If you thought Tesla’s recent rally was big, there’s one other company that’s putting the electric automaker to shame.

British billionaire Richard Branson’s pet space project, Virgin Galactic Holdings Inc. (NYSE: SPCE) has already had a standout 2020.

In just the first month-plus of the year, the spaceflight company’s shares have jumped a massive 142% as of Friday’s close. As a point of fact, Tesla Inc. (Nasdaq: TSLA) shares have only risen 100% at the same time.

Shares went even more hypersonic Tuesday after the company announced it was closer to providing commercial space flight. Shares were up another 23% in midday trading.

Virgin Galactic said it’s SpaceShipTwo was flown to Spaceport America in New Mexico to link with the mother ship, VMS Eve, on Friday. It’s kind of the equivalent of NASA flying astronauts from Houston to Florida in preparation for a shuttle launch.

Watch SpaceShipTwo Unity and our mothership, VMS Eve, land at the Gateway to Space, Spaceport America, New Mexico and complete another vital step on the path to commercial service. Read about the next steps for Unity's flight test program here. https://t.co/EYrFhjmrKd pic.twitter.com/HJeMqUxpza

— Virgin Galactic (@virgingalactic) February 14, 2020

How Virgin Galactic Stock Has Blasted Off

Outside of moving its spaceship from its development facility to its launching area, Virgin Galactic hasn’t done anything remarkable to cause this meteoric rise.

So what has driven the share price up?

A lot could be attributed to the excitement investors have related to the space industry. The focus on Virgin Galactic stock comes from the fact it’s the only publicly traded company in the space sector.

“It’s really the only stock like this,” Renaissance Capital strategist Matt Kennedy said, according to CNBC. “If SpaceX were public then (Virgin Galactic) would be valued against them, so if it had a close peer you’d think they would trade closer together. This stock is kind of unbounded.”

Firms tracking the stock — there are three — all still have Virgin Galactic stock as a “buy.”

Still A Lot of Speculation In Virgin Galactic Stock

The problem is that the company hasn’t fully seen an impact from flying people to space or its commercial operations. Banyan Hill Chartered Market Technician and Peak Velocity Trader Editor Michael Carr said it was hard to value the stock appropriately because of that.

“This a story stock. There are no earnings and there is no product right now. There is a hope that development will go well and sales and earnings will follow,” Carr said. “Complex development projects like building spacecraft rarely go as well as expected, and a problem in a competitor’s product will delay progress for all companies in this sector.”

That’s a prime reason why now would be a good time to take profits if you’ve already invested in Virgin Galactic.

“Risks are high that SpaceX, Boeing, Blue Origin or Virgin Galactic will experience an engineering delay as they all race to space,” Carr said. “Remember that both the U.S. and Soviet Union suffered setbacks during the original space race, and they had unlimited resources to apply to problems.”

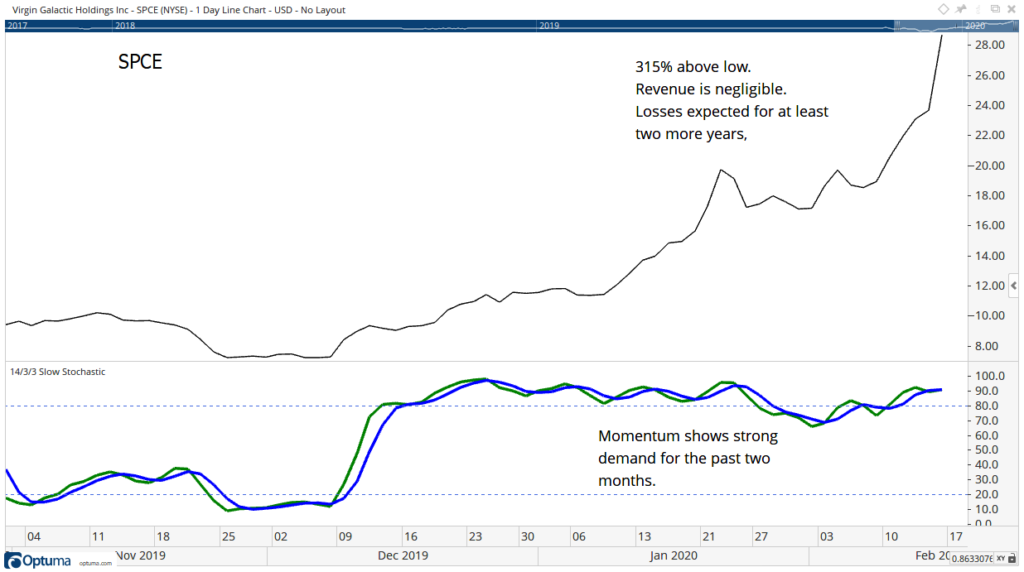

There’s been a large demand for shares since December. Large investors looking for positions are either already in or waiting for the stock to pull back. Individual investors are chasing the stock, but lack the buying power to push it much higher.

That’s why now is a good time to take profits as shares may have reached or come close to reaching their ceiling.

The Next Step for Virgin Galactic

According to the company, now that SpaceShipTwo is in New Mexico, Virgin Galactic will start to “engage in final stages of its test flight program.”

From there, Virgin Galactic said its team will start rocket-powered test flights and evaluate performance before starting commercial spaceflight operations.

The company said “significant progress” is being made on two more spaceships being built at the company’s design headquarters in Mojave, California.