In today’s Marijuana Market Update, I tackle a question from Lucas about Village Farms stock, but first, let me share with you all why I was out last week:

My grandson Gray was born right after Father’s Day.

Introducing baby Gray … the latest addition to our family.

He was born to our oldest son Nathan and his girlfriend the day after Father’s Day, and we took the opportunity to travel to Kansas and see him last week.

He’s a healthy baby boy who has already become best friends with his papa (which is me, by the way).

About Village Farms International Inc. (Nasdaq: VFF)

Now, I’ll tackle Lucas’ question.

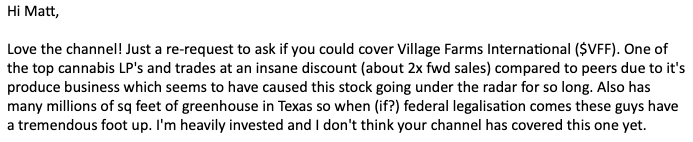

He emailed me and asked:

Village Farms International, a Canadian company, is known for producing greenhouse-grown vegetables, but it also owns and operates a power plant in British Columbia.

Its subsidiary, Pure Sunfarms, has now developed into a significant player in the Canadian cannabis market — specifically in British Columbia.

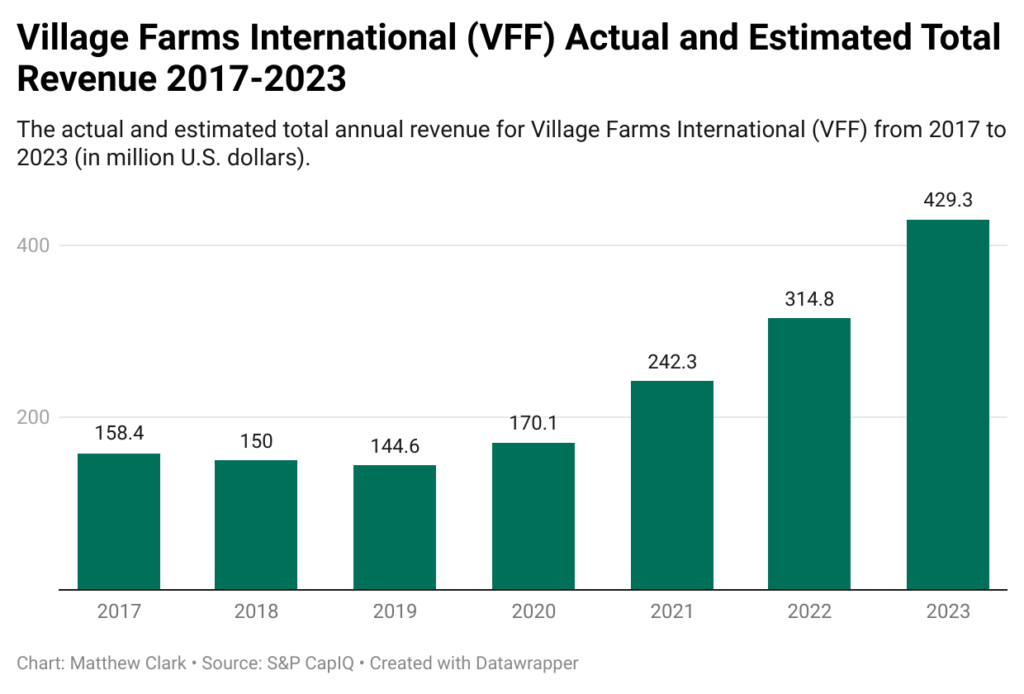

Let’s look at the company’s financials:

As you can see, the company struggled for stability from 2017 to 2019, with revenue dipping from $158.4 million to $144.6 million in those three years.

However, 2020 was a solid year for the company as it produced record revenue of $170.1 million, thanks largely to the COVID-19 pandemic and the shift from grocery store produce to more of the home-grown variety.

In 2020, total gross sales value of cannabis for Village Farms was $74.1 million — a 17% increase from 2019.

However, the company’s gross margin from cannabis sales dipped from 76% in 2019 to 40% in 2020. Furthermore, its net income from cannabis sales went from $27.4 million in 2019 to just $10.1 million in 2020 — a drop of about 62%.

Its net income included $4.8 million of debt forgiveness income per a settlement agreement in March.

So, all told, the company did not see significant growth in cannabis sales as many of its competitors did in 2020.

In the first quarter of 2021, Pure Sunfarms only booked $17.5 million in total sales compared to $17.3 million in the fourth quarter of 2020.

The company also recorded a net loss of $2.8 million for the first quarter compared to a fourth-quarter loss of $1.7 million.

This wider loss is likely due to a lower gross margin because of lower sales prices for wholesale sales and larger stock compensation.

Overall, Village Farms will have a difficult time meeting the $242.3 million in projected 2021 total income if the first quarter is any indication of the rest of the year.

It seems that the cannabis arm of the company is increasing sales, but only slightly, and the division continues to lose money at a much higher rate than I am comfortable with.

VFF Stock Analysis

Village Farms stock hit a high of nearly $20 per share in February, but it dropped to nearly $8 in May — a 58% fall in four months.

It’s slowly climbed up to around $10.50 per share today — a 107% gain over the last 12 months.

VFF (Red) Struggled to Find Footing in 2021

Another point of concern, which you can see in the chart above, is that its 200-day moving average for Village Farms stock (the orange line) is nearing its 50-day moving average (green line), suggesting another potential downturn in the price.

Its price-to ratios are all significantly higher than its peers — the P/E ratio is 355.4 compared to the agriculture industry average of 36.7, and its price-to-book is 87 compared to the industry average of 30.

Takeaway

Even at $10.50 per share, Village Farms stock is overvalued.

As for its Texas operation, Lucas is correct that the company has a significant greenhouse presence in the Lone Star State — 1.3 million square feet of cultivation in the Permian Basin.

Right now, half of that is used for hemp production.

I just don’t see cannabis or hemp production as a huge driver for Village Farms.

It’s not a bad company, but it’s not one I would invest in right now.

If you’re interested, I would see if this stock starts to pull back in the coming weeks to get in at a lower price.

Otherwise, I would sit on the sidelines for now.

New YouTube “Join” Feature

We offer members new exclusive content, including:

- Interviews with cannabis insiders.

- Blog posts, stock analysis and company breakdowns.

- More about our Cannabis Watchlist.

- Monthly live chats with me, where we’ll discuss cannabis stocks, the cannabis sector and much more.

Just click “Join” on our YouTube page to find out what you can access.

If you have a cannabis stock you’d like me to look at, email me at feedback@moneyandmarkets.com.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where we ask your questions to Chief Investment Strategist Adam O’Dell.

Green Zone Fortunes co-editor Charles Sizemore also has a weekly series called Investing With Charles, where he breaks down dividend investing each week.

Remember, you can email my team and me at feedback@moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you!

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.