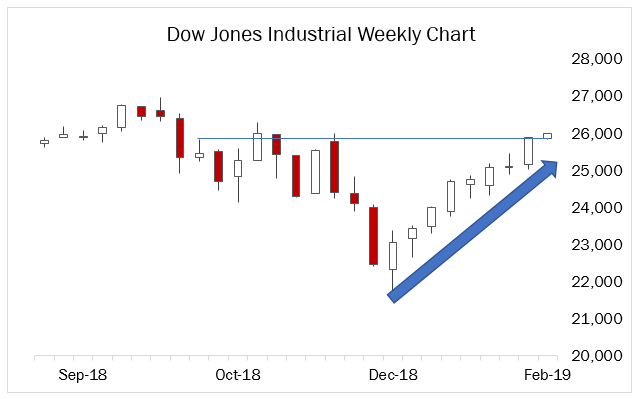

Much to the consternation of bears everywhere, the Dow Jones Industrials have been on an absolutely torrid run since the markets opened up after Christmas.

What started with Donald Trump backing off rumors of more cabinet upheaval, starting a trade war with China and criticizing the Fed has turned into a historic run of near-unprecedented length.

Only once in the past 10 years has the Dow gone on a nine-week, uninterrupted rally, with this one wiping out all of the losses in the wake of the Fed raising interest rates at its December meeting.

Trump may have kicked off the rally but it was the Fed’s punt with its January statement that put the wind under the market’s sails and kept the party going. The Fed listened to the market’s fears over raising rates too quickly, and even removed language pertaining to its balance sheet reduction program.

So here we are at the end of February and trade talks between Trump’s merry band of mercantilists and China’s are going nowhere. The March 1 deadline for Trump’s proposed 25 percent import tariffs on $200 billion in Chinese goods was extended indefinitely.

Personally, I never doubted for a second that the deadline would be extended. And the reason is that Trump, the master of leverage, has none in his talks with China.

It’s the Deficit, Stupid

Recently, in a piece for Strategic Culture Foundation, I talked about the fundamental problem Trump is facing is of his own doing — our budget deficit and need to continue printing money to keep GDP from collapsing.

That fuels nearly all of Trump’s complaints about China. We export debt and receive goods in return. He thinks trashing the dollar automatically should cause the yuan to rise, and that will balance out the trade. But it doesn’t have to work that way.

And it’s not because China manipulates the yuan — though they do, just like everyone else.

It’s because Trump’s sanctions and tariff regime around the world have increased the demand for dollars. China’s trade-surplus dollars can be recycled back into emerging market trade partners without affecting the yuan exchange rate, since the demand for dollars is rising globally as interest rates have begun to rise.

There is more than $9 trillion in foreign non-bank corporate debt out there that has its coupons paid in dollars. Turkey, for example, last year had more than $220 billion in such debt. That’s why it was so vulnerable to a collapse of the lira.

But China (and Qatar) happily supplied dollars into Turkey to help get them past the worst of the crisis. Some of those debts were paid off and redenominated. Today, the lira is stronger and President Recep Erdogan publicly refuses to take any money from the IMF because he doesn’t have to.

He knows he has other sources of emergency funding while Turkey bleeds this dollar-debt off.

And one of those sources is China.

Russia went through a similar situation in 2015 after the ruble collapsed along with oil prices. The main source of the pain was bond maturities at companies like Gazprom and Rosneft, who were barred from dollar funding markets thanks to sanctions.

The bonds were paid out in dollars, and the debts either reissued in euros, rubles or yuan, or simply retired and Russia’s forex reserves took the hit.

But, once they were past those moments with help from the Russian government getting access to China’s foreign exchange reserves through swap arrangements, the crisis ended.

What does this have to do, ultimately, with the Dow?

A lot.

The Deficit Doom Loop

Because the Dow is the U.S. equity index most sensitive to the global macro situation, it also is the most sensitive to political upheaval as it represents a relative safe-haven play for international investors. These stocks are big and liquid. They can take inflows and still pay a real positive yield.

So, in this environment, Trump can flail and fulminate all he wants but the reality is we need China as much, if not more, than they need us. He needs to fund that $1.2 trillion deficit he’s running, $500-600 billion of which comes from the trade deficit with China.

If that trade stops because of Trump’s 25 percent tariffs then interest rates will rise because the demand for dollars will skyrocket. This will cause the budget deficit to widen, asset prices to plunge alongside velocity of money and collateral chains to break like they’re made of spun sugar.

We saw this story in December. And Trump didn’t like it the first time.

He loves a rising Dow. He thinks it’s a vote of confidence of his performance as president.

He’s wrong, but what else is new with the Narcissist in Chief.

What he has to face is that China holds most of the cards here, at the margin. The Chinese no more want to see the United States fail then Trump does. So, they will give him some small wins to save face, which he will spin to high heaven — just like he did with the NAFTA renegotiations.

It’s what he does.

But the fundamental problems facing the United States that he is not addressing — pension under-funding, a demographic time bomb and latent exploding debt servicing costs — are all the leverage China needs to stand its ground on all of the most important issues.

So expect this historic rally to continue a bit longer if Trump backs downs and averts a trade war. For now, there is little to fear of a repeat of December once this rally ends. The Fed has caved and so will Trump.

After China recedes from the headlines the Dow will take a brief pause before challenging the all-time high. After that, global investors will refocus their attention on the real crisis brewing today — the political breakdown of the European Union thanks to Brexit and the European Parliamentary elections in May.

But that is a story for another day.

• Money & Markets contributor Tom Luongo is the publisher of the Gold Goats ‘n Guns Newsletter. His work also is published at Strategic Culture Foundation, LewRockwell.com, Zerohedge and Russia Insider. A Libertarian adherent to Austrian economics, he applies those lessons to geopolitics, gold and central bank policy.