Earnings season begins in earnest next week. By October 16, more than 45 companies in the S&P 500 report results from the most recent quarter.

Analysts are optimistic. Over the past three months, they have increased estimates.

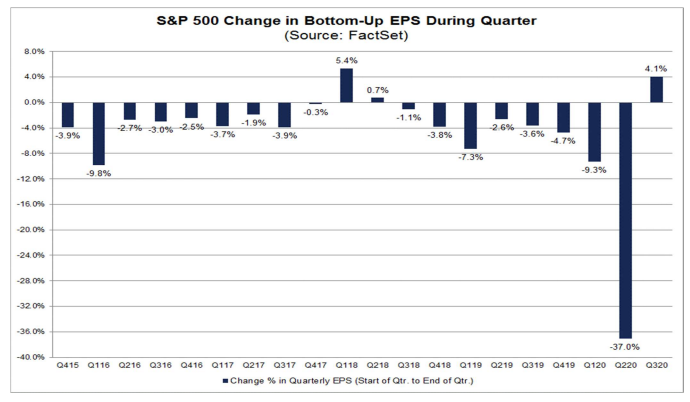

Just three months ago, analysts expected companies in the index to report $30.89 in earnings per share (EPS) for the quarter. Now they expect EPS of $32.04.

That’s a small increase, but the fact that it’s an increase is important.

This is just the third time in the past five years that estimates increased during the quarter.

Source: FactSet.

The Earnings Game

There’s a high probability that EPS will be even higher than expected. In a typical quarter, about 75% of companies beat expectations.

Traders will treat this as good news. But it’s all part of the earnings game.

The game starts at company headquarters. Management teams talk to analysts and provide insight into sales and expenses.

Analysts develop estimates based on that guidance. Management then reports actual earnings that are higher than the estimates.

It’s almost like management hides how well they’ve done when meeting with analysts. They know the stock price tends to increase if they beat expectations. So, they benefit from low estimates.

Analysts also benefit from low estimates. They need access to management teams to do their job.

They know that stock prices fall if their estimates are too high. If an analyst makes the stock price go down, management could be less inclined to meet with that analyst.

On Wall Street, it’s in everyone’s best interest to have low estimates and high earnings. That’s why so many companies beat expectations every quarter.

As investors, we need to look past the better-than-expected earnings this quarter.

We are already seeing layoff announcements and business closings that indicate conditions are not improving. Many companies will lower guidance for the fourth-quarter.

Earnings are likely to decline more than 20% for the year and won’t reach new highs until 2022 or later.

This is bad news, but as long as the Federal Reserve keeps printing money, stocks can keep going up.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.