More than 27 million Americans moved last year, according to the U.S. Census Bureau. That’s 8.4% of the total population!

People move for a variety of reasons, from affordability to seeking proximity to loved ones. But I’ve spotted a trend within the data that should be a boon for smart investors like you.

The migration pattern in the U.S. has been consistent in the last five years. More people are moving out of the Midwest and Northeast and into the South and Southwest.

And increasing the population in one area increases the need for basic services like utilities.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” stock that is reaping the benefits of this population shift:

- It provides water resources to an area of the U.S. that needs it the most.

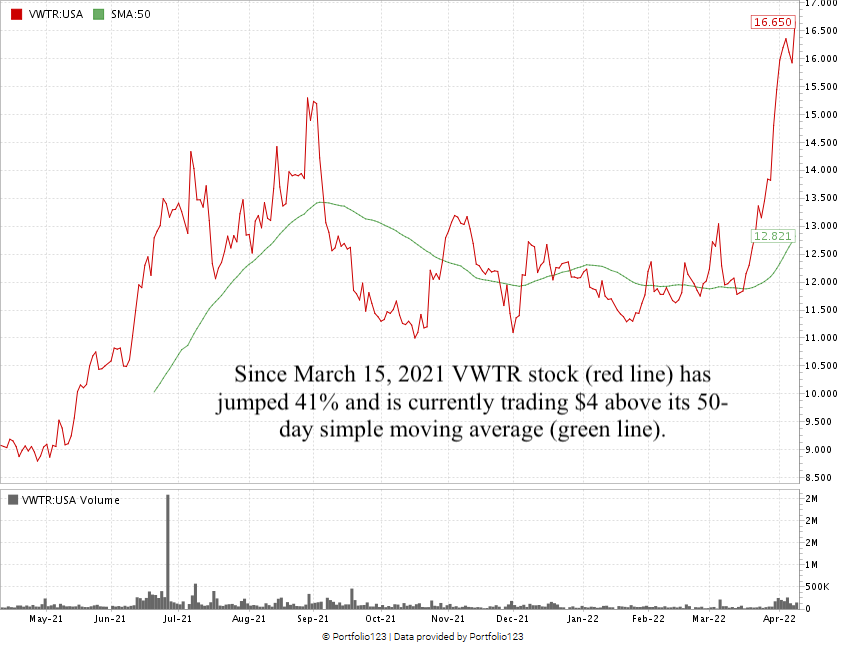

- The stock has jumped 41% in the last month … hitting a new 52-week high and continuing to move up.

- This stock is in the top 1% of all stocks we rate.

Here’s why this essential service company will be a strong performer this year and beyond.

Population Shift Shows Exodus From North to South

The population shift in the U.S. has been the same for the last five years.

People are moving from the colder, more populous northern regions of the country to the more spacious southern regions.

The chart above shows the population shift from April 2020 to July 2021, according to the U.S. Census Bureau:

- Populations declined in red states.

- Populations in green states increased.

- Populations in yellow states experienced nominal change.

- Three gray states (Connecticut, Minnesota and Wisconsin) saw no change at all.

As you can see, people fled the Northeast and parts of the Midwest and landed in more Southern and Southwestern states.

In the last 10 years, the fastest-growing metro areas in the U.S. were in Texas and Florida. But today, I’m going to zero in on three outside those two popular states:

- Phoenix, Arizona.

- Denver, Colorado.

- Las Vegas, Nevada.

These fast-growing areas have one thing in common with my Stock Power Ratings recommendation: They all need this company’s services — desperately.

Massive Growth Potential: Vidler Water Resources Inc.

The Southwest is known for gorgeous landmarks and spacious terrain.

But it’s also a desert with scarce access to water.

Nevada-based Vidler Water Resources Inc. (Nasdaq: VWTR) provides water resources to Southwestern communities — primarily in Arizona, Colorado, Nevada and New Mexico.

