As the economy continues to suffer from the pandemic, many consumers are struggling. This is known as a K-shaped recovery.

A K-shape was already present in the economy as many with working-class jobs struggled to pay bills while other consumers maintained secure lifestyles. The difference between upward and downward slopes in economic security widened as shutdowns affected working-class jobs.

Affordable used cars have long been a tool for changing the economic security of a working-class family. Used cars are needed to get to work in many parts of the country.

After the pandemic, affordable used cars could be increasingly difficult to find.

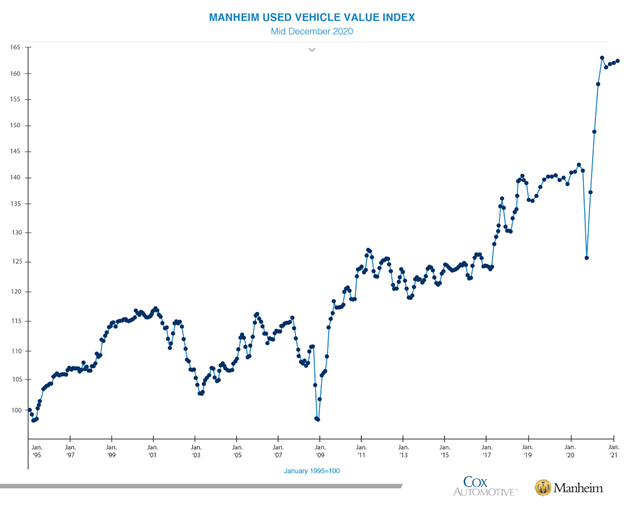

One of the most important economic indicators to follow might be the Manheim Used Vehicle Value Index. The price of used cars is up 15.3% compared to a year ago.

Source: Manheim.com.

K-Shaped Recovery: Challenge for Investors and Working Class

Used cars tend to increase in value as the economy recovers from recessions. The chart shows the prices of used cars jumped after past recessions.

In 2009, prices increased by 19.9% in the year after bottoming. This time, the index is more than 29% above its April low.

One reason prices go up in a stronger economy is that demand increases. That’s not the case right now.

Cox Automotive estimates used vehicle sales volume was down 6.8% in the past year.

Generally, decreased volume in sales would lead to lower prices as dealers responded to the market.

The higher prices we see indicates that demand is much higher than it was a year ago.

Demand for used cars could show that residents are leaving cities where public transit is available, and higher prices indicate that families struggling to escape poverty face an even steeper climb.

According to Edmunds, the average price of used vehicle purchases in October was $22,418. The average payment on a used car loan is $420. That’s after a $3,300 down payment.

Until used cars are affordable, the K-shape of the recovery will define the economy, which presents problems for policymakers that will affect us for years.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.