Even the best in the business make mistakes sometimes.

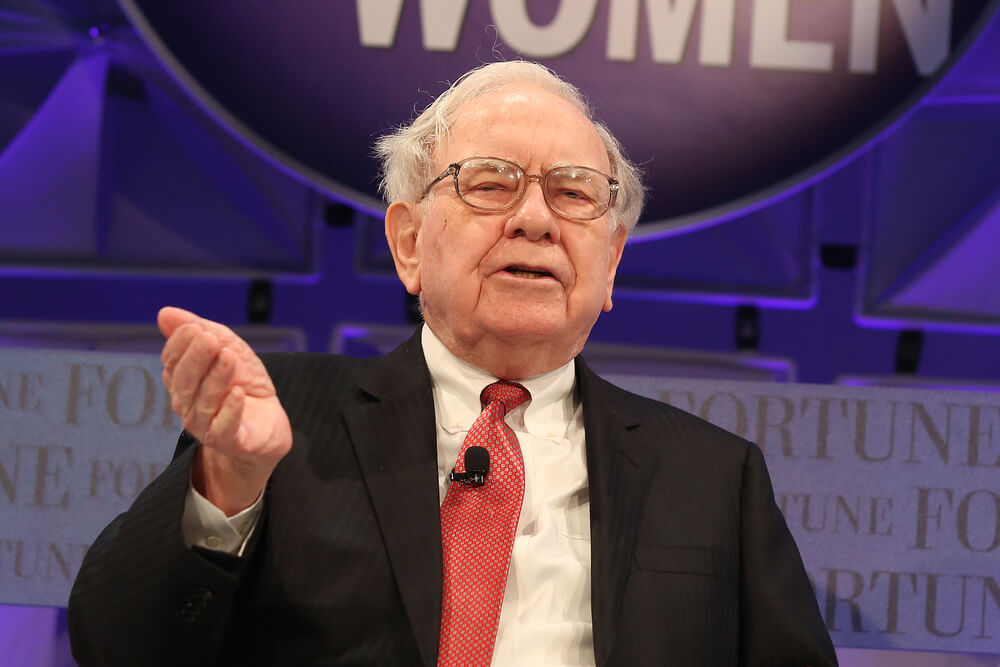

One mistake super investor Warren Buffett, and his company Berkshire Hathaway, made is proving costly as plummeting shares in The Kraft Heinz Co. have lost more than $5 billion this year, according to CNBC.

Shares in Kraft Heinz fell 14% at one point Thursday to a record low after a weak quarterly earnings report. Shares were still down 8.6% at market close.

The company that makes Oscar Mayer hot dogs, Kool-Aid, Heinz ketchup and Velveeta took charges in excess of $1 billion in the first half due in part to the “perceived risk” to the value of the company during a very rough year in which its stock has been cut in half.

Kraft earned 37 cents per share generating $6.4 billion in revenue during the fiscal second quarter, but analysts were expecting earnings to be around 75 cents and $6.58 billion revenue, according to Refinitiv.

Berkshire Hathaway owns a big chunk of those stocks, too. Its 325 million shares represent 26.7% of Kraft Heinz, and the value of those stocks has dropped from just over $14 billion to around $8.7 billion in 2019 alone. That’s roughly 37% in losses on one investment.

It doesn’t help, either, that Kraft Heinz has such a prominent place in Berkshire Hathaway’s portfolio where it is currently the sixth-largest holding, according to CNBC. Buffett admits that he made a mistake when Berkshire teamed up with 3G to purchase Heinz for $23 billion back in 2013.

“I made a mistake in the Kraft purchase in terms of paying too much,” Buffett said.

Buffett built his investing career on buying into well-known brands at prices that make sense, but sometimes it just doesn’t work out. This isn’t the first time the Kraft Heinz deal has come back to bite Buffett, either. Back in February, Berkshire Hathaway lost a staggering $4.3 billion in one day of trading after Kraft Heinz reported a string of bad news including an investigation by the Securities and Exchange Commission.

The Associated Press contributed to this article.