It’s not just you… The summer doldrums are real.

And I’m not just talking about getting sick of the heat — which, trust me, I am!

I’m talking about the stock market and the seasonal headwind it runs into around this time nearly every single year.

You see, there’s an inarguable bearish bias that occurs in the stock market during summer. In fact, since 1990, the month of August averages a -0.6% return.

This year’s been a bit more pronounced than that. The S&P 500 fell 1.5% last month.

To this, I have good news and bad news.

Let’s get the bad squared away first. This bearish bias has historically continued into September, with an even steeper average loss of -0.8% since 1990.

The good news, however, is that this is only true for the S&P 500. And because you’re reading this newsletter, chances are good you don’t just invest in the S&P 500 and accept whatever happens to your money.

There are several market sectors bucking the trend right now. Adding exposure to these right now can help you shrug off the summer doldrums and make money … you just need to know how to find them.

On the flipside, there are market sectors doing even worse than the broad market, which you should either avoid … Or, as I’ll demonstrate, use the options market to profit as they head lower.

I’ll share an example of both a bullish and bearish sector today — along with the best and worst stocks in them — with the goal of helping you make money in what’s historically the worst time of year to own stocks…

Leaders to Buy, Laggards to Sell

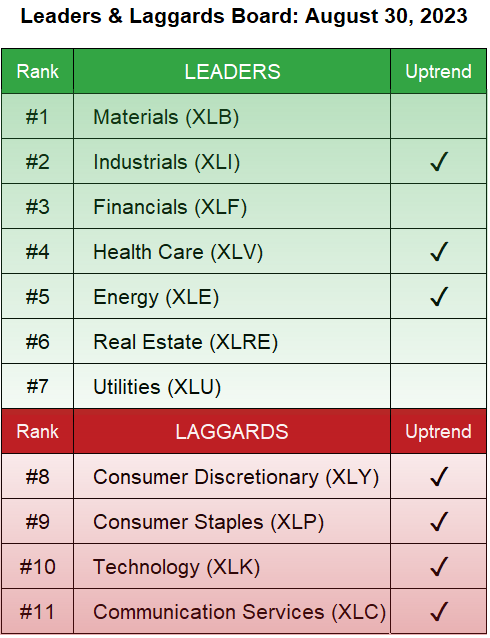

Every week, I send Green Zone Fortunes and Max Profit Alert subscribers my “Leaders & Laggards Board.”

This simple table contains the sectors set to lead the broad market over the coming weeks … and the ones set to do worse.

It’s all calculated through the use of the trend-and-momentum model I’ve used in my Max Profit Alert service for the past 12 years.

Here’s what my Leaders & Laggards Board looked like last week…

Now, a bit of explanation is in order…

The first step in the process is to determine whether or not a sector is in an uptrend over the past six months. If it is, it earns a “checkmark” and becomes a candidate for a trade.

The next step is to determine the sector’s current momentum relative to the broader market. If the sector has climbed at a faster rate than the market over the past few months, it will earn a higher rank on my Leaders & Laggards Board. If it’s been lagging, it will fall to the bottom.

Now, it’s possible for a sector to be ranked highly but not be in an uptrend. We see that this week with the materials (XLB) sector.

This means XLB may continue to outperform the market, but the odds of success with a trade to the upside aren’t as favorable as when the sector is already in an uptrend.

Conversely, we can see sectors rank low while still being in an uptrend. That’s true this week of each of the laggards, ranked #8 through #11.

This typically means the sector is going through a short-term pullback within a longer-term uptrend. If you’re in a long stock position, it may be fine to wait it out patiently through that pullback. But if you’re looking for the best entry point for a bullish options trade, it’s best to wait until the sector regains its market-beating momentum.

I exclusively use this trend-and-momentum model in my option-trading service, Max Profit Alert.

But you can also go a step further and leverage my Green Zone Power Ratings system to find the best and worst stocks within either leading or lagging sectors or sectors that are in uptrends or downtrends.

So on that note, let’s compare the best Industrials stock with the worst Communications stock according to the Green Zone Power Ratings system…

