Economists think of themselves as fun-loving. As proof, they point to games they play. Among their favorite games is “desert island indicator.”

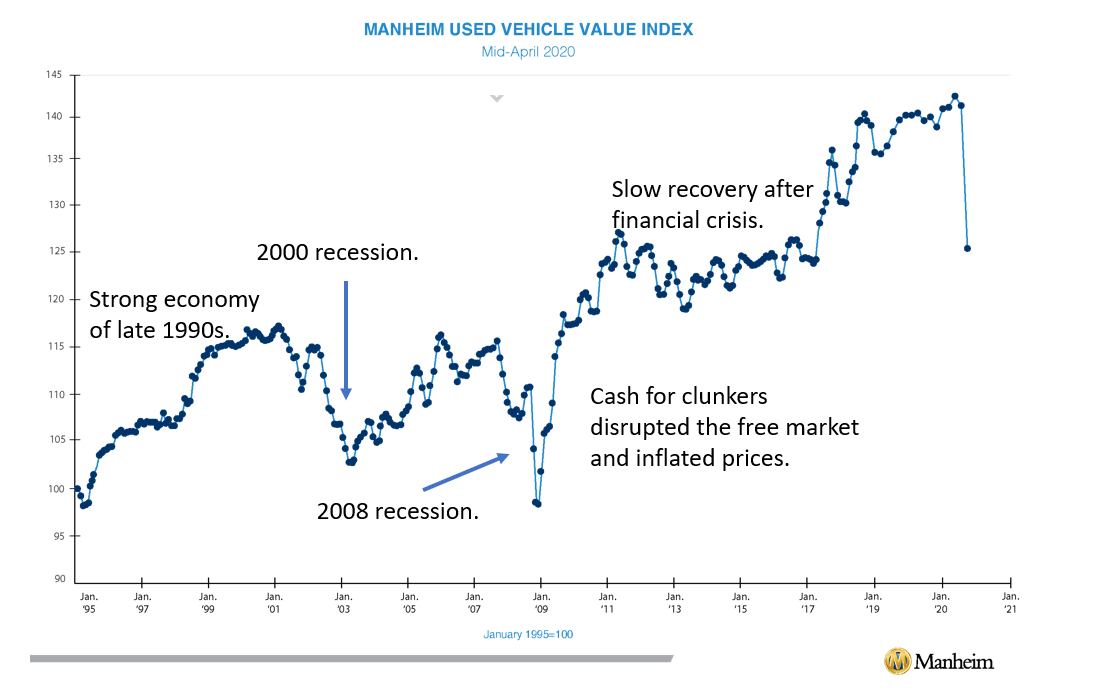

The two-month, 12.8% plunge in used car prices is the sharpest decline since the financial crisis began in 2008.

In this game, everyone names the one tool they want access to if they were stranded on a desert island.

Billionaire investor Warren Buffett was even asked that question once. He said he’d choose railcar traffic.

Railroad traffic has been widely followed since 1884. That’s when Charles Dow created the world’s first stock market average, the Dow Jones Transportation Average, to forecast stock prices.

But it’s possible rail traffic could be outdated. It provides a great view of what factories are producing, yet manufacturing only accounts for about 12% of the economy.

My Desert Island Indicator: Used Car Prices

To gain insight into the rest of the economy, my desert island indicator is the Manheim Used Vehicle Value Index. Many people in the 88% of the economy not involved in manufacturing buy used cars.

Used car prices reflect consumer behavior while new cars reflect decisions of large manufacturers. Consumers spend more on used cars in good times, choosing more expensive cars from a very large market. They spend less in bad times.

Below is the Manheim Used Vehicle Index, the industry benchmark. The two-month, 12.8% plunge is the sharpest decline in used car prices since the financial crisis began in 2008.

Source: Manheim.com

Used cars are another data series confirming we’re in a recession. Barring a government program like cash for clunkers that artificially reduces supply, the index will tell us when the recovery begins.

There are some signs that buyers are returning to the market. Manheim’s latest report notes: “According to Cox … used retail vehicle sales were down 50% year-over-year (in mid-April), which was an improvement from the 67% year-over-year decline at the end of March.”

That could be a recovery, or just a seasonal trend. Used car sales have historically been strong in the spring as tax refunds provide down payments. It’s possible the $1,200 stimulus checks will boost demand and prices as the country reopens.

This index will tell us if and when that happens.

With its deep insight into the state of economy, used car prices are a great response if you ever find yourself at an economist’s party playing “desert island indicator.”

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.