Early Monday morning, Pfizer Inc. (NYSE: PFE) announced the results of COVID-19 vaccine testing done with BioNTech.

The test began in July. It involved nearly 44,000 people.

Half of the people got the vaccine, while the other half got a placebo of salt water. The companies then waited for people to get sick to determine if the vaccine offered any protection.

So far, 94 participants got sick, which means the vaccine is over 90% effective. The FDA said a vaccine must be 50% effective to be approved.

For context, vaccines have varying levels of effectiveness. Annual flu vaccines are 40% to 60% effective. Two doses of the measles vaccine are 97% effective.

Let’s ignore that just 94 people in a population of 22,000 unvaccinated people got sick. The infection rate of 0.4% indicates the sample may not be representative of the population. But it does seem 90% effective for some people.

This news sent stocks higher. At its high on Monday, the Dow Jones Industrial Average gained more than 1,600 points. At the close, the Dow was almost 3% higher.

But tech stocks sold off. The NYSE FANG+ Index includes Facebook Inc. (Nasdaq: FB), Amazon.com Inc. (Nasdaq: AMZN), Tesla Inc. (Nasdaq: TSLA) and other stocks that led the market higher in the past months. That index closed down more than 3% on news of the vaccine.

These results are puzzling. A vaccine rally should be good for all stocks. But the tech sell-off implies there is more to the story.

What Monday’s Vaccine Rally Told Us

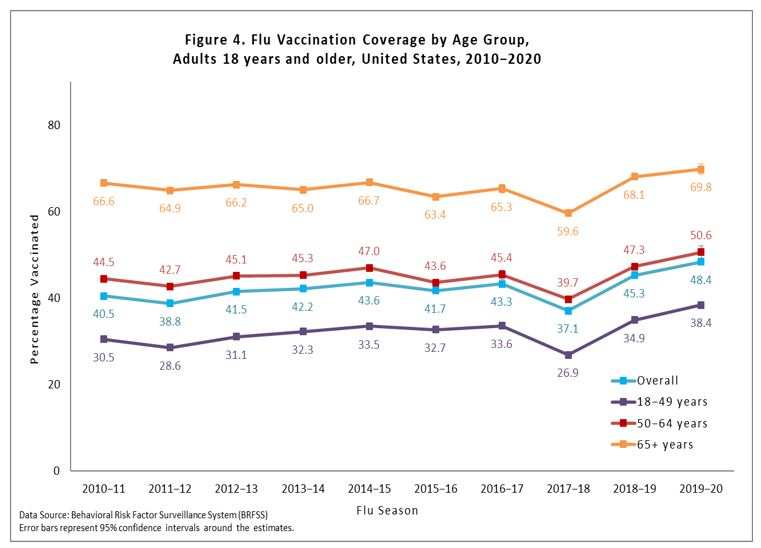

Investors trying to understand the impact a vaccine will have on the market should consider the chart below. It is government data showing less than 50% of Americans get the flu shot in any year.

Less Than Half of U.S. Adults Get Flu Vaccine

Source: CDC.

Even if a vaccine is 90% effective, it won’t stop COVID-19 if less than half of the population takes the vaccine.

Investors need to remember that vaccines don’t matter as much as vaccinations. It’s unlikely the rollout of any vaccine will go smoothly, and a second economic dip is likely.

Tech stocks led the rally, and they are likely to lead the next decline. That might be the message investors should take from Monday’s reaction to the news.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.