The markets are lauding the signing of a “phase one” trade deal between the U.S. and China, but some are skeptical that Beijing will actually hold up its end of the bargain.

U.S. markets closed up Wednesday after President Donald Trump and China’s Vice Premier Liu He signed the deal. The Dow Jones Industrial Average closed above 29,000 for the first time.

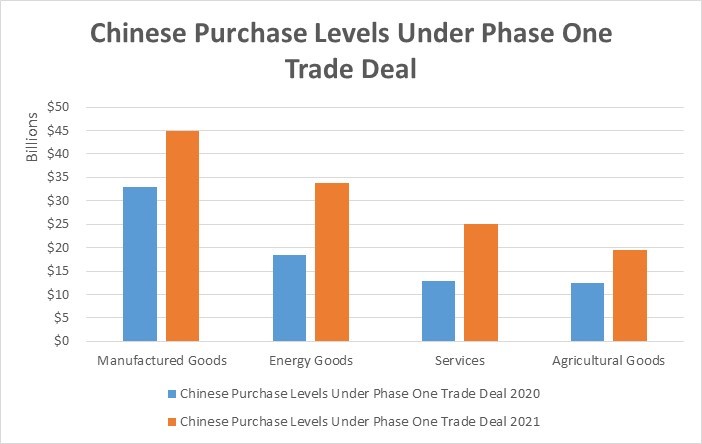

However, before the ink was dry on the paper, there were already those skeptical of the deal. The primary issue? A promise from China to ramp up purchases of American goods to the tune of $200 billion over only two years. These goods include farm products, manufactured goods, business services, oil and natural gas.

Source: CNBC. U.S.-China trade agreement

Can China Eat That Much US Food?

The increases includes $12.5 billion in agricultural products in 2020 and $19.5 billion in 2021. It’s a nearly 90% increase from 2017, according to CNBC.

Banyan Hill Publishing Senior Research Analyst Ted Bauman thinks that’s a bit of stretch.

Banyan Hill Publishing Senior Research Analyst Ted Bauman thinks that’s a bit of stretch.

“I think people are right to be concerned that the U.S. export figures people are talking about are exaggerated,” Bauman said. “For example, U.S. farm exports to China have never topped $26 billion a year. Not only should we question whether the Chinese can eat that much U.S. food — but can U.S. farmers double their export production overnight?”

The deal also includes increased Chinese market exposure to U.S. dairy products, poultry, beef, fish and rice.

Some farmers said that until retaliatory tariffs are lifted on American farm exports, it’s not clear whether the increases will help that much. The BBC reported tariffs on $100 billion of U.S. exports still remain in place.

“This deal does not end retaliatory tariffs on American farm exports, makes American farmers increasingly reliant on Chinese state-controlled purchases and doesn’t address the big structural changes the trade war was predicated on achieving,” Michelle Erickson-Jones, a Montana wheat grower and spokesperson for Farmers for Free Trade, told The Wall Street Journal.

Others suggest that until the details of specific commodity purchases are reported, it is hard to ascertain how much help the increases will provide American farmers — if any at all.

“We want to see exact details by commodity, and we want to see purchases,” Rich Nelson, chief strategist for commodity broker Allendale Inc., told the Journal.

The Big Energy Buy

While the increase in Chinese purchases of American agriculture products is around $40 billion in two years, it’s even higher in the energy sector … to the tune of $18.5 billion in 2020 and $33.9 billion in 2021.

That’s compared to the $9.1 billion in American oil and liquid natural gas product exports in 2017.

That’s compared to the $9.1 billion in American oil and liquid natural gas product exports in 2017.

“Are they really going to boost that to $34 billion next year? And if they do, what happens to global energy prices?” Bauman asked.

Additionally, to export that much would require much more investment in American energy infrastructure.

Other issues, as with agricultural products, is a lack of details on the increases and the removal of tariffs already in place. Currently, China has a 5% tariff on crude oil imports from the U.S. and a 25% tariff on liquefied natural gas.

“If the tariffs stay in place, this is not a significant step forward because U.S. exports would still be shackled,” David Goldwyn, a senior State Department energy diplomat in the Obama administration, told The New York Times.

Gas demand in China dropped 9% in 2019 from 17% in 2018, according to Wood Mackenzie, an energy consultant. That demand could be even softer in 2020. Before the trade war, China was the third-largest purchaser of American liquefied natural gas. However, after the trade war started in 2018, it wasn’t in the top 15, according to Forbes.

Little Details for Manufacturing

In terms of manufacturing, Bauman said there is little detail on what China will be buying, but currently, “it’s relatively minor compared to energy and agriculture.”

“It’s mainly aircraft,” Bauman said. “But, that raises the question of Boeing, which opens up a whole other can of worms.”

“It’s mainly aircraft,” Bauman said. “But, that raises the question of Boeing, which opens up a whole other can of worms.”

Boeing Co. (NYSE: BA) is currently under fire over its best-selling 737 Max. Production has halted, and airlines have grounded the aircraft after significant issues regarding its safety following a pair of fatal crashes.

Boeing recently reported it lost 87 commercial aircraft orders in 2019 — meaning it has more cancellations than orders. It was the first time in more than 30 years the company reported a loss.

The general message from American producers of agriculture and energy products is to show, not tell when it comes to the benefits of the phase one agreement.

“Everything about these figures tells me that this is a public relations exercise, not a genuine trade forecast,” Bauman said.