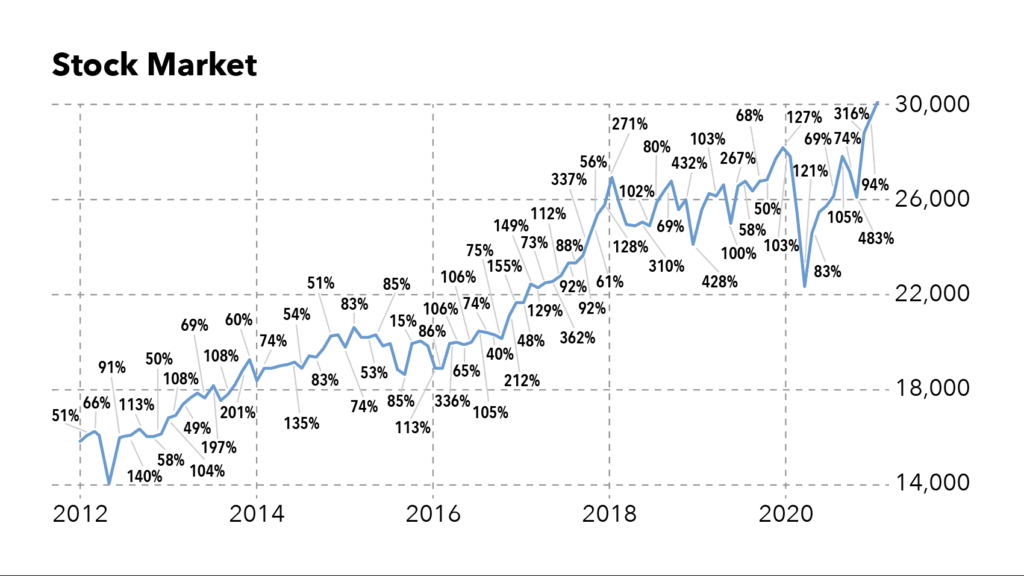

The stock market has had a good run over the past eight years.

Even taking the 2020 COVID-19 bear market into account, the S&P 500 has more than doubled since early 2012.

That’s not too shabby. Doubling your money for eight years will leave you with a respectable nest egg in retirement.

But take a close look at the stock chart below.

Those numbers are the returns of recommendations that my colleague Adam O’Dell made with his elite Home Run Profits trading strategy.

Check out those back-to-back gains of 91% and 113% in the first year alone.

Adam O’Dell’s Incredible 8-Year Performance

Best Trading Strategy for 2021

Now, you know the rules. Past performance doesn’t guarantee future results. Not every trade Adam recommended ended up doubling.

And full disclosure: A few lost money. But as I wrote last week, this is a “rinse and repeat” trading strategy. It’s OK if a trade doesn’t quite pan out because you’ll get another opportunity — generally within a few weeks.

And the wins over time are large enough to cover your losses many times over. In an eight-year stretch in which the S&P 500 doubled, Adam’s strategy would have boosted your portfolio by a factor of 40.

Time will tell, of course, what the returns will be like over the next eight years.

But it’s more important than ever to be tactical like Adam and look for regular short-term trading opportunities, rather than simply buying and holding and hoping for the best.

Here’s why.

Stock Performance: A Look Forward (CAPE)

Back in 2012, the stock market wasn’t super expensive. It traded at a cyclically-adjusted price/earnings ratio (CAPE) of about 22. That’s higher than the all-time historical average of about 17 but well within the normal bounds for the past 20-30 years.

The CAPE is a better gauge of under or overvaluation because it takes a 10-year average of earnings to smooth out the booms and busts.

Well, today, the S&P 500 trades at a CAPE of nearly 34.

The only time in history that we saw a CAPE this high was during the final blow-off years of the 1990s dot-com bubble.

A CAPE at these levels isn’t sustainable for long. Or at least it hasn’t been over the past two centuries of the stock market.

This implies that stock returns will look less than impressive moving forward.

Research site GuruFocus crunched the numbers and found that a CAPE of 34 suggests annual returns in the ballpark of about 1.2% over the next eight years.

Now, you can take that 1.2% number with a grain of salt. Returns might be higher or lower than that. Only time will tell.

But does that sound like a bet you’d want to take?

If your investment plan depends on the market continuing to rise, that’s not an investment plan. It’s a lot closer to a Ponzi scheme.

And that’s the beauty of a system like Adam’s: It doesn’t depend on the market going ever higher. It performs in up markets … in sideways markets … and even in down markets.

An S&P 500 Index fund might surprise us and end up having a decent run over the next few years.

But personally, I’d rather take my chances trading. I think we’re a lot more likely to make a decent return taking a disciplined, systematic approach than simply buying, holding and hoping for the best.

To find out about Adam’s elite Home Run Profits trading strategy, click here now to register for our event on January 12. You wont regret it.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business. Follow Charles on Twitter @CharlesSizemore.