Gold offers evidence that investors are worried about inflation.

Gold has been an inflation hedge for centuries. Its recent rise shows investors are worried about inflation.

Gold remains the best-known hedge. But other hedges became available in recent years.

Treasury Inflation-Protected Securities (TIPS) are offered by the Treasury Department. They are bonds “whose principal is adjusted by changes in the Consumer Price Index.” Here’s how they work:

- With inflation (a rise in the index), the principal increases.

- With deflation (a drop in the index), the principal decreases.

TIPS pay interest at a fixed rate. But the rate is applied to the adjusted principal. Interest payments can vary in amount from one period to the next.

- If inflation occurs, the interest payment increases.

- In the event of deflation, the interest payment decreases.

According to the Treasury Department: When a TIPS matures, “investors receive the adjusted principal or the original principal, whichever is greater. This provision protects against deflation.”

Investors have flocked to TIPS recently. In June alone, investors poured a record $6 billion into TIPS, according to data provided by the research firm Lipper. The Federal Reserve added $134 billion of TIPS to its balance sheet as part of its asset purchase program, according to SocGen analysts.

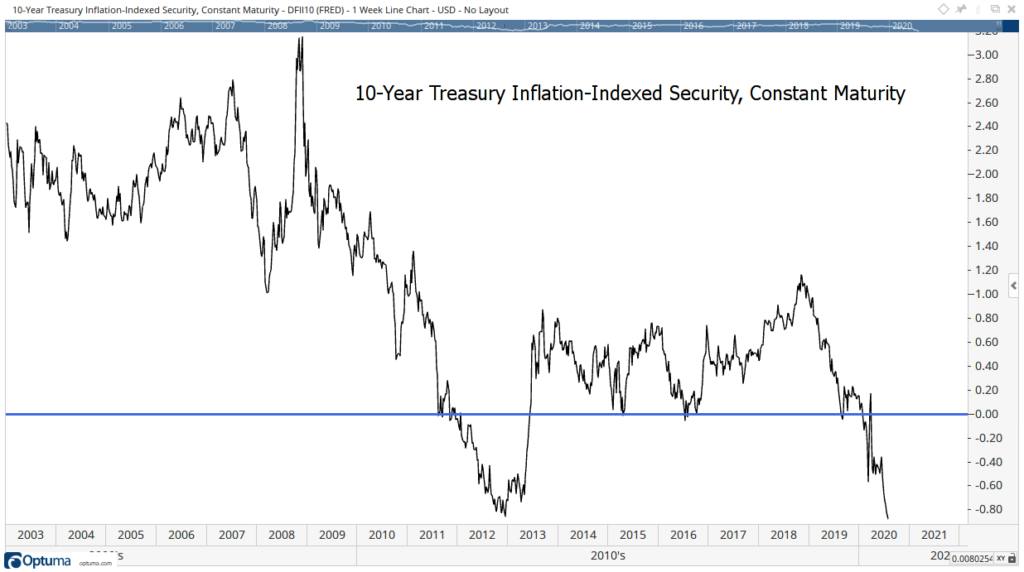

All this buying comes as the yield on TIPS fell to a record-low negative 0.90%.

TIPS Go Negative Again

Source: Optuma

Negative TIPS Are a Bullish Signal

Negative TIPS yields show investors expect slow economic growth right now.

The Treasury began offering TIPS in 2003, so only a limited history is available. But yields have only turned negative once before, from November 2011 to June 2013. And the S&P 500 index gained more than 30% during that time.

This is a rare event, but it’s bullish in the short term for the stock market.

If investors are right and growth remains slow, it’s bearish for stocks in the long run. But that’s a problem for investors to consider in a few months.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.