Imagine you are at the store, shopping for a doo-hickey.

On the shelf, there are five different ones that all do the same thing.

Which do you buy?

All things being equal, your first instinct is to buy the less expensive doo-hickey because … why not? They all do what you need them to do … why pay a higher price when the cheaper model will do just fine?

Novice investors fall into the same trap every day.

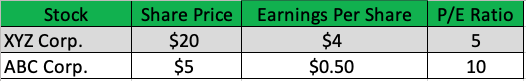

Shares of XYZ Corp. are $20 per share, but shares of ABC Corp. are $5 a share. Both companies do the same thing, so you go with the cheaper one.

But that’s not always the best approach.

Today, I’m going to show you why the cheaper stock isn’t always the best option and a different way to look at getting what you pay for.

Cheaper Isn’t Always the Best Value

Looking strictly at price, ABC Corp. costs less than the two I mentioned above.

But “cheap” stocks refer to more than the share price. Before buying, we want to make sure the price makes sense for what we’re getting. We want good value.

To find truly great value stocks, we use simple ratios comparing stock price with a company’s earnings (price to earnings), cash flow (price-to-cash flow) and book value (price-to-book value).

The price-to-earnings (P/E) ratio is one of the most popular, and we include it — and several others — in Adam O’Dell’s proprietary Green Zone Power Ratings system.

It takes the share price and divides it by the trailing 12 months of earnings per share.

Let’s use P/E to show why “cheap” doesn’t mean great value all the time.

XYZ Corp. is still trading at $20 per share. The company has produced $4 per share in earnings over the last 12 months.

XYZ’s stock has a P/E ratio of 5 ($20 share price divided by $4 earnings equals 5).

Then you have ABC Corp. which is trading at $5 per share.

Over the last 12 months, ABC has generated $0.50 per share in earnings. ABC’s stock has a P/E ratio of 10 ($5 share price divided by $0.50 earnings equals 10).

In this example, we have a stock that is cheaper per share but is considered overvalued compared to the more expensive stock.

Anytime you see these ratios that start with price (price-to-earnings, price-to-sales, etc.), it’s best to buy a stock with a lower ratio because it indicates a better “value.”

Another Way to Look at Value Investing

Instead of stocks, imagine you are going to buy a new car.

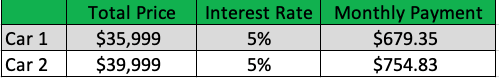

The dealership has several variants of the model you are looking for, but the prices are all over the map:

Based on price alone, you’d want to buy Car 1, right?

You would say that Car 1 was the better value.

This is because the model is the same, but Car 1’s monthly payment is lower.

It assumes that the cars are identical. But that is rarely the case with this kind of price difference.

Perhaps Car 2 has a sunroof, a bigger engine or a different transmission from Car 1.

It’s the same with stocks. When you decide whether to buy XYZ Corp. or ABC Corp. stock, it’s not always easy to see what you’ll get from each company.

That’s why Value is a key metric in Adam’s upcoming Infinite Momentum Alert. Using Value in tandem with Momentum and Quality (along with an AI-powered algorithm running in the background), Adam has designed a way to unlock unlimited potential by trading just 10 stocks every month.

It’s an incredibly simple system to follow, and sticking to it produced incredible results when he ran the numbers. In his back tests, Adam found his Infinite Momentum strategy decimated the S&P 500 300-to-1 with 35% annualized gains since 1999.

We’re putting the finishing touches on his presentation, and you can be one of the first to see it during his Infinite Momentum Summit tomorrow at 1 p.m. Eastern time.

Click here to reserve your spot for his free seminar and gain access to additional free resources explaining Adam’s brand-new strategy.

Bottom line: Value investor extraordinaire Warren Buffett said it best: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Conventional wisdom tells us, when all things are equal, it is better to buy a “cheap” stock than an “expensive” one. But in the stock market, all things are hardly ever “equal.”

That’s why it’s important to look under the hood and be certain you are paying the right price for the right stock.

Stay Tuned: The Main Event

Tomorrow, Adam is going live with his Infinite Momentum Summit…

In Stock Power Daily, he’s going to show you how Momentum plays out by highlighting some of the biggest stock success stories throughout history.

You don’t want to miss this issue…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets