You’ve likely never heard of Vaca Muerta.

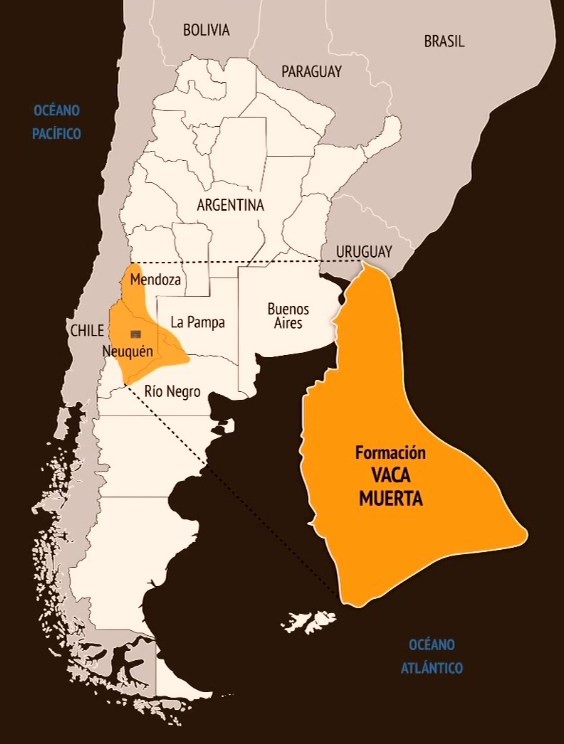

Spanish for “dead cow,” Vaca Muerta is a massive geologic formation in Argentina. It’s the world’s second-largest shale deposit.

Estimates suggest there are 16.2 billion barrels of oil and 308 trillion cubic feet of natural gas located inside this formation on the border of Argentina and Chile:

You’ve never heard of the Vaca Muerta because the Argentinian government has squandered opportunities to capitalize on the massive amounts of oil and natural gas located within — until now.

The country’s government is using a $689 million loan to complete a pipeline that will increase the amount of oil and natural gas pumped from it.

(Note: This is just one reason we’re about to see a super bull in oil, and Adam believes his No. 1 stock is set to gain 100% in 100 days when it really kicks off. Click here to sign up for his upcoming presentation to learn more.)

When I see a huge story such as what’s happening in Argentina’s energy market, I know Stock Power Ratings will help me find the best ways to play it.

I immediately started digging through different companies that could benefit from this massive new pipeline.

Today’s Power Stock will capitalize on this new investment: Vista Energy S.A.B. de C.V. (NYSE: VIST).

VIST explores and produces oil and natural gas products. It owns rights inside Vaca Muerta.

The company is planning 900 profitable wells covering 183,100 acres of the shale deposit in the near future.

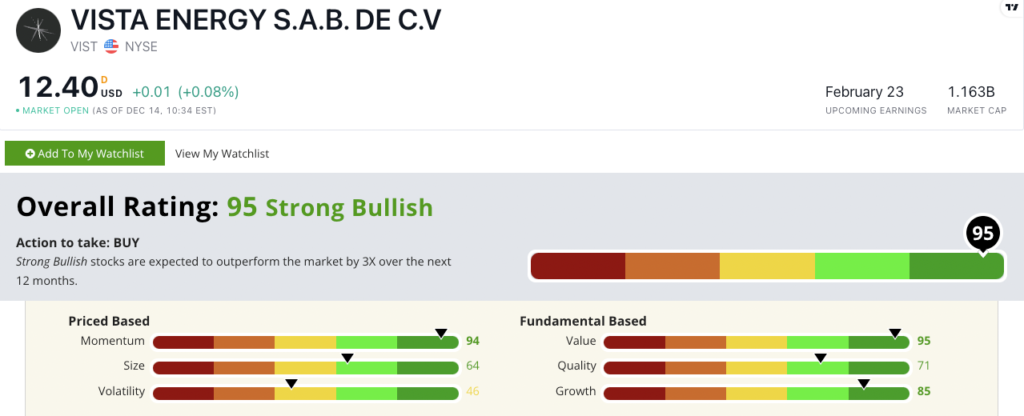

VIST scores a “Strong Bullish” 95 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

Vista Energy Stock: Strong Value + Growth

VIST had a strong quarterly report in October.

Here are some highlights:

- It reported quarterly revenue of $334 million — a 91% year-over-year increase!

- Its revenue in the first three quarters of 2022 has already surpassed the company’s total revenue for 2021.

VIST’s outstanding quarter contributed to its 85 on our growth factor.

Its fundamental rating is also anchored by strong value.

Looking at its price-to-sales ratio, it’s less than half the industry average.

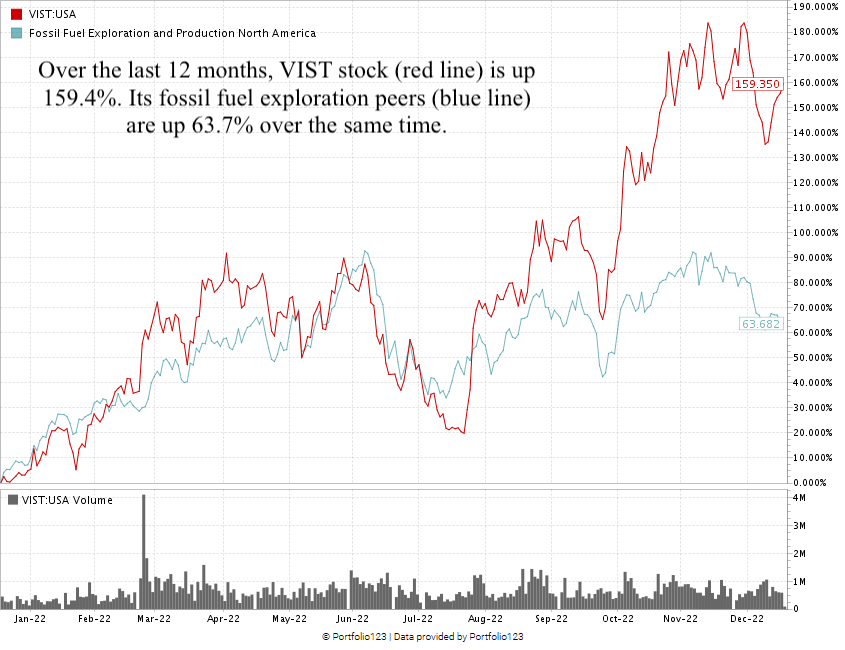

Another reason Vista Energy stock shines is its “maximum momentum”:

Over the last 12 months, VIST is up 159.4%.

It’s more than doubled the fossil fuel exploration sector, which is up 63.7% over the same time.

From its recent low in September 2022 to its 52-week high reached in November, VIST climbed 71.5% … showing the “maximum momentum” we love to see in stocks.

VIST stock scores a 95 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The Argentine government spent years squandering the opportunity to tap into the massive resources inside the Vaca Muerte.

The completion of a pipeline that connects the country to this valuable shale deposit will give Argentina the opportunity to pull more oil and gas out of one of the world’s largest reserves on the planet.

Because it has a stake in the Vaca Muerte, Vista Energy stock is a great addition to your portfolio.

Stay Tuned: A Metal Supplier Every Natural Gas Co. Needs

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a company providing critical components for natural gas extraction as the winter chill sets in.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets