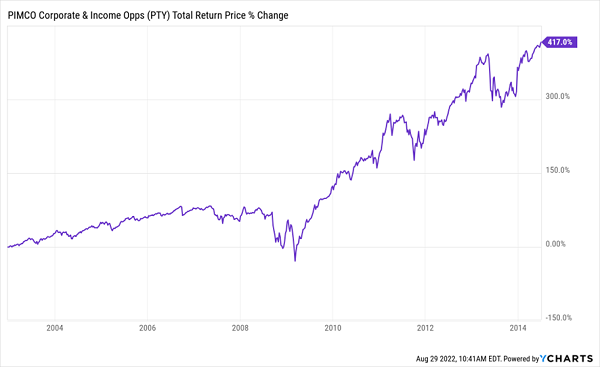

That would be the 10.3%-yielding PIMCO Corporate & Income Opportunity Fund (NYSE: PTY). It holds a range of debt securities, from government bonds to mortgage derivatives to corporate bonds. PTY acts kind of like a hedge fund, combining long and short positions on the debts it holds. That’s driven its triple-digit run since inception.

PTY’s Long History of Profits

If PIMCO is right this time, it could set PTY off on another long-term profit run, just like the one you see above.

There is one thing to bear in mind, however: Because of PIMCO’s brand recognition and record of success, PTY and other PIMCO funds often trade at premiums to net asset value (NAV, or the value of the assets in their portfolios), and that’s the case with PTY today. As I write this, the fund sports a high 19% premium.

That’s roughly the same as the one-year average premium the fund has held, but we want to buy for far less than that. This means now would be a good time to put the fund on our watch list and mark it for buying on any big dips in the premium.

The good news is that PIMCO’s call, should it pan out, is great news for other bond funds, too. We’ve got two corporate-bond funds trading at discounts and yielding north of 9% in our CEF Insider portfolio. Taken together, they give you a great way to ride along with PIMCO’s call while dodging the steep “PIMCO premium.”

To learn more about generating monthly dividends as high as 8%, click here.