Natural gas is a huge energy resource for Europe.

From heating homes to keeping the lights on, gas is essential to every country in the European Union.

Russia’s invasion of Ukraine and the following sanctions turned off more than half of Europe’s natural gas supply.

As winter approaches, the natural gas crisis in Europe could get much worse.

This chart shows the International Energy Agency’s estimates of the change in pipeline gas exports from Russia to Europe.

If countries accelerate their cutoffs of Russian gas, exports will decline by 75%, according to the agency.

Countries will have to find natural gas elsewhere.

Today’s Power Stock is a Canadian oil and natural gas company with a significant presence in Europe: Vermilion Energy Inc. (NYSE: VET).

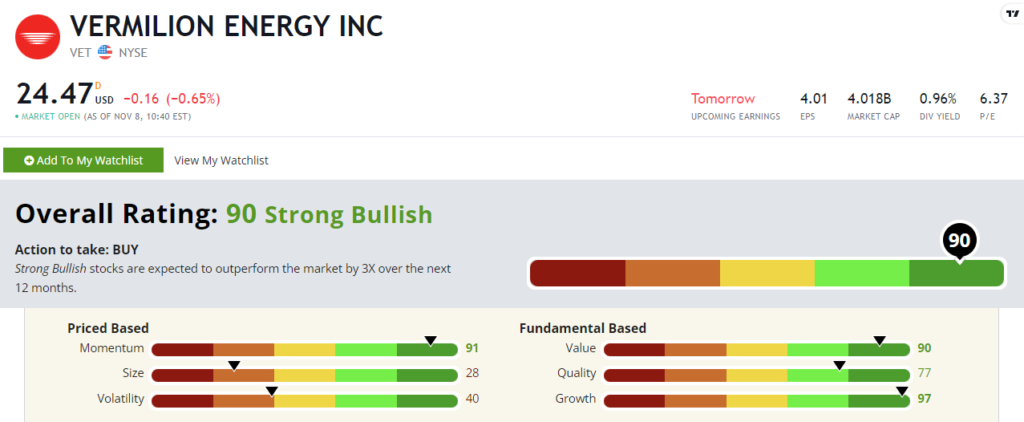

VET’s Stock Power Ratings in November 2022.

VET explores for and produces oil and natural gas in North America, Europe and Australia.

Its European operations serve some of the biggest consumers of natural gas:

- France.

- The Netherlands.

- Germany.

- Ireland.

Vermilion Energy stock scores a “Strong Bullish” 90 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

VET Stock: Strong Value, Growth and Max Momentum

Here’s what stood out from VET’s most recent earnings report:

- Its total petroleum and gas sales were $858.8 million, an increase of 110.9% over the same quarter last year.

- The company’s sales over the first six months of 2022 were higher than all of 2021!

Those figures illustrate why VET earns a 97 on our growth factor.

VET is also a fantastic value stock.

Its price-to-sales and price-to-cash flow ratios are all lower than the fossil fuel exploration industry averages.

VET’s price-to-earnings and price-to-book value ratios are in line with industry averages.

This tells us VET is a better value stock than most of its competitors … it earns a 90 on our value factor.

Created in November 2022.

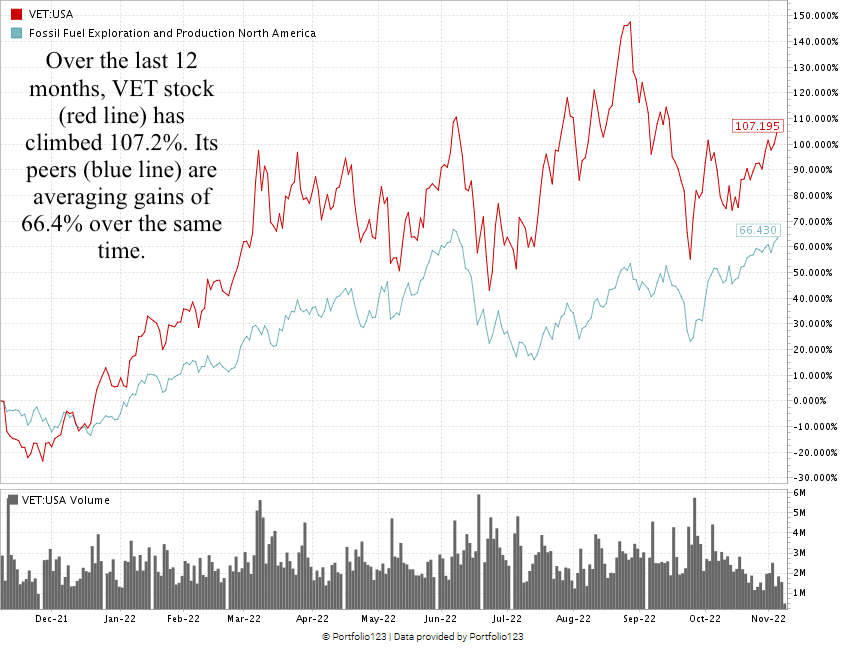

It’s been a rocky but strong year for VET.

Over the last 12 months, VET stock has gained 107.2%, while its industry peers averaged a 66.4% gain over the same time.

Vermilion Energy stock scores a 90 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The EU is trying to turn off the spigot to Russian oil and gas.

To do that, it must find other sources of these fuels.

With a strong presence in Europe, you can see why VET is a strong candidate for your portfolio.

Bonus: The company’s forward dividend yield of 0.96% means it will pay $0.23 per share per year just to own the stock.

Stay Tuned: Music Streaming Stock to Avoid

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

I’m switching it up with the next issue, where I’ll share all the details on a music streaming stock that’s feeling the crunch of the tech stock crash. (For more on what’s going on within the Nasdaq, click here to read my take on if this is the next dot-com bubble or not.)

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets