Warren Buffett’s move to invest heavily in Apple is proof that the value investor’s still got it. So just how much has the tech giant made for the guru, his company, Berkshire Hathaway, and their investors?

A lot. A whole lot.

All told, the Oracle of Omaha’s big bid on the iPhone maker has made him and his conglomerate around $30 billion dollars, almost doubling his original investment.

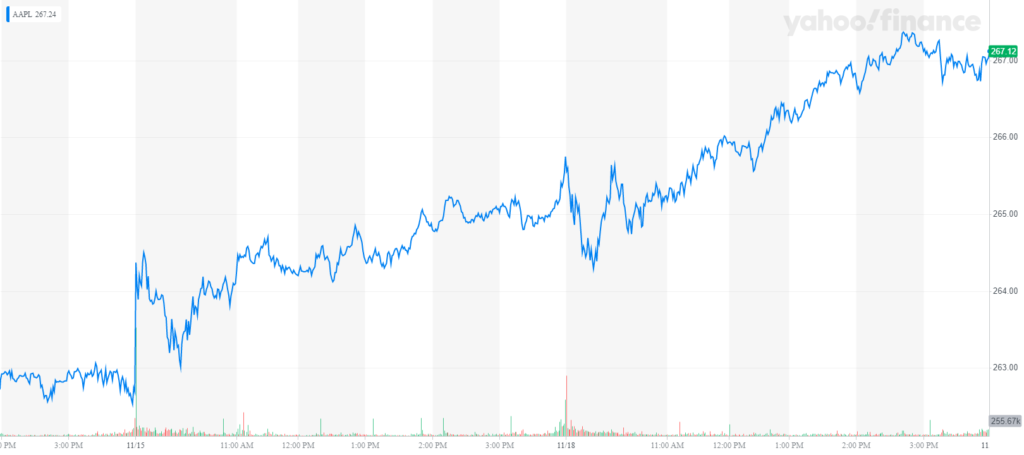

According to The Motley Fool, Berkshire’s cost basis for Apple stock was $36.044 billion at the end of 2018. A Security and Exchange Commission filing at the end of 2019’s third quarter shows the company owned 248.8 million shares of the stock. Apple (AAPL) shares were sitting at $267.10 at market close Monday, so that stock is now worth around a whopping $66.4 billion.

Berkshire’s stake in Apple now makes up almost a quarter of Berkshire’s total value, which sits at almost $236 billion, according to its latest SEC filing.

And that’s not all.

Buffett is raking in $191 million a quarter in dividends based on Apple’s $0.77-per-share payout. That’s an extra $766 million a year. Apple’s dividend rate alone has increased by 48% since the first quarter of 2016, which is when Berkshire started its endeavor into the stock.

Berkshire started off small (for Berkshire at least), only investing $1 billion initially with a purchase of 9.8 million shares, according to the 13F SEC filing in May of 2016. Buffett didn’t make the initial move, either. He revealed that it was actually one of Berkshire’s other investment managers, either Todd Combs or Ted Weschler, that bought the first shares.

Buffett was quick to see the value though and upped his stake by purchasing $35 billion more in shares between 2016 and 2018.

“Apple strikes me as having a sticky product, and an enormously useful product to people that use it,” Buffett said in an interview with CNBC.

The value investor has been wary of investing in tech in the past, citing a lack of familiarity in the sector. Berkshire bucked that trend again earlier this year with big stake in tech and retail giant Amazon (AMZN), which was once again a suggestion from another manager within the firm.

Ultimately, though, the Apple win is going to be hard to beat.