Bloomberg broke the news Tuesday that Uber has reached out to food delivery competitor GrubHub with a takeover offer, but investors should pump the brakes on buying in.

People familiar with the matter told Bloomberg that Uber Technologies Inc. (NYSE: UBER) has approached competitor GrubHub Inc. (NYSE: GRUB) with an acquisition bid.

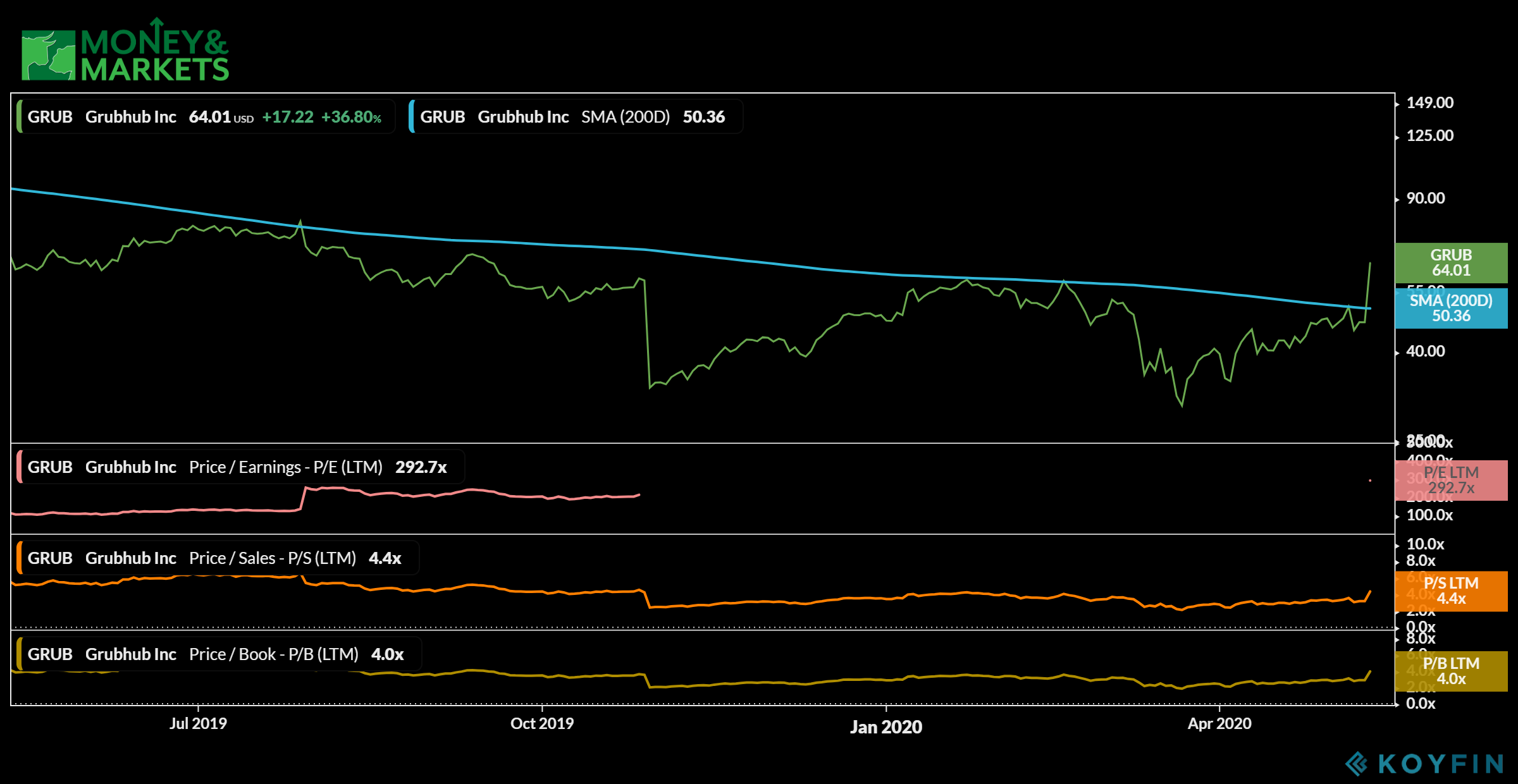

The news sent GrubHub stock soaring so high and so fast that trading was halted three times Tuesday on Wall Street.

But while investors couldn’t wait to jump into GrubHub on the news, the smart money suggests it might be time to wait and see when it comes to either of these companies.

Why Uber’s GrubHub Takeover Makes Sense

GrubHub has been a thorn in the side of Uber and its own delivery service, Uber Eats, for some time.

And Uber Eats was really the lone bright spot in the company’s first-quarter earnings report. The Eats division reported a 54% year-over-year growth in bookings. Uber’s core Rides division was down 3%.

However, Uber’s total loss for Q1 was still nearly $3 billion.

GrubHub, on the other hand, netted a 12% year-over-year increase in revenues in Q1 2020. Its gross food sales were up to $1.6 billion — 8% higher than the same period a year ago.

So for Uber, sinking its teeth into a competitor that has grown steadily amid the coronavirus lockdown is beneficial, depending on the price, of course.

GrubHub is valued at $4.5 billion. Uber’s market capitalization is around $55 billion.

Why Investors Need to Pump the Brakes

It’s easy to get caught up and fear you might be missing out on a golden opportunity for short-term profits when news like this breaks.

But there are peripheral things to consider here.

First, this is not a substantiated report. In fact, when GrubHub was in the middle of speculation that Walmart Inc. (NYSE: WMT) and other grocery chains were considering acquiring the company, they denied they were even for sale.

“We felt it was important to clarify that there is unequivocally no process in place to sell the company and there are no plans to do so,” a GrubHub spokesperson told CNBC at the time.

Shares of GrubHub spiked from $48 per share to $54 in a day when it was first reported. However, things cooled and the stock went into a decline.

Uber is facing its own issues. Due to a downturn in business, the company said it is laying off 3,700 employees.

A recent report by the University of California at Berkeley also says if Uber considers its drivers employees and not contractors, they would owe hundreds of millions of dollars in unemployment benefits to the state. The company was also fined $650 million over misclassification of its drivers in California — a decision it is contesting.

There are too many factors to suggest this is either just a rumor or not something GrubHub would seriously entertain.

That said, if it proves to be false, those who bought on Tuesday will be in a big hurry to sell, which could drop the price of GrubHub to the point where it would be worth jumping in.

But until then, it’s best to stay on the sidelines.

Editor’s note: Want to learn how to profit from stock market volatility and grow your money 10 times over with just two simple investments? Sign up for The 10X Switch, a free webinar with Money & Markets Chief Investment Strategist Adam O’Dell on Thursday, May 14, at 8 p.m. EDT. You’ll also receive a free copy of Adam’s report, “The Simplest Investing Strategy Ever,” just for registering. Sign up here and reserve your spot!