The last time I wrote about gold it was at a crossroads. Silver was breaking higher, above $18 an ounce, but gold couldn’t push through the $1,515 level. Was it going to do so or break down?

This correction in gold is giving us the exact signal we need to know that we’re closer to a seismic moment in the capital markets than we were when it was rallying earlier this year.

The hand off of power in Europe along with what looked like the end of the worst of Brexit’s uncertainty, I felt helped weigh on gold.

This had the effect of seeing the euro rally weakly and the British pound rally hard. Any alleviation of political risk in the West lays the foundation to give gold a thorough shellacking.

And that’s exactly what happened. Gold was crushed into the end of last week to challenge support at $1,460 and it’s bounced around that level all this week in a daze.

Silver reversed a strong technical breakout to collapse back to $16.60 and looks unable to regain $17.

But as the Fed and the ECB continue to fire up their money printing presses it’s only putting more fuel on the fire for the day when gold and silver both take off like a shot to the upside.

That time is not now, however. The reason they are doing this is because there is a mountain of debt out there trying to collapse in price. I remind you regularly that the real problem for gold is how the dollar is demanded overseas.

Remember that gold will always be pressured during times of relative calm and confidence in the financial system as well as during the early stages of a real panic in the financial system.

During the former periods, faith in governments and their institutions is high enough to give central bank issued currency a strong air of legitimacy. That explained the first part of the gold bear market, which ended in 2015. Up until this summer gold had been in a transition period waiting for the next bull market to start.

Have we exited that transition period? The rally through the post-Brexit high at $1,375 this summer sure suggests this.

But gold is vulnerable, even during bull markets, to the early stages of financial panic. Gold is sold with impunity when foreign demand for the dollar overwhelms the worry over political unease. It’s a panic into cash to cover funding shortfalls and gold gets hit because it can’t be posted as collateral in the same way that ridiculously over-priced sovereign bonds can.

In that sense gold operates in a rigged market, rigged to minimize its demand and over-state its supply through massive rehypothecation of available dealer inventory.

And once you understand these dynamics it makes weathering these bouts of weakness with less anxiety. I’ve been doing this so long now I no longer even react to a $30 or $40 drop in the gold price.

It’s clear right now that the markets understand the central banks are reacting the way they are because conditions underneath the surface are far worse than they want anyone to know.

The Fed is now in the business of serving a single mandate, creative ways of providing liquidity without it looking like it. But since they opened up their repo window and then turned that into permanent “Not QE 4” interest rates around the world have risen sharply.

