Money & Markets Week Ahead for March 14, 2021: I break down Nike’s earnings expectations, and a lesser-known name hits the IPO market.

A big apparel company reports its earnings this week.

And we’ll get insight into consumer confidence with the monthly retail sales report.

Here’s more of what to look for in the week ahead on Wall Street:

On the IPO Front: Vine Energy

It’s not a big name, but there is a sizable IPO on the calendar this week.

Vine Energy is expected to price its IPO on March 18. It will list on the New York Stock Exchange under the ticker VEI.

What it is: The company is primarily a natural gas exploration and production company based in Plano, Texas.

The company was founded in 2014 and focuses on natural gas properties in the Haynesville and Mid-Bossier areas of northwest Louisiana.

In its S-1 filing with the Securities and Exchange Commission, the company said it has 932 total drilling locations between the two regions.

The company’s total revenue dropped from $586.5 million in 2019 to $378.7 million in 2020. The drop in revenue is attributed to a 6% drop in natural gas sales year-over-year and a $164 million reported loss on commodities derivatives.

Vine Energy is backed by investment firm Blackstone (NYSE: BX).

The offering: The company is offering 18.8 million shares at a price range of $16 to $19 per share.

It hopes to raise around $328 million with the offering, which will be used to help pay down debt.

According to Renaissance Capital, at a mid-point of $17.50 per share, the company would see a market value of $1.2 billion.

Bank of America Securities, Barclays, Citi, Credit Suisse, Morgan Stanley and RBC Capital Markets are bookrunners on the deal.

The skinny: Vine Energy is one of the biggest operators of natural gas production in Louisiana.

According to the U.S. Energy Information Administration, the state produces 9.3% of all natural gas in the United States.

While that is good, the concerning part of this company is the reduction in revenue from 2019 to 2020.

It’s operating income went from $136.7 million in 2019 to minus-$132.7 million in 2020 … also a bit of a red flag.

However, a lot of that is attributed to the COVID-19 pandemic.

Stronger market prices for natural gas in the future will go a long way to helping Vine Energy’s balance sheet. The biggest question is: When will that happen?

Deeper Dive: Nike Inc. (NYSE: NKE) Earnings

Perhaps the biggest company reporting earnings this week will be Nike Inc. (NYSE: NKE).

The Oregon-based company will report quarterly numbers on Thursday.

It is one of the largest athletic apparel, footwear and equipment manufacturers in the world, with a market cap of $216.7 billion.

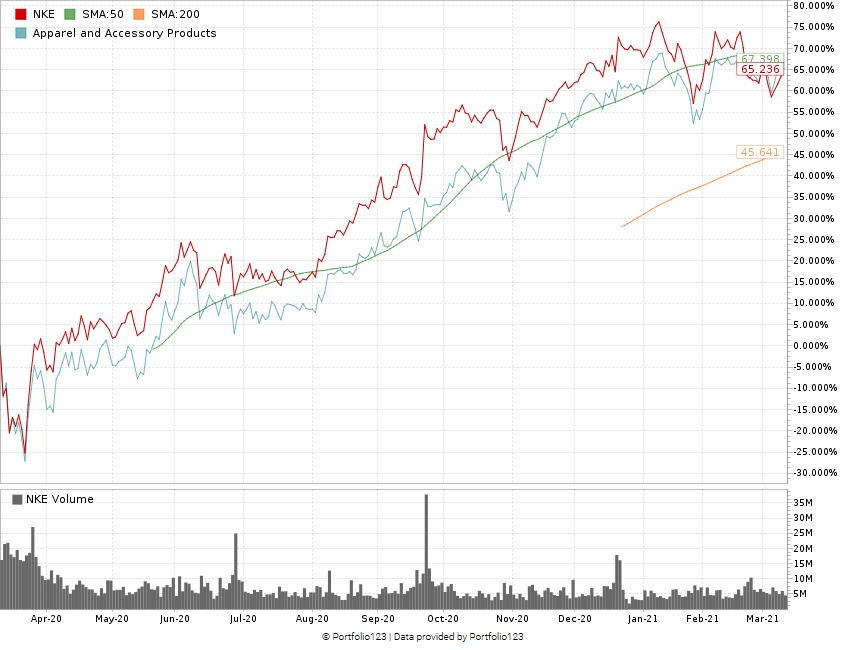

Nike Stock Lags Apparel Industry

The company’s stock went from a low of $62.25 in March 2020 to a new 52-week high of $146.75 in January 2021. That’s a 136% jump in stock price.

However, Nike has pared some of those gains back and dropped as low as $130.75 in late January. The stock ticked back up and is trading around $141 currently.

The company’s quarterly revenue rebounded nicely from a second-quarter 2020 dip.

In April 2020, Nike reported total revenue of only $6.3 billion — down 37% from the previous quarter.

However, it rose back to $10.6 billion in August 2020 and $11.2 billion in October 2020 — a 78% increase from the middle of the year to the end.

Nike has struggled a bit with its earnings per share.

It went from an EPS of minus-$0.51 per share in April 2020 to a positive $0.95 per share the following quarter.

However, its earnings dipped to $0.78 per share in the October 2020 quarter.

The Wall Street consensus forecast for the last quarter is for earnings of $0.758 per share on revenue of $11.03 billion.

Earnings and revenue are expected to dip in the next quarter to earnings of $0.52 per share on just $10.32 billion.

Nike saw really strong headwinds in the middle of 2020 but was able to rebound from those. I expect earnings and revenue expectations to be in line with actual figures.

Money & Markets Week Ahead: Data Dump

We’ll get a look at the changes in retail sales when the U.S. Census Bureau reports its advance monthly retail trade report on Tuesday.

The report measures the change in the total value of sales at the retail level.

It is a strong indicator of consumer spending, which gives some view into the state of the U.S. economy.

In January, the value of retail sales jumped 5.3%, indicating more confidence from consumers.

However, the marked increase should be tempered by the fact that those values dropped in each of the two months before.

The general consensus is that retail sales will dip 0.4% in February.

Investors will also get a look at crude oil inventories on Wednesday along with economic projections from the Federal Reserve’s Federal Open Market Committee — which concludes its two-day meeting.

Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports due out this week:

Monday

360 DigiTech Inc. (Nasdaq: QFIN)

FuelCell Energy Inc. (Nasdaq: FCEL)

Zepp Health (NYSE: ZEPP)

Tuesday

Crowdstrike Holdings Inc. (Nasdaq: CRWD)

Lennar Corp. (NYSE: LEN)

Jabil Inc. (NYSE: JBL)

Wednesday

Cintas Corp. (Nasdaq: CTAS)

Williams-Sonoma Inc. (NYSE: WSM)

Five Below Inc. (Nasdaq: FIVE)

Thursday

Nike Inc. (NYSE: NKE)

FedEx Corp. (NYSE: FDX)

Dollar General Corp. (NYSE: DG)

Canadian Solar Inc. (Nasdaq: CSIQ)

Friday

BRP Inc. (Nasdaq: DOOO)

That’s all for this week.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.