The Presidential Cycle is a popular way to look at the stock market. This tool recognizes that politics affects stock prices.

The most important political event in the U.S. is the election of the president every four years. Many analysts use this fact to construct a cycle that repeats every four years.

Logic makes this cycle appealing. It’s based on the idea that politicians do all they can to get elected. They try to push stocks higher in election years and the year before elections. In the other two years, the stock market suffers as they implement less popular policies.

You’ll often hear cycles expressed in general terms and applied to broad stock market indexes. They can also be calculated at finer units of time and applied to any price data.

Presidential Cycle and the VIX

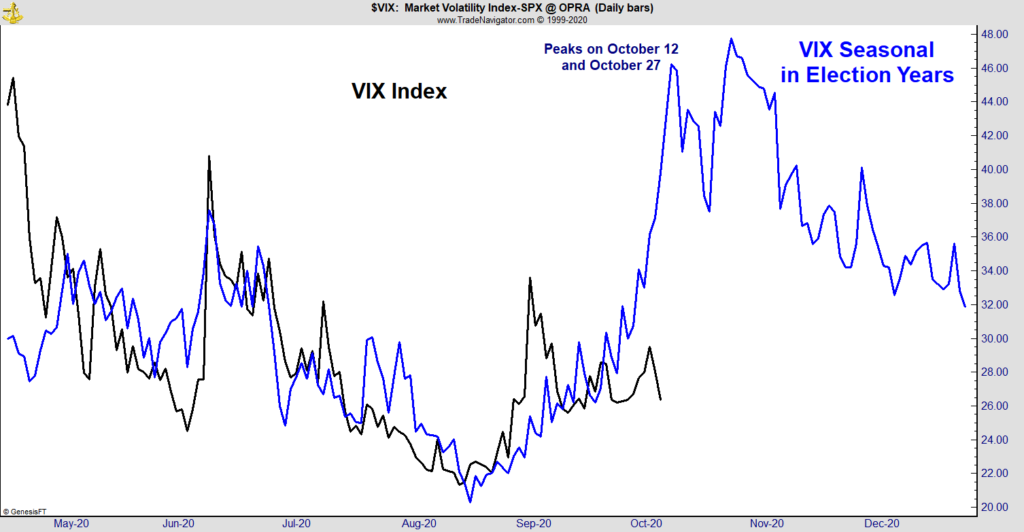

The chart below applies the four-year election cycle to the VIX Index. VIX is a measure of volatility. It’s calculated with a complex formula applied to option contracts on S&P 500 futures.

It shows that volatility is likely to increase over the next two weeks.

Presidential Cycle: Expect Volatility

Source: Trade Navigator.

VIX is often called the fear index because of how it behaves. The index rises when fear increases as the S&P 500 declines.

Logic supports this, too.

When the S&P 500 declines, hedge funds and other large traders tend to buy put options to protect against further declines. A put option increases in value when prices fall.

Increased buying of puts options pushes their prices up. As the stock market keeps falling, VIX keeps rising. The chart above shows that fear is likely to rise as traders worry about the election.

This chart shows the average trend of volatility in election years. It can be calculated four years ahead of time. VIX has tracked the forecast closely since May. If that continues, we could see sharp declines in stocks as VIX spikes this month.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.