In this week’s Marijuana Market Update, I cover a little-known cannabis investment company I believe is a bargain stock given the present market downturn.

I also answer a viewer’s question about cannabis ETFs.

Geopolitical issues in Europe, inflation and the Federal Reserve’s interest rate plans are pummeling markets.

In response, I spent a lot of time poring over our Cannabis Power Rating system to find cannabis stocks with solid value and the potential for strong momentum.

Today, I have one to share.

Value Cannabis Stock: Plant-Based Investment Corp. Analysis

Plant-Based Investment Corp. (OTC: CWWBF) is a Canadian principal investment firm. It invests in companies — both public and private — in the cannabis space. It uses fundamental analysis (like looking at finances) to find these companies.

It’s a small company, with a present market cap of $5 million to $6 million.

Plant-Based’s Recent Turnaround

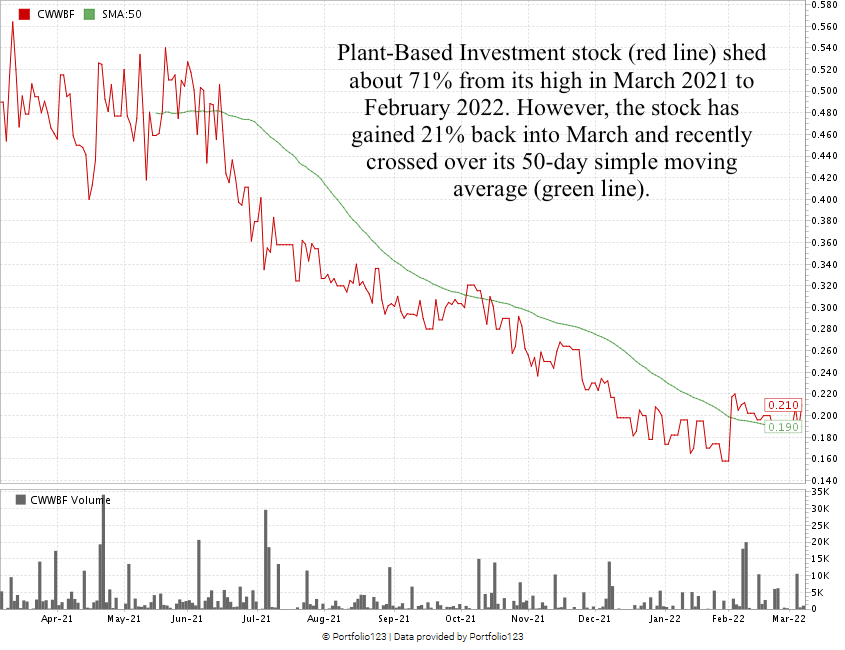

CWWBF hit a 52-week high of $0.56 per share in March 2021 before stagnating and dropping with the rest of the cannabis market. It pared back about 71% from its high to its low of $0.16 per share in February 2022.

However, I’ve seen an uptrend in the stock. It has jumped about 21% off its 52-week low in just a few weeks.

CWWBF has maintained its position above its 50-day simple moving average (green line in the chart) for several weeks, indicating it has passed support at $0.19.

This could indicate a potential uptrend is in the making.

But there is an important reason to consider CWWBF: its stock value.

Its price-to-book (P/B) ratio — which you get by dividing a company’s stock price by its book value per share — is in a great spot today.

In 2018, the company saw its highest P/B ratios — between 0.53 and 0.85. There was a drop in the first quarter of 2019, but the ratio picked up.

Today, the P/B ratio for Plant-Based Investment Corp. is 0.33.

This would indicate the stock is a much better value today than it was even three years ago.

We can also look at our Cannabis Power Rating to indicate how CWWBF rates as a potential cannabis investment.

The Cannabis Power Rating ranks cannabis stocks against each other using several metrics, but it’s focus is primarily on momentum and value.

As you can see, Plant-Based Investment Corp. scores a 95 overall, meaning we are “Strong Bullish” on the stock and expect it to outperform the broader market.

Its highest rating is on value, where it scores an 82. This is because of its strong P/B ratio.

The company scores a “Bullish” 75 on momentum as the stock has tested and appeared to have broken through key support levels.

The Takeaway on Value Cannabis Stock CWWBF

There is potential for this stock, but be cautious. Investors are backing away from over-the-counter stocks, especially those in the cannabis space.

However, if you were interested in adding a good value cannabis stock to your portfolio, CWWBF does have some momentum on its side and scores as a bargain.

The State of Cannabis ETFs

Now, I want to answer a viewer’s question. Patrick emailed me and asked:

Thank you for your service and information on the psychedelic market. I have invested in many different MJ stocks, including some ETFs like PSIL, MJ and MSOS. What do you think of those ETFs I mentioned? Do you believe, as I do, that the psychedelic market has great potential as research continues to show promise? Thanks again for your insight and research on these markets. — Patrick

Thank you for your questions, Patrick. I’ll try to cover them as best I can.

I’ll start with the second question first.

Yes, I do believe the psychedelic market has strong potential. Companies are beginning to free up cash to invest in the research and development of various psychedelics to treat Alzheimer’s, Parkinson’s, anxiety and depression.

These ailments affect millions of Americans, and finding ways to treat them should be paramount.

Now, to answer your first question: It’s no secret that exchange-traded funds (ETFs) are great ways for investors to gain exposure to a broad sector or theme.

But, as you can see in the chart above, all three ETFs are down significantly over the last 12 months.

- The AdvisorShares Pure U.S. Cannabis ETF (NYSE: MSOS), shown above as the green line, is off by 57%.

- The ETFMG U.S. Alternative Harvest ETF (NYSE: MJ), the red line, is down 59.2%.

- The AdvisorShares Psychedelics ETF (NYSE: PSIL), the blue line, is down 59.3%.

Cannabis ETFs move in lockstep with each other. While PSIL (which released in September 2021) had a stronger downturn, it has since leveled off to perform closer to its cannabis cousins.

I do believe that ETFs are a great way to get instant broad exposure into sectors like cannabis.

However, now is a time to be a little more tactical with your trading philosophy.

If you are holding any of these, you might sell a portion (not all) of your holdings and rotate into something more conducive to battling market conditions.

If you have already bought positions in these ETFs, I would stay in them. If you aren’t holding, you may want to wait for an uptrend before getting into them. I believe in “buy high, sell higher,” as you never know when a dip will end.

But even a confirmed uptrend in any of these three would provide a strong buying opportunity with decent value.

I hope that answers your questions, Patrick.

One more thing: You, like Patrick, can get Money & Markets swag by submitting a question for me, Adam O’Dell or Charles Sizemore that we’ll use in any of our videos. Just send us your questions and feedback.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

Make sure you subscribe to our YouTube channel and get notified each and every time we post a new video.

We have a lot of great weekly video features on our channel, including:

- Ask Adam Anything — Where I get to sit down with chief investment strategist Adam O’Dell and ask him any question (from you or me) and get his insights into the stock market.

- Investing With Charles — Green Zone Fortunes co-editor Charles Sizemore and I talk about all things related to stocks and the economy, including comparing stocks to give you the best investment advice.

- The Bull & The Bear — Our weekly podcast where I show you the trends and analysis that move the market.

All of these series are on our YouTube channel.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.