According to a Bloomberg report last week, the major U.S. banks trimmed about $21 billion off their tax bills last year. With many of you dealing with tax refund sticker shock this tax season, I’ll bet you’re wondering what we got for our $21 billion?

In addition to massive payouts to shareholders via buybacks and dividend increases, U.S. banks are now beginning to hungrily eye each other.

About the same time Bloomberg released its report, BB&T Corp. (NYSE: BBT) announced it was buying SunTrust Banks (NYSE: STI) for $66 billion in cash and stock. It is the biggest bank merger in the past decade.

According to BB&T CEO Kelly King, the merger “provides the scale needed to compete and win in the rapidly evolving world of financial services.”

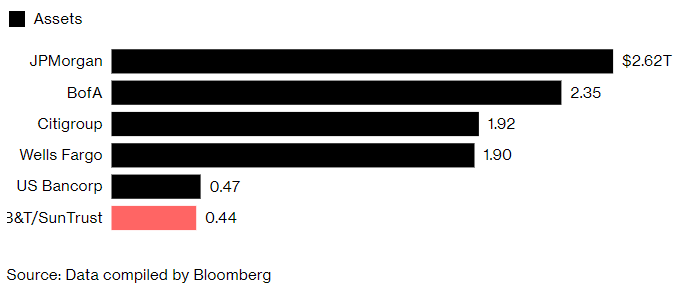

The combined bank would be the sixth largest in the U.S., with $442 billion in assets.

The move puts the combined BB&T-SunTrust just behind U.S. Bankcorp, but far behind the big four of JPMorgan Chase, Bank of America, Citigroup and Wells Fargo. For instance, Wells Fargo, the smallest U.S. megabank, has more than $1.9 trillion in assets.

In addition to the Tax Cuts and Jobs Act of 2017, the major U.S. banks are being helped along their way toward merger mania by everyone’s favorite villain, the Federal Reserve.

According to a report in Barron’s, the Fed has changed the way it responds to merger objections and expansion plans. This so called “sea change” at the Fed was signaled last year when it approved Synovus Financial’s merger with FCB Financial and Cadence Bancorp ’s merger with State Bank Financial. Furthermore, the rollback of key provisions in Dodd-Frank is also a major contributing factor.

So, who’s next?

Which banks will be next to jump on the merger and acquisition bandwagon? Analysts began speculating the moment the BB&T-SunTrust news broke, and Synovus Financial and First Horizon National along with Independent Bank Group and Veritex Holdings have risen to the top of the speculation heap.

Other notable regional banks that could benefit from M&A activity include Ameris Bancorp, Renasant, South Shore Bank, and United Community Banks, according to financial services investment banking firm KBW.

So, while you are eyeing a smaller refund (or wondering how you were left with a tax bill for the first time ever this year), the major U.S. banks already have their “refunds.” And they’re using that money to grow even bigger.