In the winter, ice is a problem for the roads in Kansas.

Crews spread salt on the roads from big dump trucks before storms and use plows to move snow and ice off them after.

These trucks cost hundreds of thousands of dollars.

The important part is keeping them on the road and in good condition for as long as possible.

This chart shows the growth of the global heavy construction equipment market from 2020 to 2030.

Over those 10 years, the market will grow 55.2% to reach $273.5 billion.

Today’s Power Stock makes and sells tires, wheels and rims for these huge trucks: Titan International Inc. (NYSE: TWI).

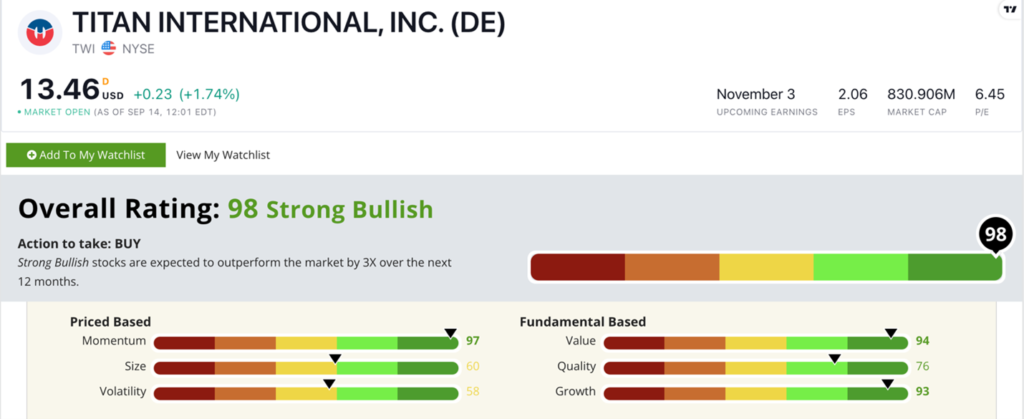

TWI Stock Power Ratings in September 2022.

TWI makes the essential parts keeping large industrial equipment moving, from huge tractors on the farm to massive snowplows.

It makes tires as big as 2 feet wide and 6 feet tall!

Titan International stock scores a “Strong Bullish” 98 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

TWI Stock: “Maximum Momentum” + Excellent Value

Highlights from Titan’s excellent second quarter include:

- Net sales of $573 million — up 30.6% from the same quarter a year ago and the highest since 2013.

- Gross profit was 75% higher than the same quarter in 2021.

Those points show why TWI scores a 93 on our growth metric.

TWI also outpaces its peers on value: Its price-to-earnings ratio is more than three times lower than the industry average.

Its price-to-sales ratio is nearly six times lower than its peer average … all telling us TWI is an outstanding value compared to the rest of the machinery manufacturing industry.

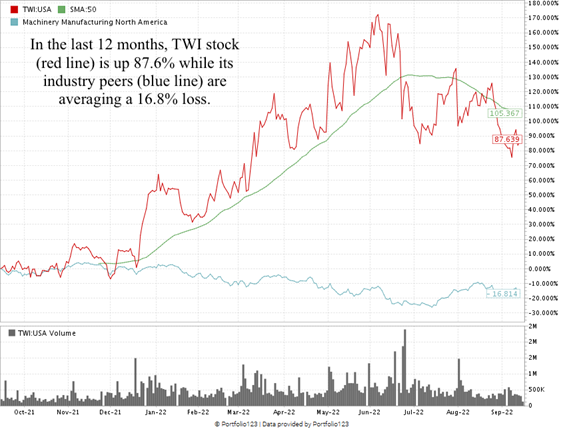

From September 2021 to June 2022, TWI stock ran up 178.4% to reach a 52-week high.

Broader market sell-offs pushed the stock down, but it remains up 87.6% over the last 12 months.

It’s killing its peers, which average a 16.8% loss over the same time.

TWI scores a 98 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The market for heavy machinery is only getting bigger.

So is the demand for parts to keep those trucks, haulers and plows running for years to come.

As a market leader in providing wheels, tires and rims for these massive pieces of equipment, Titan stock is an excellent addition to your portfolio.

Stay Tuned: International Water Solutions Co.

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a company that makes and operates reverse-osmosis plants and water distribution systems.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.