In today’s Marijuana Market Update:

- I cover a cannabis stock that has a lot of potential in 2022.

- I answer a viewer’s question about a stock I covered in December.

Let’s start with the company I discovered over the winter holiday.

Verano’s Impressive Cash Flow

Over the holiday, I caught up on research reports covering all market sectors. Reports on cannabis piqued my interest.

I read one covering the third-quarter cash flow of several cannabis operators in 2021, and one company stood out: Verano Holdings Corp. (OTC: VRNOF).

The Chicago-based company is a multi-state cannabis operator in the U.S. with consumer brands like Encore, MUV and Verano.

It holds licenses to operate in 14 states: Illinois, Florida, Arizona, New Jersey, Pennsylvania, Ohio, Maryland, Massachusetts, Nevada, Michigan, Arkansas, California, Missouri and West Virginia.

While cash flow decreased for many cannabis companies, quarter over quarter, 54% of the 28 companies covered in the report saw positive operating cash flow in Q3 2021. That’s important for cannabis businesses because it shows the company can generate enough cash to maintain and grow its operations.

If operating cash flow is negative, a company has to turn to a bank to finance any capital expansion — and we know how difficult that can be in the cannabis space.

Verano reported a 221% year-over-year growth in revenue in the third quarter. Still, more importantly, its operating cash flow margin was 58% — 4,161 basis points higher than the previous quarter.

It also led the way in cash from operations — the amount of money brought in from ongoing, regular business activities — with a margin of 32% (a quarterly increase of 1,723 basis points).

All told, Verano led all 28 companies in operating cash flow, cash from operations and adjusted earnings before interest, taxes, depreciation and amortization (EBITDA). What’s more, Verano was in the top three in both adjusted EBITDA and cash from operations in the previous quarter — indicating sustained performance.

COVID Boosted VRNOF’s Numbers

Verano’s operations have paid off in terms of total annual revenue.

In 2018, it only managed about $31.1 million in total annual revenue. That more than doubled to $66 million in 2019.

COVID-19 was generous to Verano in 2020 and 2021 as its revenue jumped to $228.5 million and then to $763.9 million, respectively.

Forecasts suggest the growth isn’t over yet.

By 2023, Verano is estimated to bring in more than $1.5 billion in total annual revenue — a 101.7% increase from its record-setting 2021 numbers.

Verano’s EBITDA is also expected to grow at a strong clip.

Verano’s EBITDA was only $10.9 million in 2018. That fell to $8.8 million the following year.

But 2020 and 2021 saw impressive growth for Verano as its EBITDA jumped to $218.7 million in 2020 and $362.9 million in 2021.

Estimates have the company’s adjusted EBITDA to $684.6 million by 2023 — an 88.6% increase over 2021.

The margin percentage for total revenue and EBITDA is expected to be lower than 2020 but still in a very healthy range.

All of this suggests that Verano’s management, especially its new CFO Brett Summerer, is doing a great job of managing the company’s money.

Summerer spent 10 years in financial planning and analysis, controller and CFO positions at General Motors. He was also head of finance and analysis at Corning and the CFO at Kraft Heinz’s U.S. operations.

Plus, the company just closed on the acquisition of Caring Nature LLC and Connecticut Pharmaceutical Solutions Inc. — giving it a solid foothold in Connecticut, which made adult-use cannabis legal in July 2021.

VRNOF Is Trending Upward

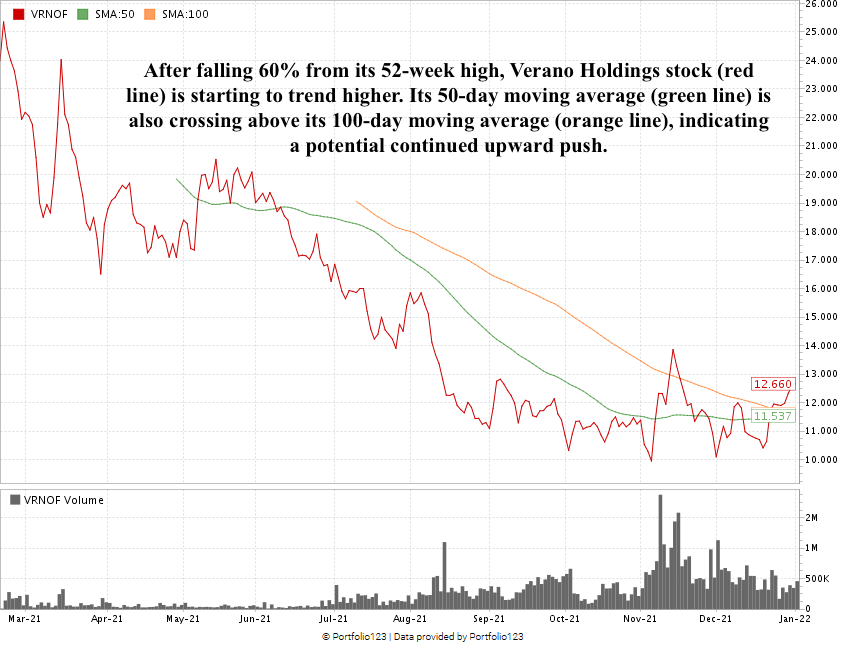

This financial stability is starting to move VRNOF up.

