NVIDIA Corp. (Nasdaq: NVDA) is laying the foundation to be an artificial intelligence (AI) superpower for years to come.

It’s targeting $1 trillion in revenues of the burgeoning AI market! And that’s only 1% of the market potential NVIDIA CEO Jensen Huang sees.

It’s doing it the best way it knows how — by developing revolutionary new computer chip technology.

In a recent presentation, Huang unveiled NVIDIA’s new “Hopper” family of chips. Named after Grace Hopper, a pioneer of computer science and programming languages, these new chips will be a nine-fold improvement over the performance of its current Ampere AI chip.

Huang calls it: “the engine of the world’s AI infrastructure.”

But get this … NVIDIA’s AI strategy is overlooking an industry that I believe has the greatest potential for growth as companies find new and exciting applications for this futuristic tech.

Does that mean we should steer clear of NVIDIA stock?

Artificial Intelligence Is Ubiquitous

It’s not just for games anymore. Artificial intelligence — or AI — is now ubiquitous. It’s a critical component of some of the biggest investment themes of the next 20 years.

Autonomous driving requires AI. Efficiently managing modern renewable energy production and storage requires AI. Even genomics — another one of my favorite investment themes — requires AI for advanced modeling.

AI can’t replace human labor in a lot of endeavors. It might be a while before we have robotic barbers or dentists.

But leveraging AI solutions is a big part of resolving the global labor shortage, both by replacing some workers outright and by allowing other workers to be more efficient and handle more responsibility.

Just as AI is a critical component of a host of industries, NVIDIA’s chips are a vital part of the hardware that makes AI possible.

And you want to know if it’s worth buying some shares of NVDA as it ramps up its AI efforts.

Let’s see what my proprietary Stock Power Ratings system reveals.

NVIDIA Is a Fine AI Investment — We Can Do Better

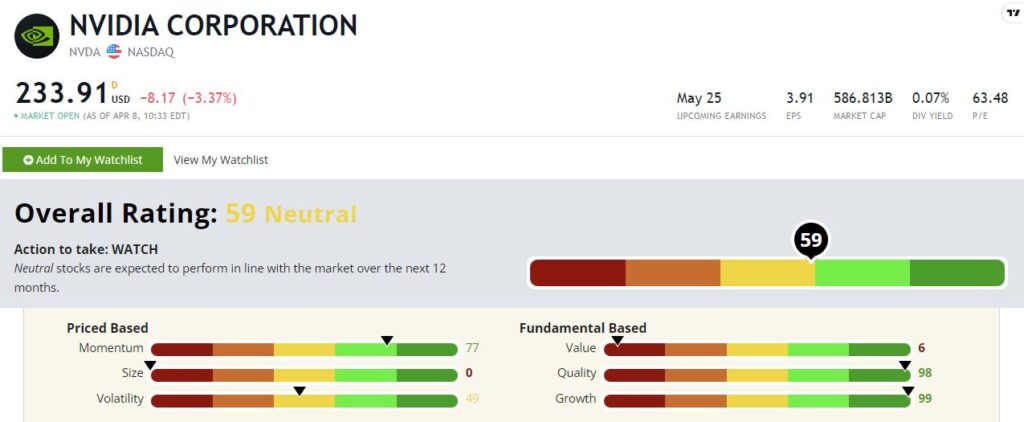

NVIDIA rates a “Neutral” 59 out of 100 on my Stock Power Ratings system. But it’s worthwhile to dig into the numbers because there is a much bigger story here than the composite score suggests.

Growth — NVIDIA chips go into almost everything these days. This is obvious from NVDA’s stellar growth factor rating of 99. NVIDIA is in the top 1% of all companies in our universe in terms of growth. And with revolutionary new AI tech, I don’t expect that growth to slow down soon.

Quality — We measure quality objectively, using various measures of profitability and balance sheet strength. NVDA is near-perfect here as well, with a quality rating of 99. It has no weaknesses here and rates highly across its returns on equity, assets and investment. The company also maintains only moderate debt.

Momentum — I’m always looking for opportunities within market mega trends and I like to buy high and sell higher. NVDA rates a respectable 77 on momentum. It’s common for high-growth stocks to also be high-momentum stocks. And to see some of that momentum in action, just look at NVDA’s stock chart. Over the last year, NVDA has gained 69%, and that’s even after the tech sell-off that we witnessed earlier in 2022.

Volatility — Despite NVIDIA’s torrid growth, the stock isn’t that volatile. It rates a 49 on our volatility factor, which places it squarely in the middle of the pack. Some of NVDA’s moderate volatility can be explained by its sheer size. Larger stocks often have volatility factors in line with the broader market.

Value — Tech stocks and high-growth companies are expensive these days. NVIDIA rates a 6 on our value factor. It’s an exceptionally high-growth and high-quality company. Investors are willing to pay a premium to own this stock.

Size — NVIDIA is one of the largest chipmakers in the world with a market cap of $700 billion. It’s not a hidden gem at that size! It rates a zero on our size factor, which knocks several points off its composite score.

Bottom line: NVIDIA is a wonderful company and a good way to play the long-term artificial intelligence mega trend. But it’s also a large, established company and already widely owned.

So, while I like NVDA, I know we can do better.

And that’s why AI is the focus of my latest presentation.

NVIDIA and its CEO see a $1 trillion opportunity in AI, but I’m thinking bigger.

I’m targeting the fastest-growing sector of the artificial intelligence industry, an industry Cathie Wood, CEO of ARK Invest, says will add $80 trillion to markets over the next 10 years.

I call this sector “x.AI,” and it’s set to grow TWICE as fast as every other sector of AI over the next decade.

And my No. 1 stock in this sector has the potential to create life-changing wealth for its early investors.

To find out more, click here to watch my brand-new x.AI presentation.

You won’t regret it.

To good profits,

Adam O’Dell

Chief Investment Strategist

Story updated on April 8, 2022.