Managing Editor’s Note: What’s your top concern for 2023? Let us know by participating in our simple one-question survey here. Your responses will help us give you the tools you need to thrive in the new year. — Chad Stone

Adam O’Dell and I aren’t big on bold predictions, especially when it comes to the stock market.

There are too many variables that make predicting what will happen impossible.

So I struggled at the end of 2021 when we were asked for predictions on the 2022 market.

I had a few in mind … but I mostly wanted to hedge and not go off the deep end.

In the end, I dug deep and made a bold call.

After decades of underperformance, I predicted value stocks would outperform growth stocks over the course of the year.

And I was right.

The chart above shows the movement of the S&P 500 Growth Index (SGX) and the S&P 500 Value Index (SVX).

While neither made gains in 2022 due to a swell of market headwinds, the Value Index only fell 7.6%, while the Growth Index lost more than 30%.

I will take a short victory lap here to show you how our Stock Power Ratings system helped us capitalize on this shift.

Value Beating Growth Is More Unexpected Than You Think

At the time we were asked to give our predictions, growth stocks were beating the tail off value stocks.

This chart below shows the Wilshire Growth vs. Value Ratio.

It divides the Wilshire U.S. Large-Cap Growth Index by the Wilshire U.S. Large-Cap Value Index.

When the ratio rises, growth stocks are outperforming value stocks. And the opposite is true when the ratio falls.

The ratio climbed steadily to a high of 1.4 between 2016 and December 2021 … right around the time we were asked to make our bold prediction.

What the ratio tells us is that growth stocks fueled the most recent bull market run that ended up carrying on for more than a decade.

I started to see a reversal into late December. The table was being set for value stocks to begin a run.

And that they did.

The ratio is now at its lowest point since November 2019 … and it’s still falling.

How did we capitalize in Stock Power Daily?

2 Examples of Value Stocks That Soared in 2022

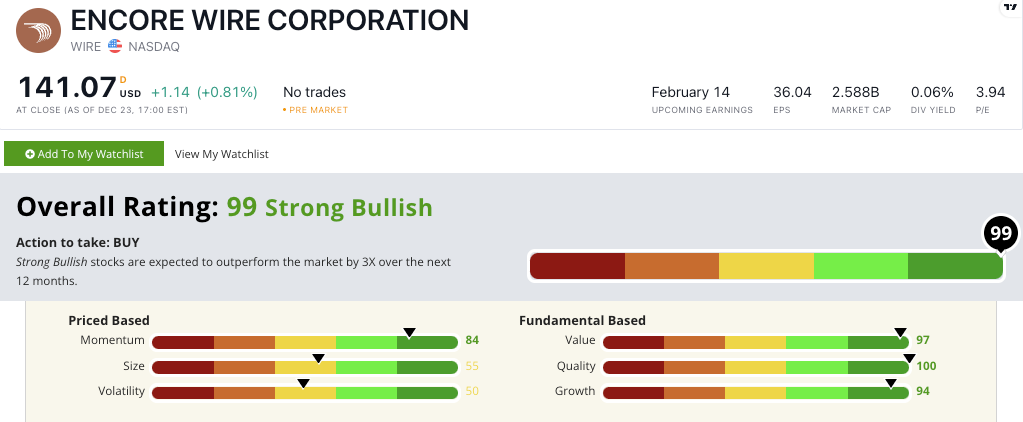

Our proprietary Stock Power Ratings system uses three technical factors (momentum, size and volatility) and three fundamental factors (value, quality and growth) to score thousands of stocks.

In our Stock Power Daily, I look for stocks that score high in as many of those factors as possible.

The idea is to find stocks that excel across the board, not just on one or two factors.

I went back through our Stock Power Daily companies to find stocks with a high-value rating that outperformed the rest of the market.

I found several, but I’ll highlight two.

The first is Encore Wire Corp. (Nasdaq: WIRE).

Encore supplies industrial wire, cables and connectors used in the construction industry.

At the time I told you about WIRE (July 2022), its price-to-earnings ratio was more than five times lower (cheaper) than the industry average.

As I write, that ratio is now more than eight times lower!

WIRE’s price-to-cash flow ratio is 3.72, while its industry peer average is 13.31.

The result is that WIRE is up more than 26% from when I told you about it.

Over the same time, the S&P 500 is down 3.5%.

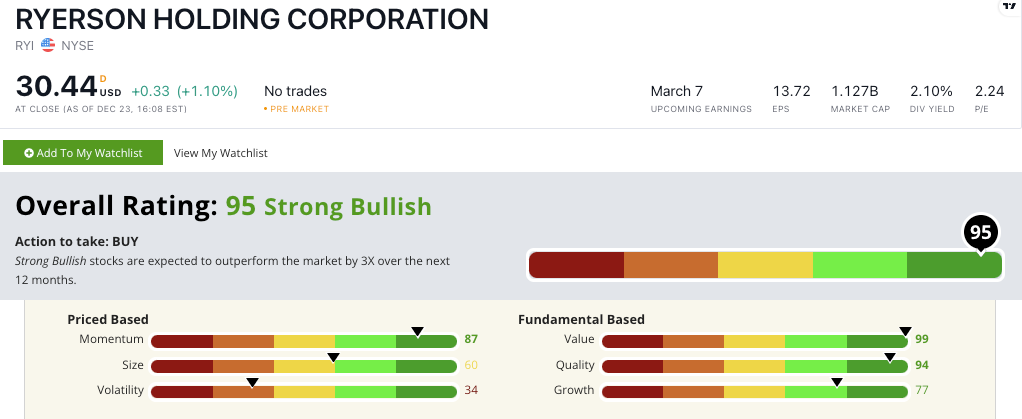

Another high-value stock that performed well is Ryerson Holding Corp. (NYSE: RYI).

Of note: I reported on RYI the day before I told you about WIRE.

RYI is a global distributor of industrial metals (stainless steel, aluminum alloy, copper, etc.) used for industries including aerospace and automotives.

When I told you about RYI, its strongest performance was on our value factor.

As you can see from the graphic above, that hasn’t changed.

Its current price-to-sales ratio is three times lower than the industry average. Its price-to-sales ratio is almost four times lower.

RYI stock is up 30% from the time I told you about it.

Congratulations on your gains if you bought into WIRE and RYI when I mentioned them. (Email us at StockPower@MoneyandMarkets.com to tell me about your success with these or any other companies I’ve featured in Stock Power Daily.)

The bottom line: Value stocks outperformed growth stocks in 2022.

The biggest question now is: Will that trend last?

According to the numbers, growth stocks have a lot of ground to make up to overtake value stocks.

With market uncertainty heading into the new year, you want to arm yourself with the tools necessary to find the right stocks at the right time.

Make sure you use our proprietary Stock Power Ratings system at MoneyandMarkets.com to do just that.

Stay Tuned: An Entertainment Stock to Avoid

I’m going to throw another curveball tomorrow as we continue to kick off the new year.

Stay tuned for the next issue, where I’ll share all the details on a popular entertainment stock that should be avoided in 2023.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets