It’s Black Friday.

I’m down in Peru, and the Christmas trees are already up around town.

And the best part about being out of the U.S. right now is there’s no pressure to participate in today’s Black Friday madness.

It’s going to be a doozy … U.S. shoppers are expected to spend $800 billion shopping this holiday season.

In today’s Investing With Charles, research analyst Matt Clark and I discuss two retailers that stand to benefit the most from this spending spree: Walmart Inc. (NYSE: WMT) and Amazon.com Inc. (Nasdaq: AMZN).

Here are some highlights from my conversation with Matt:

Black Friday’s Waning Popularity

Matt: On Black Friday, even the night before, on Thanksgiving, past lines at the Walmart were massive. It’s even worse as you move into larger cities, where you have other big retailers. The lines were just huge.

Now, that is not the case.

Charles: I would like to think we have evolved as a species to no longer do the Black Friday thing, but that is not true. Black Friday just starts a month earlier now.

Matt: Exactly. Stores throw out their deals on November 1.

Charles: That’s an interesting point, though. The reason we had Black Friday before was this sense of urgency — that this is the day you need to be here because this is when it is happening. It is an event.

When you start Black Friday a month early, that sort of dissipates. You do not have that sense of urgency to get out. I would have always thought that keeping it in this fixed part in the calendar is better, but the marketing wizards must know something I don’t.

Matt: I still think there are going to be some lines, but I do not think it is going to be near as crazy as it’s been in the past. No more waking up at 2 a.m. to go stand in line.

Charles: I have never done that. I have done some things I regret in life, but waking up at 2 a.m. to go wait in line for Black Friday is not anything I have ever done.

Walmart: Strong 2020 vs. Today

Matt: We’ll look at Walmart first.

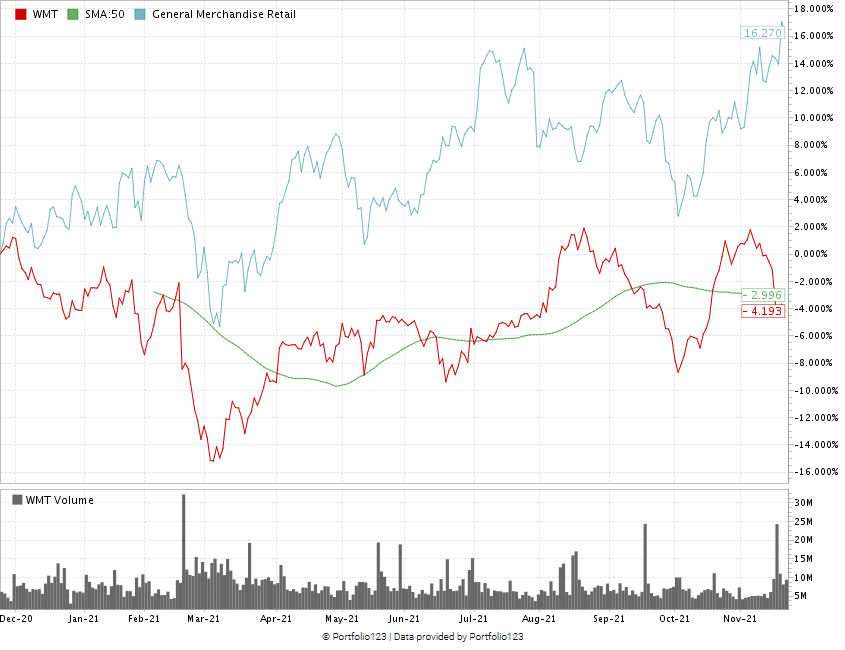

Walmart’s 12-month performance so far is not what you would expect. The stock performance is actually down about 4 % since this time last year. It is trading about 2% below its 50-day, simple moving average.

If you compare that to the general merchandise retail industry, that industry average is up 16%. So there’s about a 20% difference between how WMT performed compared to its peers.

WMT Stock: 12-Month Overview

That is not in Walmart’s favor. Is that shocking?

Charles: No, it’s not shocking at all.

Think about last year. Half of America was closed for large stretches or had reduced hours. Even if a store wasn’t officially closed, people were not going.

But Walmart sold basic necessities, so 2020 was a fantastic year for Walmart. It made hay while the sun was shining there.

Now, what happened? The stock got ahead of itself.

WMT did so well last year that it was sort of due to cool off this year. I would say this year’s stock performance is not indicative of failing business performance on the part of Walmart.

Walmart is doing what it does. It is one of the best retailers in the history of retail. Arguably until Amazon came along, Walmart was the undisputed king of retail. It manages its business phenomenally well. It’s not a question of Walmart getting it together. It is more a question of Walmart’s follow-up to a great 2020.

