European Central Bank President Mario Draghi just folded. He followed the lead of FOMC Chairman Jerome Powell, who also folded at the end of January.

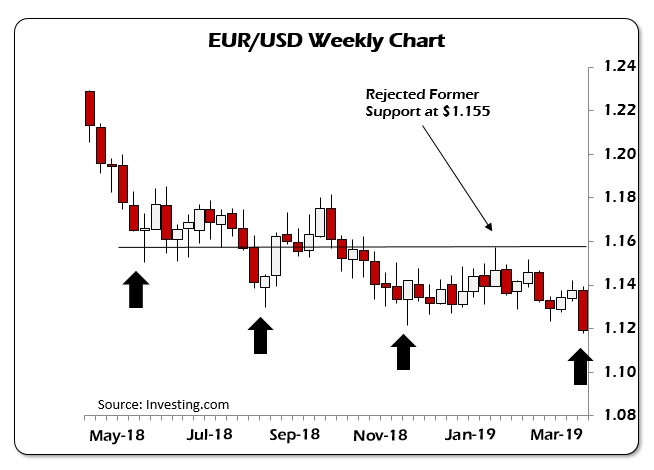

Draghi’s latest policy statement went beyond what the market was expecting and the reaction was extreme. The euro collapsed through support at $1.127 to close the day below $1.12. Draghi not only extended the current policy rate of -0.4 percent until the end of the year, he announced a new, massive TLTRO — Targeted Long-Term Refinancing Operations — program.

In short, more QE (quantitative easing) and more NIRP (Negative Interest Rate Policy).

The weird part was that the equity markets didn’t rejoice like they did when the Fed folded. The Fed folds and the Dow Jones goes on a historic run that I talked about in my first article here on Money & Markets. All U.S. equities were off between 0.8 percent and 1.2 percent after Draghi’s announcement.

Only a last-minute rally kept the German DAX from falling.

But the telling thing was the massive buying in U.S. and European bonds as “safe-haven” was the phrase of the day.

As was liquidity. This was a flight to cash across Europe. It was a flight to collateral. And with Basel III rules going into effect at the end of the month, banks will be looking at tighter funding requirements as the Tier 1 portion of the reserves rises to 10.5 percent.

And what is interesting is that with Basel III rules changing the definitions of capital, Gold will no longer be relegated to the lowest tier, previously known as Tier 3. Tier I capital can be held at par — no discount to its face value.

For gold, the discount applied for reserve buffer calculations rises from 50 percent to 85 percent, making it far more attractive for central banks and banks to hold as part of their liquidity profiles.

Why is this important? Because the closer we get to Basel III, the more gold decouples from the euro and a simplistic binary trade. Long dollar/short gold (euro) and vice versa.

What happened after Draghi folded on Thursday? Gold was flat as the euro was pounded to levels we haven’t seen in nearly two years.

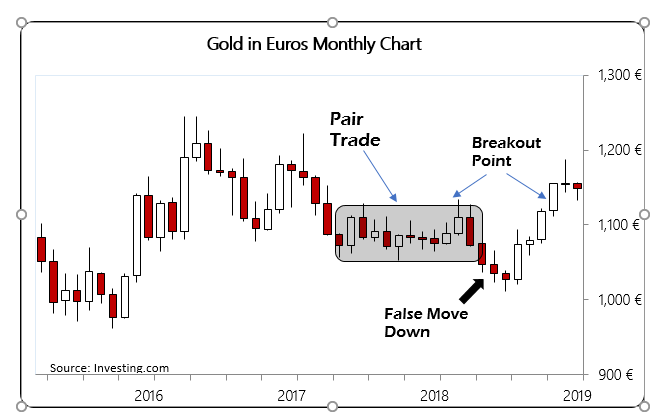

Looking at gold in euro terms is illuminating of what I’m talking about.

For most of 2017 and early 2018, gold and the euro traded in lock-step (see shaded area). But last spring that relationship shattered after U.S. President Donald Trump launched his trade war with the world and Euroskeptics rose to power in debt-ridden Italy. This caused a massive shakeup in the offshore dollar markets, known as Eurodollars.

