In the past few years, electric vehicle stock trends have dominated the market. Financial advisors are always talking about the future of electric vehicles and how stocks in electric energy companies will grow your portfolio.

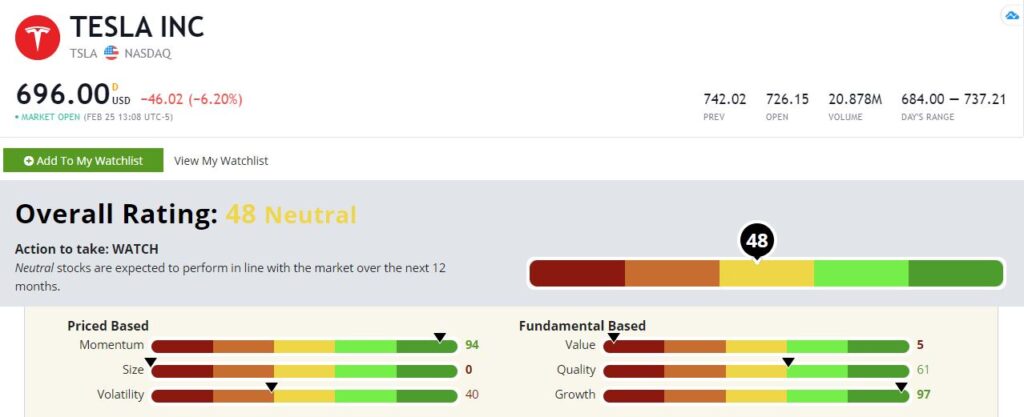

I’m skeptical because electric vehicle stocks don’t look investable to me. If you look at Tesla Inc. (Nasdaq: TSLA) on our Green Zone Ratings system, it rates “Neutral” at 48. But there’s only one factor preventing this rating from tanking: momentum.

Tesla Inc.’s Green Zone Rating on February 25, 2021.

TSLA is a momentum stock at risk of losing steam. Don’t get me wrong, TSLA’s run-up last year was impressive, but it has recently stalled out. Now the company’s price-to-earnings ratio is estimated to be around 1,000! That explains its Green Zone value rating of 5.

I believe in the theme of electric vehicles: Governments and consumers see these products as inevitable parts of our future.

The problem is that these stocks are tricky when it comes to investing. Electric-only car companies like Tesla face extreme competition from traditional automakers that are also developing electric products.

And that leads me to my recent pick for The Bull & The Bear podcast.

Volvo Stock Is a Better EV Buy

Let’s take a look at the reliable automaker Volvo AB (OTC: VLVLY).

In 2019, Volvo announced all new and future models would have either electric or hybrid options. By 2025, Volvo said it hopes all of its products will be either electric or hybrid. By 2040, the company wants to be carbon neutral.

Volvo has some ambitious yet concrete goals, and the company’s electric future is reflected in its stock.

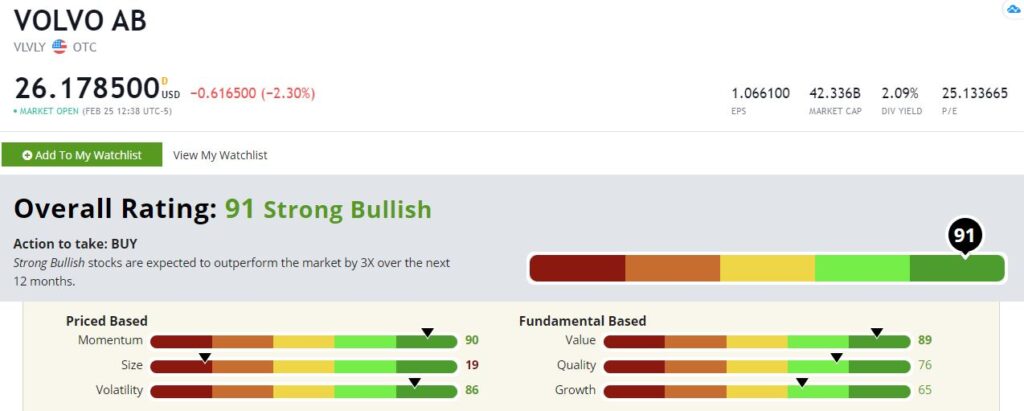

Volvo AB’s Green Zone Rating on February 25, 2021.

Using the Green Zone Ratings system, Volvo stock rates a 91 overall, which means we are “Strong Bullish” on the stock.

Momentum — VLVLY’s extensive plans for the future make the stock prime for momentous growth. VLVY rates a 90 on momentum. Like TSLA, Volvo’s momentum rating is high, but it’s also ranked well in fundamental factors like growth, quality and value.

Volatility — Volvo’s 86 volatility rating pairs nicely with its high momentum score. A high score here denotes “low volatility,” so the stock is rising at a steady clip.

Growth — The company’s global market and expansive range of products means the stock is set to grow exponentially in the future. VLVLY rates an 65 on growth. If you want to read more about how to target the right high-growth stocks, read Adam’s guide here.

Value —VLVLY is a unicorn stock because it rates high in momentum, growth and value. VLVY’s value rating is an 89, which means it’s “cheaper” than all but 11% of stocks we analyze using Green Zone Ratings.

To safe profits,

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

P.S. Check out The Bull & The Bear podcast every week for more picks from Adam, Matt and me. You can listen on Apple Podcasts, Spotify, Amazon and Google Podcasts. You can also catch episodes on our YouTube channel here.