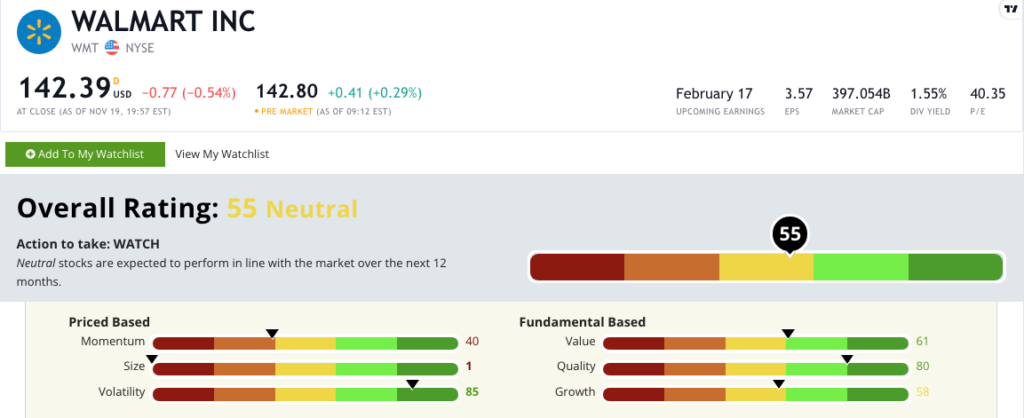

Matt: If we take a look at its Green Zone Ratings, right now, Walmart rates a 55, which is neutral.

Its size pulls it down because it has a massive market cap of almost $400 billion.

It does rate in the green in both value and quality, as well as volatility, which means the stock hasn’t moved downward in any significance. It has moved down. But it has been more of a flat movement over the last 12 months, indicated by the fact that it is only down about 4% — which, for WMT’s price of around $140-$145 a share, is not that significant.

Charles: With the volatility rating of 85, this is not a stock that is going to make you sick to your stomach. You are not going to be nervous and chain smoke watching this stock move. It is a low-volatility stock.

The value rating of 61 is not dirt-cheap by any stretch. But if you dig into those numbers, WMT trades for less than one-time sales. It trades at a retail valuation. Its valuation here is what I would consider fair for a large retailer.

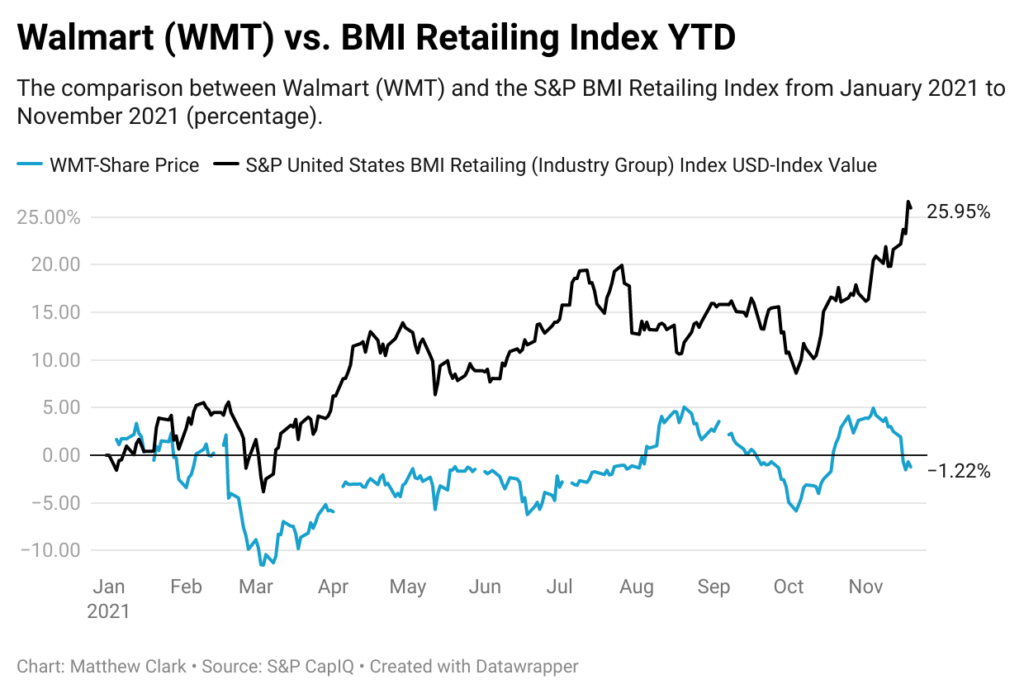

Matt: Now, the other thing that I did here is I looked at Walmart, and I compared it against the S&P BMI retailing index. This is a broader index used of S&P 500 companies, and it shows its price movement.

Looking at just year-to-date from January 1, 2021, to today, the BMI retailing index is up almost 26%. Walmart was down 1.2% in terms of comparison of that value.

So again, I think this is where we see Walmart had a phenomenal 2020.

Charles: And its peers did not. Remember, a lot of these retailers really struggled last year. Some of that out-performance is those competitors catching up.

Matt: Right. We are seeing Walmart come back down to reality a little bit, whereas its peers are now experiencing that growth.

It’s a tale of two different types of performance here.

Walmart is paring itself back from a massive 2020. Its peers are moving up after a lackluster 2020. When you compare the two, it is not fair to say that Walmart is in the dumps or anything like that.

Be sure to come back on Saturday for part two, where Matt and I will break down Amazon and tell you which stock we think is the better buy right now.

Where to Find Us

Coming up this week, Matt will have more on The Bull & The Bear podcast, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where chief investment strategist Adam O’Dell answers your questions.

You can also catch Matt every week on his Marijuana Market Update. If you are into cannabis investing, you don’t want to miss Matt’s weekly insights.

Remember, you can email my team and me at feedback@moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you! We may even feature your question or comment in a future edition of Investing With Charles.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.