President Donald Trump has never been shy about calling out monetary policy he disagrees with, but the U.S. dollar took a hit after the president’s latest call to match China and Europe’s “currency manipulation game.”

“China and Europe playing big currency manipulation game and pumping money into their system in order to compete with USA,” Trump said on Twitter. “We should MATCH, or continue being the dummies who sit back and politely watch as other countries continue to play their games – as they have for many years!”

The U.S. Dollar Index, a comparison between the dollar and other major global currencies, went into the red after the tweet, but has since recovered.

China and Europe playing big currency manipulation game and pumping money into their system in order to compete with USA. We should MATCH, or continue being the dummies who sit back and politely watch as other countries continue to play their games – as they have for many years!

— Donald J. Trump (@realDonaldTrump) July 3, 2019

“He’s amplifying a move that to me is happening anyway, for the right reasons,” Mark McCormick, FX strategist at TD Securities, told CNBC.

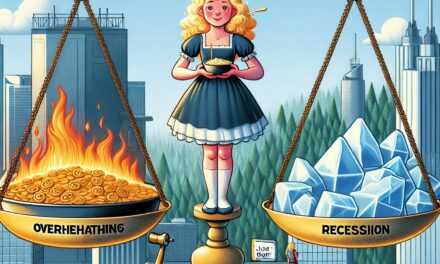

“It’s pretty clear the currency is definitely a focus … you have some new Fed nominees which lean on the dovish side, you have the Fed ready to cut rates, you have a slowing U.S. economy,” McCormick added. “There’s a period here where the currency is going to weaken on these things.”

Recently, China did not make the Trump administration’s list of countries that manipulate their currency to gain an economic advantage despite Trump’s complaints that Beijing devalues its currency, further increasing the trade deficit between the U.S. and China.

The Treasury Department declared in May that no country met the criteria to be labeled a currency manipulator, but nine nations will be monitored more closely in the following months. China — along with Germany, Ireland, Italy and Japan — made that short list.

Trump also recently called out the European Central Bank after it took a similar stance to the Federal Reserve in stating it was ready to cut interest rates as a means of stimulating the European economy, if needed.

Trump slammed the move saying that a lower euro was “making it unfairly easier for them to compete against the USA. They have been getting away with this for years, along with China and others.”