The share price fell 60% from its 52-week high set in February 2021, but since late December, we’ve seen nice momentum upward.

Its 50-day moving average is set to cross above its 100-day moving average, setting up a “golden cross” that indicates additional strength in that momentum.

The VRNOF Takeaway

I like where Verano is heading. It is showing good upward momentum even though the rest of the cannabis market is either flat or pushing down slightly.

All seven analysts covering Verano — eight if you count me — have rated Verano as a buy or outperform.

It has strong financials, and its expansion doesn’t seem to be pie in the sky but rather scaled to market conditions.

I think this recent upward trend in stock price presents a nice buying opportunity as we like to “buy high and sell higher.” VRNOF found support at $10 and could see a resistance point at $14, but I think it has the potential to go even higher than that.

Now, on to a reader question.

Viewer Response

Frank emailed me at Feedback@MoneyandMarkets.com to ask:

I have an investment in Columbia Care (OTC: CCHWF) stock. Where do you see the stock in the next 12 months? Thanks, Frank.

Thanks for your question, Frank.

In my December 2 update, I talked about cannabis market volatility— which we have seen since 2020.

However, in the third quarter last year, 10 of 11 cannabis multi-state operators saw a positive change in revenue quarter-over-quarter, as reported by Marijuana Business Daily.

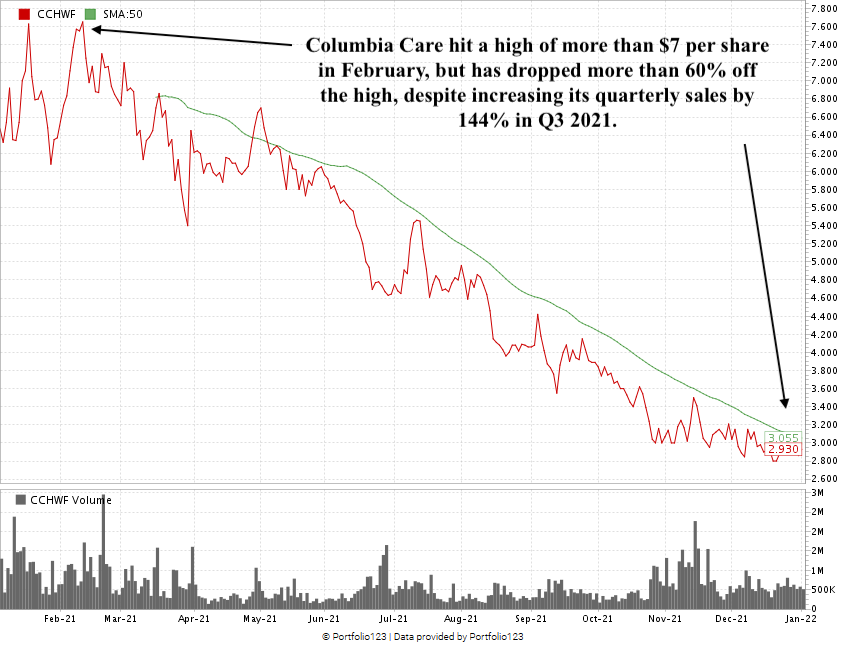

Columbia Care made the biggest positive change. It reported $132.3 million in quarterly revenue — up 21% from the previous quarter and up a whopping 144% from the prior year.

However, the company reported a loss of $37.2 million for the quarter — which is part of why CCHWF it is now more than 60% off its 52-week high.

CCHWF Had a Rough 2021

As I said in that video, I like Columbia Care. It has 99 dispensaries and 31 cultivation and manufacturing facilities. Reporting a 21% quarter-over-quarter and 144% year-over-year increase in revenue would suggest this stock should be hot with investors.

Institutional investors are likely looking at Columbia Care’s $37 million quarterly loss and not the fact that CCHWF has a footprint in one of the largest markets in the European Union set to legalize cannabis — Germany.

Columbia Care is already in both Germany and the U.K. — including a joint venture with German-based Moeller Pharma GmbH to sell cannabinoid-infused products.

The Takeaway

With some stronger upside momentum, I think Columbia Care would present a nice buying opportunity for investors looking to capitalize on the cannabis expansion in Europe.

However, the price of Columbia Care may remain below $3 per share until something significant breaks in the U.S.

I hope that answers your question. For sending it, we are going to hook you up with some Money & Markets gear as our way of saying “thanks.”

You, too, can get Money & Markets swag by submitting a question for me, Adam O’Dell or Charles Sizemore that we use in any of our videos. Just send us your questions and feedback.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

And check out our Ask Adam Anything video series, where we ask any question to chief investment strategist Adam O’Dell, as well as our Investing With Charles series, in which our expert Charles Sizemore and I discuss the trends you write in to ask about.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.