Super Bowl Sunday is upon us — and with it, the biggest game of the year!

Meanwhile, we’ve also got a battle playing out on Wall Street as tech stocks get pummeled.

Today, we’re covering both of these critical topics … and I’m also highlight a few of the stocks that are building stronger teams to help send their share prices soaring through the rest of the year.

Let’s get into it…

Video transcript:

Welcome to Moneyball Economics. I’m Andrew Zatlin, and we’ve got some ground to cover today.

Speaking of ground to cover, let’s start off with the Super Bowl this Sunday.

I love, love, love Super Bowl Sundays.

I am looking forward to this year because I think this year’s going to be an exciting matchup. I think we’re going to have a lot of shooting match. I think we’re going to have a lot of defensive turnovers. I think it’s going to be an exciting game. Hopefully the commercials will step up and I don’t know halftime, who knows what’s going to happen there.

And of course, in the Zatlin household, we celebrate with Super Bowl chili, and when I’m talking chili, I’m talking mainstream. Back to basics, traditional chili, no weird stuff. We’re talking kidney beans, we’re talking ground beef, some Bailey’s. We’re talking a little bit, a bit of spice and we’re talking, maybe I might tart it up with some okra, green beans, mushrooms, but whatever flavor middle of the road.

Now this is kind of a pet peeve of mine…

I’ve noticed this over the past decade where anything goes when it comes to food and drink, you’re seeing flavors mixed that quite frankly are a little bit odd to me.

And maybe this is a cultural thing where these days anything goes as well, but I’m sorry, I don’t need weirdness in my chili and when I go out for chicken wings, I just want chicken wings. I don’t need weird flavors in my chicken wings. Hot sauce.

What is pineapple doing in my hot sauce? What the hell is up with chocolate flavored beer?

No. Let’s get back to basics.

I’m all about this Sunday. I’m going to have regular beer. I’m going to sip some Woodford bourbon. I’m going to have some chili, some garlic bread, some chicken wings, and I am going to enjoy my day.

So having said that, rant over. Let’s talk about the economy again…

The economy is firming up and we saw some of that in the data this week. Remember what I’ve said is we are in a transitioning period. Some data’s going to look strong, some data’s going to look weak. We have to understand that that’s what happens when you transition.

Data starts to get a little conflicting, and that’s what we saw this week, beginning of the week, flashed positives for the manufacturing space, flashed expansion in the PMI data. This is what I’ve been saying.

Now that we are one year past the tariffs, there’s a lot more certainty, a lot less anxiety, and quite frankly a lot less inventory. So restocking has to start in January is when you start doing that, and that’s what we’re seeing. At the same time, we had another economic data point that came out and looked weak, but the thing is the manufacturing data is current.

It reflected what happened in January. Then we got this thing called Jolts data that came out that was looking at December. Jolts data tracks what the government thinks is happening in terms of job openings, layoffs, that kind of thing. And it was a little bit weak, but again, it’s December and in my opinion, what was happening through the fourth quarter last year was window dressing companies were excited. They were seeing a lot of margin expansion and so they cut back on things like job postings.

That is a testimony to what happened last year, not this year, but nevertheless, what happened to me this week is a lot of phone calls. I have a lot of nervous clients and I mentioned that there’s going to be volatility in the markets This week was certainly very volatile and it’s not going to end because next week we start to get some additional hard data about the state of the economy specifically.

We get payrolls that was booted from this week to next week. And the payrolls will look at a combination of December and January and we get retail spending for December caution.

Now, the markets look at these data points very carefully, but again, these are reflecting more of what was happening in December and not about the new year.

I keep coming back to not about the new year because again, January is kind of a Groundhog Day. It’s when companies start to emerge and come out. Everything that was happening in December is a reflection of trying to make sure that they ended the year on a really strong positive note.

Retail’s looking at consumer spending. There were a couple things, positive and negatives, but I believe that retail is going to come out and again, be about the same as we saw the previous month.

Nothing strong, nothing weak when it comes to payrolls. This is the one that’s going to trigger a massive market reaction right now, alternative data companies like ADP and others are saying this is going to be a terrible month for payrolls. I don’t think so. It’s not going to be a great month, but I think it’s going to be a pretty decent month.

And the market is expecting decent, not negative. If they see something negative, there’s going to be panic because we are shifting narrative from good news is bad news and bad news is good news, right? Meaning if bad economic data comes out like it might next week, then rate cuts are on the table.

But the reality is, if we’ve got a firming economy, then you won’t get rate cuts. And so good news is bad news needs to shift because the new reality is good news is good news, but the market’s got to adjust and they haven’t.

Again, we’ve got conflicting data because we are transitioning into a growing economy and that’s not something that the market’s ready to see.

Now let’s do the third and final thing I want to talk about. And that is the gift you got this week of a market dip, in some cases more than a dip. In some cases it was a blow off top.

Let’s face it, silver at 120 bucks came back down closer to reality. But there is overselling. There was probably margin calls, a lot of the squeeze short squeezing ended, but you also had some panic selling. You just got handed a very nice buying opportunity.

And I would like to share with you as I promised before, how hiring can help you with your target list. So I’m going to share a couple of companies that popped up. Now that January is done, I want to get in the habit of the first week of the month talking about a couple companies that look strong, a couple that look weak based on their hiring.

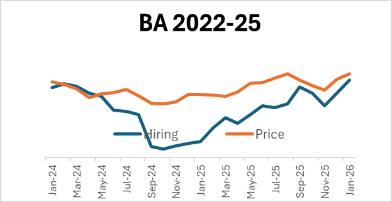

Let’s kick it off with two that I’ve mentioned in the past, Boeing (BA) and Huntington Ingalls (HII)…

Now these are two different experiences when we’re talking Boeing, it looks like Boeing has had their run. What I mean is they popped up, they continue to move up, but that short-term opportunity seems to have played out, not so with Huntington Ingalls.

This is the latest snapshot that I have of their growth when it comes to hiring and their growth when it comes to stock price hiring, again, being in blue, orange being the stock price growth:

And what you can see is in general, this is still a big buy. They are hiring like you wouldn’t believe at HII. And the stock market sees it and is in there and it looks like it’s going to continue a run.

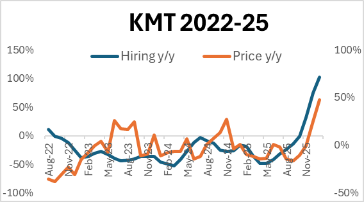

Two companies that I want to introduce that are net new, [starting with] KMT Kennametal. Now, I’m not really familiar with them as much as I should be, but they’re hiring. Not only is it accelerating after being flat for the longest time, but it’s accelerating at a pace that is fast than the stock price so that the market is playing catch up. That might be a good opportunity there.

And then there’s something called COP or Cooper. Again, this is a company where they are flashing a lot of hiring growth and the stock price has yet to catch up to that. I don’t know a lot about Cooper, I don’t know a lot about Kennametal:

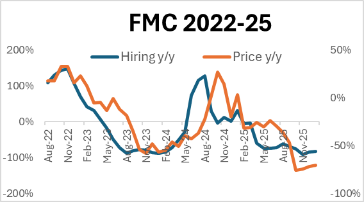

I’m just saying from a hiring perspective, this is a pretty powerful signal that they are seeing growth, not so for FMC, A chemical company:

They are not hiring. Let me be very clear. They are not hiring and they haven’t been hiring. And in fact, you see how the stock price finally caught up with that in the fall.

And what’s interesting is while the hiring is just horrible, the stock price seems to be perking up a little bit. So this is a company where I would say, I don’t know if they’re a short, but I certainly would not want to be part of this company. They’re not hiring.

Why on earth would you want to have this company in your portfolio? Let me know if you have any particular companies you want me to look at right now. I’m looking at a couple hundred. There are some great opportunities out there. Let me know if you’ve got some of interest. We are totally in it to win it. 2026 is our year.

Zatlin out.

Andrew Zatlin

Editor, Moneyball Economics