The U.S. government spent $3.1 trillion more than it took in as revenue in the last fiscal year, and some worry that U.S. debt is out of control.

Reports struggled to put the number into context. Here’s the data, according to The Associated Press:

[The deficit] was three times the size of last year’s deficit of $984 billion. It was also $2 trillion higher than the administration had estimated in February, before the pandemic hit.

It was the government’s largest annual shortfall in dollar terms, surpassing the previous record of $1.4 trillion set in 2009.

Deficits raise fears of inflation. One concern is that issuing debt means the government is spending too much money and will raise prices on goods and services it buys.

This concern seems logical, especially after the amount of outstanding government debt topped 100% of GDP in 2020. Experts have long warned this much debt would create inflation.

But history shows that might not be a problem. Japan has maintained low inflation despite years of high debt loads.

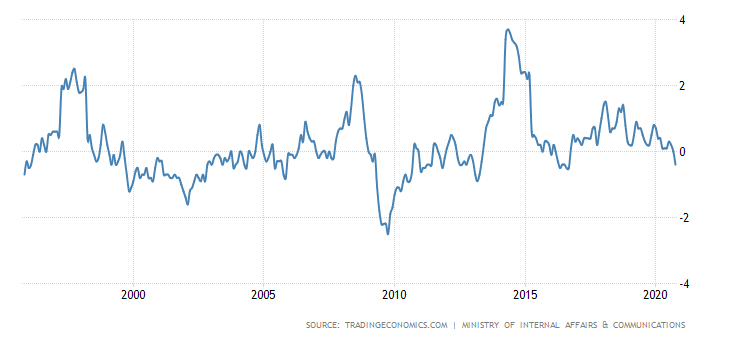

Japan’s Inflation Rate

Inflation Isn’t Inevitable Despite High U.S. Debt

The most recent data indicates that Japan is experiencing deflation, with consumer prices falling 0.7% in October compared to a year ago. That follows a 0.3% decline in prices in September, marking the steepest move into deflation since March 2011.

Deflation is existing alongside high debt levels. Japan’s government debt is about 230% of GDP, among the highest ratio in the world.

For those worried about U.S. debt, remember that the cost of servicing the debt determines whether or not it’s a problem. Japan’s interest rates are low and have been below 2% for the past 25 years. Rates on ten-year government debt have been negative for much of the past five years.

Japan demonstrates that high debt levels don’t guarantee inflation.

However, high debt may contribute to slow growth. Japan’s economy grew an average of about 1.6% a year since 1990. The U.S. economy grew about 4.2% a year, on average, over that time.

Investors should be more concerned about slow growth than inflation.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.