Every week in Earnings Edge, we cover a couple of stocks set to report quarterly numbers.

Earnings are a key event for any company, but you’ll notice I’m reluctant to bet on the single-day moves the event brings. These single-day pops and drops are what puts the big day on everyone’s radar.

Traders are hoping for a chance at quick profits.

I flip that approach to earnings season upside down.

I don’t look for quick, overnight gains.

Instead, I use the move on earnings to look for even bigger profits in the days that follow.

It’s a phenomenon called an “earnings drift,” where the stock tends to drift in a certain direction after reporting quarterly numbers.

Today, I talk about two stocks set to report earnings on my shortlist.

But it all depends on what happens this week.

Some stocks trigger a new trade, while others don’t hit the right parameters.

Even if these two stocks don’t produce a new signal, I’ll have dozens of opportunities throughout the earnings season. The only way to access this unique trading strategy is through my top research service, Quick Hit Profits. You can check out this special presentation highlighting my earnings drift approach.

Earnings Edge Stock No. 1: CarMax Inc. (NYSE: KMX)

Earnings Announcement Date: Tuesday, before the open.

Expectations: Earnings at $1.28 per share. Revenue at $7.49 billion.

Average Analyst Rating: Outperform.

The used car dealership that changed the game decades ago is dealing with intense competition as inventory is tight, even though used vehicles are fetching record prices.

It’s quite a conundrum.

Knowing that used vehicles are selling like hotcakes and at premium values, you’d expect the stock to be doing great.

But after the long run-up since the pandemic crash, shares have plunged 35% in six months.

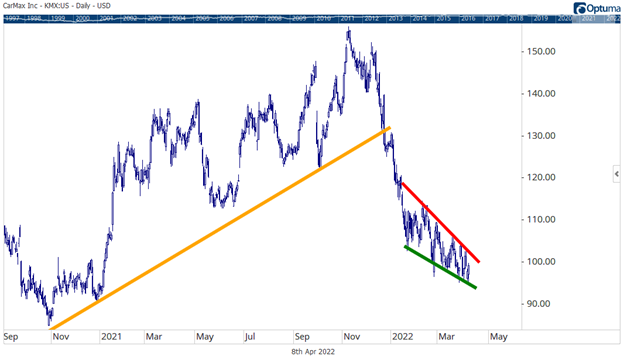

KMX’s Precipitous Wedge

KMX is stuck in a tight falling wedge pattern that is likely to be broken with earnings this week.

Shares could go either way. This is me being reluctant to make a call before the big day. But, seeing the price chart, things look weak. It broke the uptrend late in 2021, and the falling wedge pattern may signal more pain.

I won’t gamble on this event, though.

Instead, CarMax is on my list of 75 stocks that experience clear drift patterns. And this one happens to be a bearish signal.

Most of the earnings drift patterns are bullish, but in volatile times like this, our bearish trades can become more popular.

So let’s track CarMax into this week.

If the stock falls by 5% and misses earnings expectations by at least 5%, we want to bet on the stock to continue falling over the next couple of months.

Earnings Edge Stock No. 2: Delta Air Lines Inc. (NYSE: DAL)

Earnings Announcement Date: Wednesday, before the open.

Expectations: Earnings at a loss of $1.26 per share. Revenue at $8.95 billion.

Average Analyst Rating: Outperform.

Delta is finally experiencing some normal travel volumes. Since the pandemic, it took over a year for things to begin to normalize, and we are still not all the way back.

But it’s a lot closer than before.

So why is the stock still trading 35% below its pre-pandemic peak? To put that in perspective, the S&P 500, the broad index with 500 of the largest stocks, is up 35% since DAL peaked on January 17, 2020.

It’s an opposite reaction to an economy that is recovering.

Investors are worried about higher costs due to fuel prices and the pinch inflation puts on consumers.

This week, we get insights into those pressures as it reports earnings.

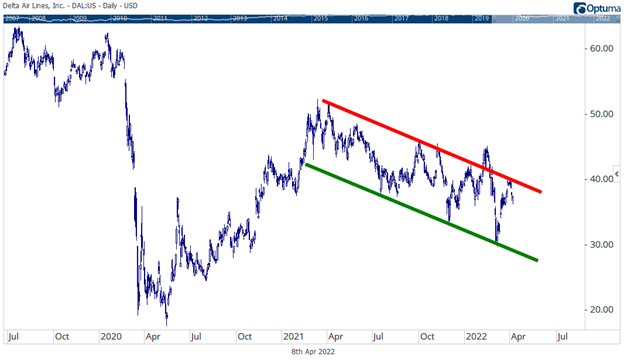

On the chart, the airline giant is also showing some weakness, sitting in a clear downward price channel.

DAL Trends Downwards

After trending higher since the March 2020 crash, shares topped before reaching the previous high. You can see the downtrend on the chart between the red resistance and green support lines.

After trending higher since the March 2020 crash, shares topped before reaching the previous high. You can see the downtrend on the chart between the red resistance and green support lines.

My signal on Delta is a bullish opportunity, but only if it hits.

I’m looking for an earnings beat of at least 5% and the stock to pop by 5% or more. Both sides have to be true for the expected earnings drift.

For Delta, you’d be looking at the stock to rise over the next couple of weeks.

So if you get a strong earnings beat and pop in the stock, look for call options as the stock is likely to break this downtrend it’s stuck in.

Click here to join True Options Masters.