Sir Richard Branson, billionaire founder of the Virgin Group, is stark raving mad.

Good for him. There’s no point in being rich if you can’t be a little crazy.

So with crazy as the theme, let’s take a look at his recreational space travel company, Virgin Galactic Holdings Inc. (Nasdaq: SPCE).

“Recreational space travel” is pushing it, as commercial flights to the Moon or Mars are decades away.

But Virgin’s flights will give passengers a view of the Earth from space. The experience will take about three hours and includes six minutes of weightlessness in space. The tickets are expected to go for $250,000 each.

Of course, Virgin Galactic has to survive in order for this to happen. Virgin Atlantic creditors just passed a vote Tuesday for a 1.2-billion-pound ($1.6 billion) recapitalization deal. The company will hold another vote in early September to finalize the deal.

Analyzing Virgin Galactic stock is hard at this stage of the game because the company doesn’t do anything.

It plans to launch its commercial space flights early next year. But for the time being, Virgin Galactic is just running test flights. Branson himself plans to be the first commercial passenger.

At $250,000 per ticket, this isn’t a mass-market product. But the ultra-wealthy won’t be its only audience. Plenty of retirees would put this experience on their bucket list.

Think about it: A high-end RV can easily cost $200,000. At that price tag, would you rather cruise Route 66 in a Winnebago or see Earth from the edges of space?

We’ll see how successful the concept is.

In the meantime, let’s see how Virgin Galactic stock stacks up using Adam O’Dell’s Green Zone Ratings system.

Ranking Virgin Galactic Stock

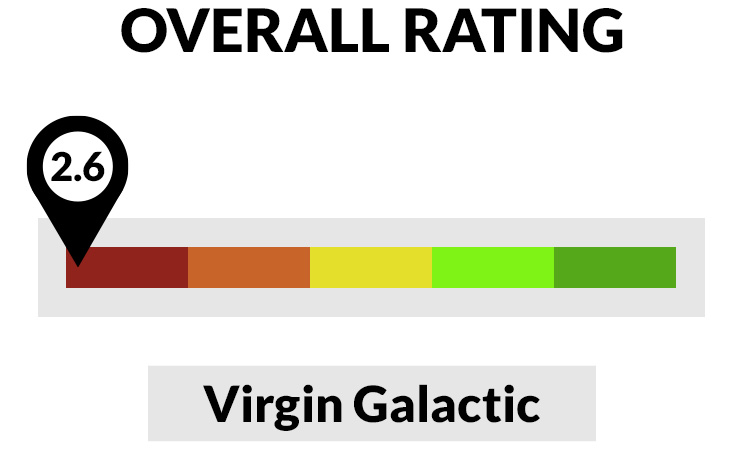

Virgin Galactic hasn’t managed to launch an actual product yet, and that shows in its stock rating.

The company sports an overall rating of 2.6, meaning that over 97% of companies rate higher within Adam’s system.

Let’s dig deeper.

- Size — Perhaps this is a testament to just how much Fed liquidity is flooding the capital markets. Despite being a recent IPO with almost no revenues expected for six months, Virgin Galactic rates a 38 on size. Smaller stocks tend to perform better over time, and Virgin Galactic is already larger than 62% of the stocks in our universe of over 5,000 rated stocks.

- Momentum — Virgin Galactic isn’t a momentum winner either, rating a 30. An object in motion tends to stay in motion, but Virgin Galactic has stalled out.

- Volatility — While the company has stalled out, its stock hasn’t. With a rating of 19, the stock is more volatile than 81% of the stocks in our universe.

- Value — And despite all of this, the stock isn’t cheap, rating a 13. In fairness, this company is still effectively a startup, and it’s difficult to compare its share price-to-earnings or sales when the company has no earnings or sales.

- Quality — Virgin Galactic is a low-quality company, rating just a 9. The way this metric is constructed, a company needs a history of profitability to rate well. So, given Virgin’s lack of revenues, quality isn’t there yet.

- Growth — And finally, we get to growth. Virgin Galactic rates poorly here at a 3. It’s hard to grow without a consistent stream of revenue coming in.

Takeaways: There are some takeaways here. It’s almost impossible to value a company like Virgin Galactic based on traditional fundamentals. This is more like a venture capital investment than a traditional stock market investment.

We won’t know how Virgin Galactic rates for another several years … and that assumes the company is still in business.

If you want to roll the dice on something exciting and exotic, then Virgin Galactic stock might be fine for your play money. Adam laid out some of the risks and rewards of buying Virgin Galactic, or other speculative stocks, earlier this year.

But since it’s impossible to analyze using real numbers, I wouldn’t make this a cornerstone of your retirement portfolio.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.