It sells water rights to real estate developers, alternative energy facilities and commercial/industrial users. Vidler also sells stored water to cities, counties and states for projects or community use.

And Vidler has seen massive growth due to this population explosion in the Southwest:

As you can see, Vidler's sales and earnings-per-share (EPS) have grown exponentially over multiple time frames.

Its sales jumped 576.4% from the fourth quarter of 2020 to fourth-quarter 2021, while its EPS jumped 238.5%.

Now, let's see how the stock has performed.

VWTR Hits Its 52-Week High

Thanks to a massive fourth-quarter report, VWTR stock reached a 52-week high last week. The company increased its total annual revenue from $9.6 million in 2020 to $29.2 million in 2021 — a 204% increase, according to that report.

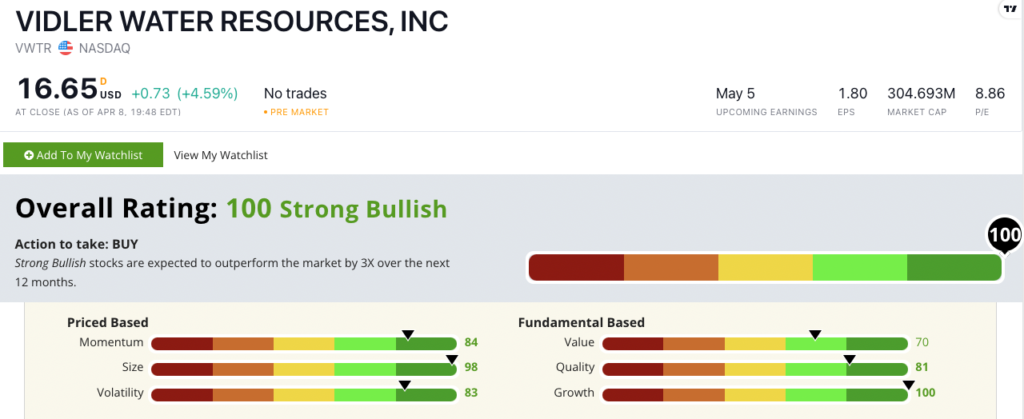

Vidler Water Resources Inc. Stock Rating

Using Adam’s six-factor Stock Power Ratings system, Vidler Water Resources Inc.’s stock scores a 100 overall.

That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least three times in the next 12 months.

VWTR rates in the green in all six of our rating factors:

- Growth — The chart I showed you above illustrates Vidler Water’s strong growth. Triple-digit EPS and sales growth in the last year show this company is a massive growth play. VWTR scores a 100 on growth.

- Size — With a market cap of $304.7 million, VWTR is a small-cap stock that gives us even more room to grow our gains. Smaller stocks tend to outperform larger stocks with similar ratings on the other five factors of Adam’s system. Vidler Water scores a 98 on size.

- Momentum — VWTR‘s share price rallied in a huge way following its fourth-quarter report in March. That 41% jump in stock price is exactly the “maximum momentum” we love to see in stocks we rate. It rates an 84 on momentum.

- Volatility — From October 2020 to February 2021, VWTR traded sideways without a lot of movement up or down. But the stock took off in March with little resistance. The stock scores an 83 on volatility.

- Quality — VWTR has double-digit returns on assets, equity and investment, where peers average negative returns. It also has a net margin of 112% compared to the sector average of minus 20%. VWTR scores an 81 on quality.

- Value — Vidler scores a 70 on value, but its price-to ratios all remain below industry averages. Its P/E ratio is currently 9.26, while its industry peers trade at 22.03. Vidler’s P/B ratio stands at 1.46, and its peers average 2.24.

Bottom line: Americans are migrating to the Southwest.

As the cost of living continues to rise in other parts of the country, this is a trend that’s likely to continue.

More people moving means developers, cities, counties and states will need greater access to one of the scarcest resources in the region: water.

That’s why Vidler Water Resources Inc. is a must-have for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.