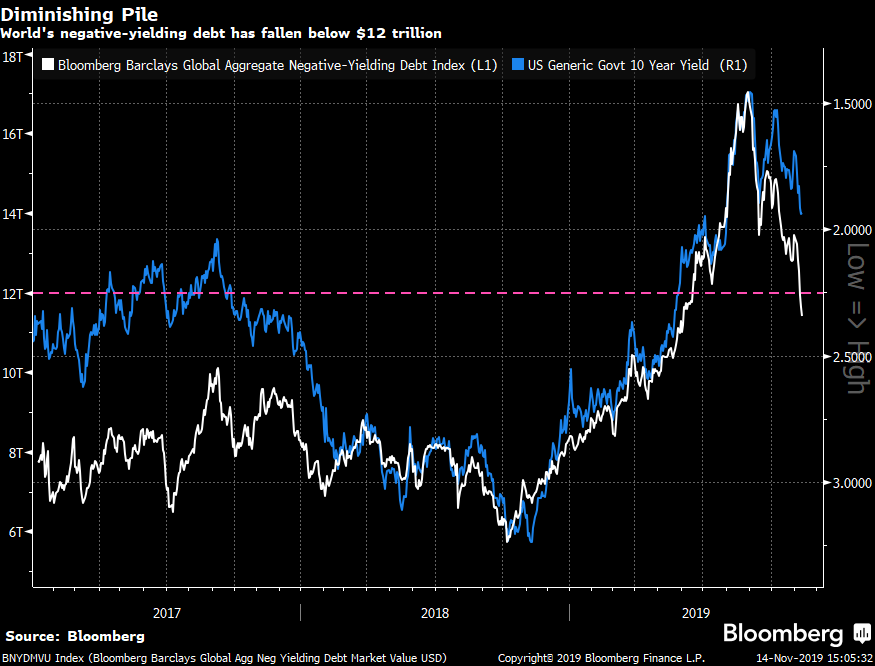

We’ve seen a sharp contraction in the amount of negative-yielding sovereign debt over the past six months. Rates are rising now in conjunction with the restart of quantitative easing (QE) by the major central banks in the hope that this will spur growth and take us out of the liquidity trap we were in during quantitative tightening (QT).

The safe-haven trade of early 2019 is over for now as the markets still believe the central banks are capable of responding to the underlying crisis forming below the surface.

But a slightly closer look at what’s happening tells a different story.

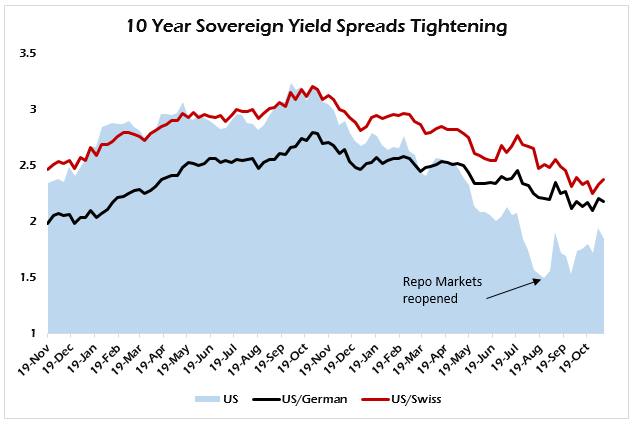

The chart above is pretty clear. Since the Fed opened up the liquidity taps and the ECB signaled future QE, safe-haven bond yields have been on the rise and stocks across the board have gotten a strong bid.

But looking one step closer, we see that yield spreads between safe-haven assets are tightening. Traditionally, U.S., German and Swiss bonds are considered the place to run if you’re worried about recession. But comparatively in the current environment, investors are looking preferentially to U.S. debt and assets versus their European counterparts.

Germany narrowly avoided recession this month, posting a 0.1% GDP gain. It’s all but over for the German economy except for the headline-shaping. The Swiss National Bank has turned itself into the biggest hedge fund in the world trying to stave off strength in the Swiss franc over the past eight years.

And while the Fed is clearly venturing into uncharted territory in terms of monetary policy and the U.S. domestic economic situation isn’t good by any rational metric, there is far more confidence in our government than those in Europe.

Against a backdrop of rising liquidity concerns and central banks fronting that they have the policy tools to handle the situation (because, frankly, do they have any other choice?) gold simply can’t rally. And nor should it.

In fact, this correction in gold is giving us the exact signal we need to know that we’re closer to a seismic moment in the capital markets than we were when it was rallying earlier this year.

The rally was the initial response to the shift in attitude of the central banks, from tightening to easing. That U-turn created a shock that panicked people into gold and even Bitcoin because they were unsure of how the central banks would respond.

Now that they have responded they confirm that the problems we’re facing are real and far bigger than they can account for. And gold is giving us that signal as well, to the downside as the interbank markets experience sporadic lock ups, which increase the likelihood of U.S. dollar hoarding.

With the technical damage done to both gold and silver over the past two weeks, it means we’re in for more downside risk in the short term than upside. The central banks are fighting deflation and that means they haven’t created inflation — yet.

• Money & Markets contributor Tom Luongo is the publisher of the Gold Goats ‘n Guns Newsletter. His work also is published at Strategic Culture Foundation, LewRockwell.com, Zerohedge and Russia Insider. A Libertarian adherent to Austrian economics, he applies those lessons to geopolitics, gold and central bank policy.