Commodities — goods such as gold, oil and livestock — have never been cheaper.

But you can’t calculate the relative “cheapness” of a commodity the same way you can a stock.

A barrel of crude oil doesn’t have “earnings,” per se, so we can’t just look up its price-to-earnings ratio.

Instead, we have to view the price of commodities relative to an asset investors might otherwise invest in … like stocks.

By tracking the relationship between the price of a basket of stocks and the price of a basket of commodities over time, we can discern when one or the other is relatively cheap.

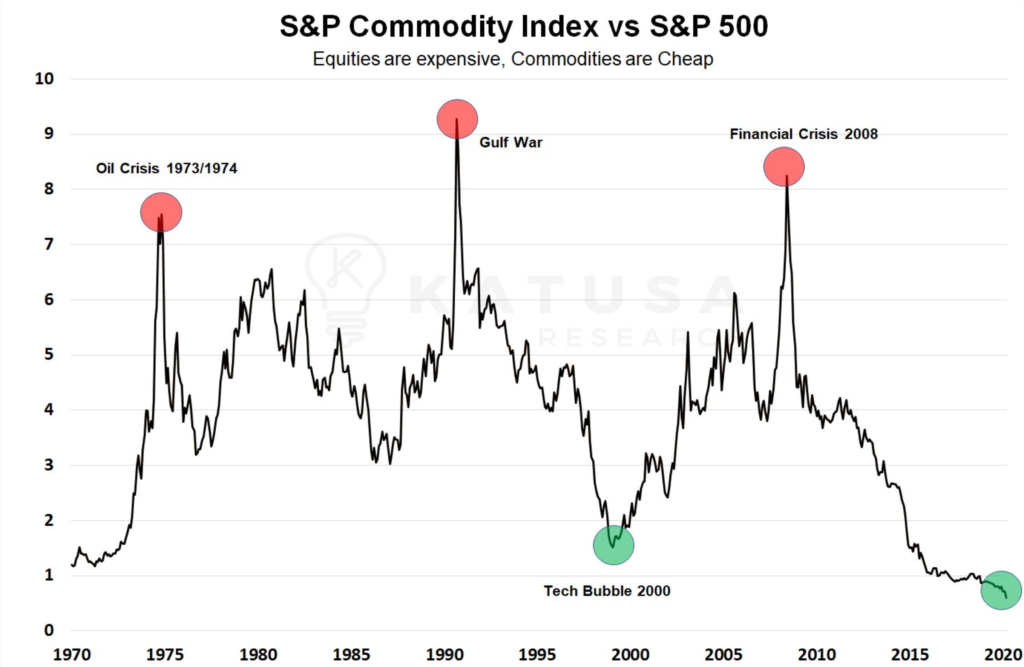

Have a look at this chart:

I maintain a version of this chart on my own analytics platform, but I like this version — credited to Katusa Research — because it highlights the major turning points in the relative valuations of stocks and commodities (the green and red dots).

As you can see, commodities have never been so cheap, relative to stocks, as they are now.

Why Commodities Are Appealing Now

I could speculate on why…

Folks have completely given up on the oil and gas industry, assuming it will go away overnight as soon as electric vehicles and renewable energy grab the baton.

Not as many anti-fiat currency investors are interested in buying gold these days — at least not the younger generation of investors — because they’re hooked on bitcoin.

And frankly, corn, wheat and soybeans just aren’t as fun to talk about when you’ve got a massive wave of “next-big-thing” technology IPOs and SPACs vying for your attention.

It’s reasonable to assume these factors have contributed to disinterest and disgust in commodities.

And with that, commodity prices have been pushed lower and lower. They’re now the cheapest they’ve been, relative to stocks, in the past 50-plus years.

You see, commodities are integral to the global economy. They aren’t going anywhere. We can’t “replace” them with technology.

And pessimism is at such an unjustified negative extreme, it’s almost guaranteed that prices must rise from here!

I mean, there are no guarantees in life and the markets. But at these levels of pessimism and valuation, it would be foolish not to make a bullish play on commodity prices.

I’ve been watching commodity prices begin to turn the corner for a few months now.

And I’ve been putting my elite Home Run Profits subscribers’ “money where my mouth is” since last year.

We’ve accrued profits of more than 14% in just over a month on a diversified energy-sector ETF … and more than 226% in just over two months on the third portion of a partial play on an oil & gas exploration company. The first third of the same play did 39% in a month and then 105% in 2 months on the second third!

I’ve also beaten the drum about the opportunity in energy commodities on The Bull & The Bear podcast.

And just this week, I’ve given my Home Run Profits subscribers another bullish commodity market recommendation — one I expect to hand us significant triple-digit profits in the months ahead. Find out more here.

A Once-in-a-Lifetime Opportunity

As I see it, the current opportunity in commodities is truly a once-in-a-lifetime type of opportunity.

And it gives you the chance to:

- Diversify a stock-heavy portfolio.

- Take advantage of dirt-cheap valuations.

- Earn S&P-beating returns in this up-trending and momentum-building market.

Of course, while my Home Run Profits subscribers started off in the energy sector, crude oil and gasoline are only part of the larger basket of commodities that I expect to rally higher this year.

And that’s why I’m recommending a broader commodity-market play via the DB Commodity Index Tracking Fund (NYSE: DBC).

This fund holds futures contracts on major commodity markets that include:

- Energy (crude, gasoline and natural gas).

- Precious metals (gold and silver).

- Base metals (copper, aluminum and zinc).

- Agriculture (corn, wheat, soybeans and sugar).

I’ve kept a close eye on this fund as it rallied off the March 2020 lows — $16.25 was the price to beat, as that represented the pre-COVID-19 peak and an area of potential price resistance.

Shares of DBC recently motored through that price level and are now trading through $17 a share.

I highly recommend adding some bullish commodity exposure to your portfolio today.

The DB Commodity Index Tracking Fund (NYSE: DBC) is a simple, one-click way to do that.

And if you’re interested in “amping up” your positioning in this space, I’d love to welcome you into my Home Run Profits family and share with you the specific commodity-market recommendations I’m making. Click here to find out more.

To good profits,

Adam O’Dell

Chief Investment Strategist

Adam O’Dell is the chief investment strategist of Money & Markets and has held the title of Chartered Market Technician for nearly a decade. He is the editor of Green Zone Fortunes, the trend and momentum options-trading powerhouse Home Run Profits and the time-tested switch system 10X Profits.