The resulting yield curve inversion in the 2020/21 futures market (written about extensively by Jeff Snider of Alhambra Partners) created cascading liquidity problems the world over. Italian bond yields blew out, the Turkish lira collapsed, as did China’s and Europe’s stock markets, causing even more anxiety across Europe.

Gold was sold with impunity, even more so than the euro, which fell back off its 2018 high at $1.25. This fear eventually caught up to oil and the general commodity markets. The only thing that seemed immune was the U.S. equity markets because they were acting as a sink hole for global capital flight.

The Fed kept right on raising rates because it needed to begin assisting the U.S. pension markets while it also, at the same time as Donald Trump was taking the U.S. budget deficit to plaid, began running off a few hundred billion dollars of U.S. Treasuries for the banks to absorb.

But once gold bottomed alongside the peaks in the U.S. equity markets to begin Q4 last year, it began to rise while the euro continued to tank. And despite the best efforts of the central banks to keep the fiction up that the euro is still sound, it kept on pressing lower and lower against the dollar.

The euro price of gold hit a low of €1110.68 in the ensuing sell-off. But given the rally since then, this move looks more and more like a false one; a move that gets too many people on the wrong side of the long-term trade.

So Draghi finally had to come clean. Euro-zone growth will be not 1.9 percent but 1.1 percent, with inflation barely above 1 percent. No take-off, just meandering around. And nothing that will allow for a natural steepening of yield curves across Europe, which would allow Draghi to take his boot off short-term rates.

Now the real problem starts, however. The banks need to both to fund higher requirements of the upcoming Basel III standards and the existing TLTRO loans, some $720-plus billion of them, will not be available to use as capital to calculate net stable funding ratios, which go into effect on March 31. The old loans expire on June 30. The new TLTRO loans won’t be available until Sept. 30, leaving a three-month funding gap the banks have to cover.

Meanwhile, the banks will be hard-pressed to make any money as interest rates will be held negative. Deutstche Bank is a basket case. Commerzbank isn’t much better. And the markets have been supporting Italy’s sovereign debt market in a prisoner’s dilemma ever since Draghi stopped buying them in December.

Those most exposed to Italy’s insolvent banks are now buying to keep prices from collapsing without ECB support.

How much longer do you think that can go on if the euro continues to push lower, building losses even faster?

Draghi just let the market know he doesn’t have any more weapons. He can’t “Do Whatever it Takes” to save the euro. In fact, quite the opposite. He just admitted that he can’t let rates rise a whisker or the entire Ponzi scheme comes tumbling down.

I’ve been waiting for him to finally admit this for a couple of years now.

Brexit is around the corner. And there is a very real possibility of it happening on WTO terms despite what you may read in the headlines. The potential for a massive shock wave to the European financial markets by this summer is high.

For now, the euro is only just beginning to breakdown. The market will not wake up next week and have regained confidence in this mess. Both Draghi and Powell tried to instill a little discipline on the markets in December and reassert control and both, within sixty days, have had their hats handed back to them.

Is it any wonder I expect Trump to fold completely on trade talks with China? Anything that undercuts global trade now will be abandoned by the politicians. That’s one of the undercurrents in the Brexit negotiations. Everyone knows that a hard Brexit will upset markets and create pain.

Even if the British Parliament votes for a three-month extension and the EU grants it, that will only kick the can down the road until June. And all that will do is extend the uncertainty and the false signals that people like Mario Draghi have even the faintest clue as to what they are doing.

There is no magic solution to Europe’s problems. Draghi just ended that fantasy.

And when enough people finally figure that out? That’s when we’ll find out what is and is not considered the best kind of capital.

• Money & Markets contributor Tom Luongo is the publisher of the Gold Goats ‘n Guns Newsletter. His work also is published at Strategic Culture Foundation, LewRockwell.com, Zerohedge and Russia Insider. A Libertarian adherent to Austrian economics, he applies those lessons to geopolitics, gold and central bank policy.