The Leading Leaders and Lagging Laggards

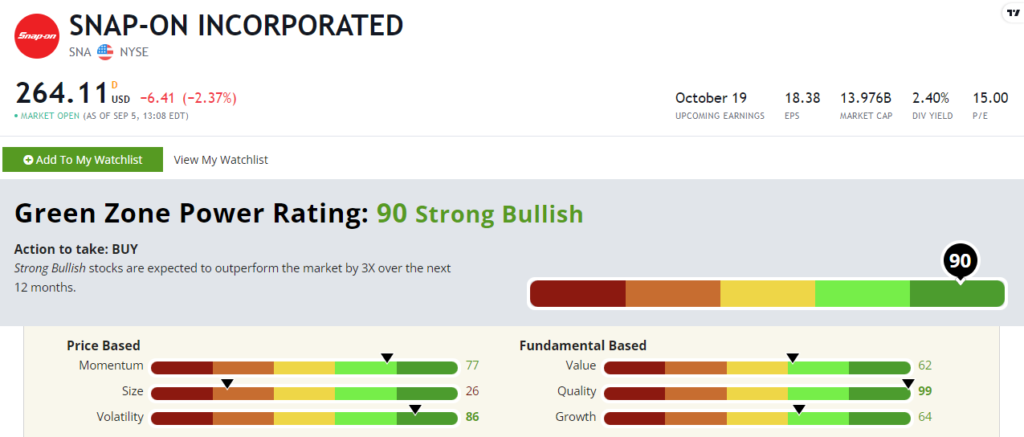

The top-rated stock of the Industrials sector, for example, is Snap-On Inc. (NYSE: SNA), with “Strong Bullish” Green Zone Power Ratings of 90…

Snap-On’s business is clearly firing on all cylinders. It rates a decent 62 on Value, a 99 on Quality and a 64 on Growth — all the metrics we want to see for a fundamentally sound business.

It’s also got a high Momentum score, indicating its recent price action has been positive. It gets a ding on Size for being a $14 billion company… But it’s also a stable stock, with an 83 Volatility rating.

Since this is the top stock of the bullish and uptrending Industrials sector … and has a Strong Bullish rating … we should expect this stock to outperform the broad stock market over the next two to three months… AND the next year.

This sets up a great trade opportunity.

If you were to, say, buy an at-the-money call option on SNA dated out three to 12 months … with just half of the funds you would normally put into a stock position … you could leverage the gain we see in SNA and minimize your risk at the same time.

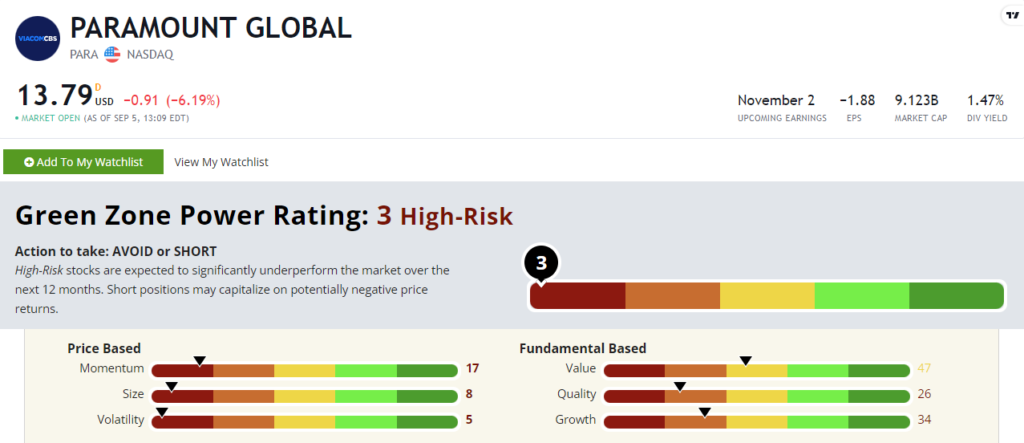

Now, pit that against the worst-rated stock in the lowest-ranked Communications sector, Paramount Global (Nasdaq: PARA), which rates a “High-Risk” 3…

Here, we see the inverse of the opportunity SNA presents. Poor fundamental metrics, with a 47 in Value, 25 in Quality and 34 in Growth…

But also poor price-based metrics, like its 7 in Momentum, 8 in Size and 7 in Volatility.

And all this, being in the worst-lagging sector in the S&P 500?

PARA is a stock to sell. And if you have a penchant for trading, you could buy an at-the-money put option dated three to 12 months away from today to leverage a potential downside move into a windfall trade.

Now, I share these trade ideas as simple, fairly low-risk ideas to try out with a tiny percentage of your portfolio. They’re not the same trades I share with my Max Profit Alert subscribers.

There, I use an additional method of momentum analysis to confirm the trades that have the highest odds of success.

Max Profit Alert, you should know, has used this strategy for over a decade with great success. Here are just a few of the highlights over the years:

- +121% and +293% on two separate exits of one-third of the position in a trucking company in under five months.

- +100%, +247% and +322% on three separate thirds of a position in a midcap regional bank in six months.

- +501% on the final third of a position of an oil exploration company in three months!

And just recently, we began including my Wednesday Windfalls two-day trade recommendations and a weekly live Trade Room into the mix.

If you’re into trading options, it’s easily the best-valued service I’ve ever seen — not to mention the one with the longest track record.

And even if you’ve never traded an option contract before, Max Profit Alert has all the resources you need to get you up and running, quickly.

You can get the full story of Max Profit Alert right here, including the details behind a recent trade I recommended on one of the most fragile sectors in the market.

To good profits,

Adam O’Dell

Chief Investment Strategist, Money & Markets