The Federal Reserve surprised traders at its meeting on Wednesday with a statement that may lead to price hikes.

In March, the Fed indicated short-term interest rates would remain near zero until 2024. This week, the guidance changed to indicate there could be two rate hikes in 2023.

Higher rates are a response to higher inflation. Forecasts released after the meeting show that the Fed now expects inflation of 3.4% in 2021. That’s 1% higher than expectations three months ago.

However, the central bank still insists there’s nothing to worry about, noting: “Inflation has risen, largely reflecting transitory factors.”

Consumers believe inflation is rising. But they view inflation differently than the Fed. Using the Fed’s logic, a price rise of 23.6% is desirable.

In its statement, the Fed shared a goal of keeping “inflation at the rate of 2% over the longer run. With inflation having run persistently below this longer-run goal, the [Fed] will aim to achieve inflation moderately above 2% for some time so that inflation averages 2% over time…”

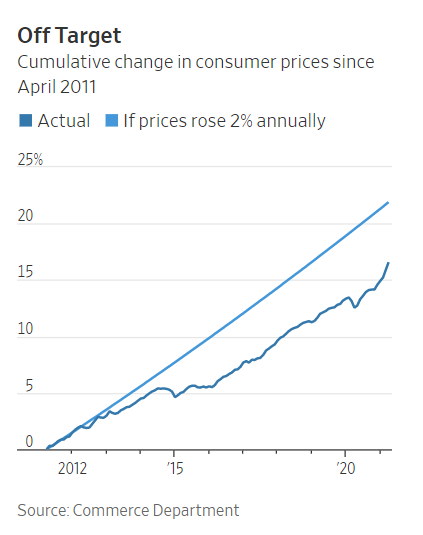

The Fed is speaking in terms that economists favor. The next chart shows how this looks in reality.

Fed Strategy Would Create Disastrous Price Hikes

Source: The Wall Street Journal.

Price Hikes Mean Investors Must Fine-Tune Risk Management

In that chart, the straight line shows where inflation would be if we experienced inflation of exactly 2% a year. Right now, after the recent spike, we are 23.6% below that line.

If prices jumped 30% over the next year, the Fed could argue inflation is merely moving towards the 2% long-run average. The Fed can declare victory as consumers face disaster.

If the Fed gets its way, expect interest rates to move much higher in 2023. As rates move up, bond prices will fall. Bonds could drop in value by more than 20% if interest rates jump by 2%. Junk bonds could lose even more.

While the Fed assures us that everything is under control, investors need to fine-tune their risk management strategies. Consumers need to buy now before inflation makes goods and services unaffordable.

While I didn’t exactly design the internet, I can take full credit for this.

I’ve created a first-of-its-kind innovation in the financial markets. It allows everyday traders to get ahead making one simple trade per week.

Click here to see how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.