We are an instant gratification society. We want what we want … five minutes ago!

It’s changed how we shop.

And smart companies — the ones we want to invest in — realize that.

Massive companies, like Amazon, are investing in their infrastructure to meet our desires. They’re building warehouses closer to customers and developing more efficient delivery methods. All to ensure our goodies arrive at our doorsteps fast.

A 2021 report found that Amazon needed to invest billions in expansion to keep pace with consumer demand. And that’s after the e-commerce giant almost doubled the number of its warehouses since 2020.

Transportation and logistics companies — the ones moving goods to these “last mile” warehouses — are key in this e-commerce expansion.

And I found a solid stock to invest in today.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Green Zone Ratings system, I found a “Strong Bullish” transportation stock:

- It’s an industry leader in the United States.

- Its total revenue rebounded 24% in 2021.

- This stock is in the top 2% of all stocks we rate.

Here’s why transportation stocks will rise through 2022 and beyond.

Transportation Stocks Beat the Broader Market

The Dow Jones Transportation Average is a group of 20 railroad, airline and freight stocks.

Looking at the chart below, note how transportation stocks (green line) have performed in the last six months.

During that time, transportation stocks have crushed the broader market … and it isn’t close.

From October 2021 to today, the transportation index has gained 15.1%, compared to the S&P 500’s gains of 5.1% and the Dow’s 2.6%.

The gains in transportation stocks are even more significant considering how energy prices have soared through the roof.

During the same six-month period, the price of West Texas Intermediate crude oil has surged more than 50% — a barrel is still over $100.

This transportation stock trend led me to a strong company with massive potential … right now and in the future.

High Value, Strong Growth Transportation Stock: Covenant Logistics Group Inc.

Tennessee-based Covenant Logistics Group Inc. (Nasdaq: CVLG) provides truckload services across the U.S.

It delivers a variety of freight and even provides warehouse management services. It can handle everything from loading and unloading, to transporting and even overseeing a warehouse.

From 2016 to 2019, CVLG‘s total annual revenue jumped from $670.7 million to $885.4 million — a 32% rise in four years.

Like most businesses at the time, COVID-19 hammered Covenant. It temporarily closed some warehouses and limited transportation to prevent further spread of the virus.

But it’s already rebounding out of pandemic lows in a strong way.

CVLG‘s total revenue for 2021 was around $1 billion — a 24% jump from 2020.

Projections suggest CVLG could reach $1.15 billion total revenue this year and $1.17 billion in 2023 — a new high for the company.

Let’s look at its stock performance.

CVLG Doubles the Performance of Its Peers

From the spring to the fall of 2021, CVLG stock gained a massive 422% in share price.

Concerns over rising oil prices pushed the stock back down into early 2022, but it’s showing signs of breaking out of a $22-per-share level. That could send it back to a new high.

Covenant Logistics Group Inc. Stock Rating

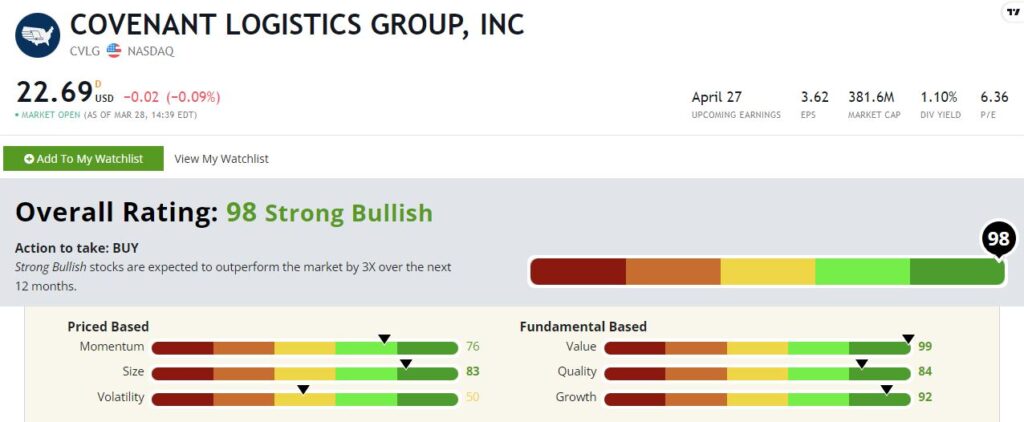

Using Adam’s six-factor Green Zone Ratings system, Covenant Logistics Group Inc. stock scores a 98 overall.

That means we’re “Strong Bullish” on the transportation stock and expect it to beat the broader market by at least three times in the next 12 months.

CVLG rates in the green in five of our six rating factors:

- Value — CVLG’s trading multiples show it is especially undervalued. Its price-to-sales ratio is 0.37, while its price-to-book ratio is 1.1. It scores a 99 on value — meaning it is in the top 1% of all stocks we analyze.

- Growth — CVLG has a one-year annual sales growth rate of 24.7% and a one-year annual earnings-per-share growth rate of 258.8%. Covenant scores a 92 on growth.

- Quality — Covenant’s returns on assets, equity and investments are all strong. It also operates with a gross margin of 15.5%. CVLG scores an 84 on quality.

- Size — With a market cap of $381.9 million, CVLG is a smaller company that gives us even more room to grow our gains. Smaller stocks tend to outperform larger stocks with similar ratings on the other five factors of Adam’s system. Covenant scores an 83 on size.

- Momentum — In the middle of 2021, CVLG stock jumped more than 400% in price. That run has pared back, but the stock is still up 97% from a year ago. It rates a 76 on momentum.

The stock rates "Neutral" in one category …

CVLG scores a 50 on volatility, as it pared back recent gains.

However, the stock is testing some resistance at the $22 price level. A breakout past $22 could see this stock soar higher than even its 52-week high set back in October.

Covenant Logistics also comes with a 1.1% forward dividend yield. That equals a $0.25 payout per share per year.

Bottom line: Despite supply chain struggles and rising inflation, companies need to get goods from one place to another.

CVLG is a “Strong Bullish” transportation stock with incredible value and strong growth — the best of both worlds. It also has solid momentum.

That makes this U.S. transportation stock a great addition to your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.