As you might know, oil and gas has been the best-performing industry in the stock market so far this year.

But the second-best caught my attention in my research…

The construction and engineering industry gained 25.7% from January to mid-August 2022.

I dug deeper and found this:

The chart above shows that pieces of equipment sold will increase 43% from 2021 to 2027.

Today’s Power Stock sells and rents construction and agriculture equipment in the U.S. and Europe: Titan Machinery Inc. (Nasdaq: TITN).

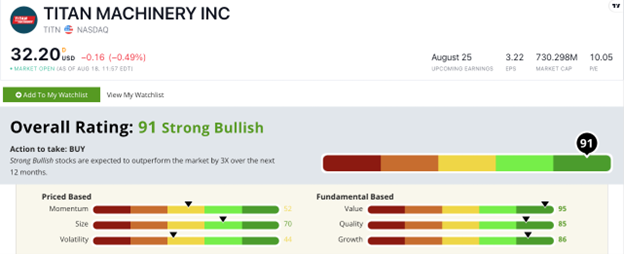

TITN Stock Power Ratings in August 2022.

Titan’s equipment is used for commercial, residential and highway construction.

The company also markets agriculture equipment and provides parts and maintenance.

Titan Machinery stock scores a “Strong Bullish” 91 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

TITN Stock: Strong Fundamentals

Titan started strong this year:

- In the first quarter, TITN reported total revenue of $461 million — a 23.7% increase over the same quarter a year ago.

- Company management revised full-year estimates up — meaning it expects a much better year than it first thought.

TITN is a terrific value stock, as you can see from its Stock Power Ratings above.

Its price-to ratios (earnings, sales, cash flow and book value) are all lower than the industry average, earning it a 95 on our value metric.

Along with top-notch value, TITN is a high-quality stock.

Its sales have increased in each of the last five years … and the company expects this year to make six!

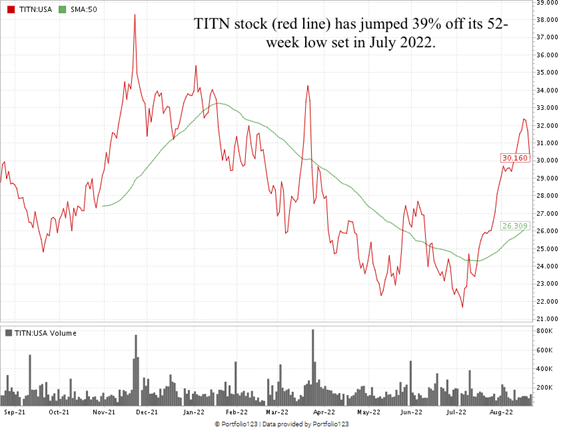

TITN has bounced up 39% since hitting a 52-week low in early July 2022 … showing the “maximum momentum” we love to see in stocks.

Titan Machinery stock scores a 91 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The construction industry is one of the best performers this year.

Equipment sales will trend higher in the coming years.

Titan Machinery provides the equipment construction companies need to get the job done. TITN is an excellent candidate for your portfolio.

Stay Tuned: Excellent Portuguese Retailer

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a specialized retail company in southwestern Europe.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.