It’s been called “Woodstock for capitalists.”

Thousands converge on Nebraska for a weekend of market musings from the Oracle of Omaha himself, Warren Buffett.

I’m talking about the Berkshire Hathaway annual shareholder meeting, of course.

I won’t focus so much on what Buffett said in today’s Investing With Charles. To read my takeaways on that front, click here.

Instead, Research Analyst Matt Clark and I want to dive into how Buffett approached his conglomerate’s portfolio.

Let’s see what’s changed and if any of these stocks are a buy using our Stock Power Ratings system as a guide.

Here are highlights from part of our conversation. Watch the full video above.

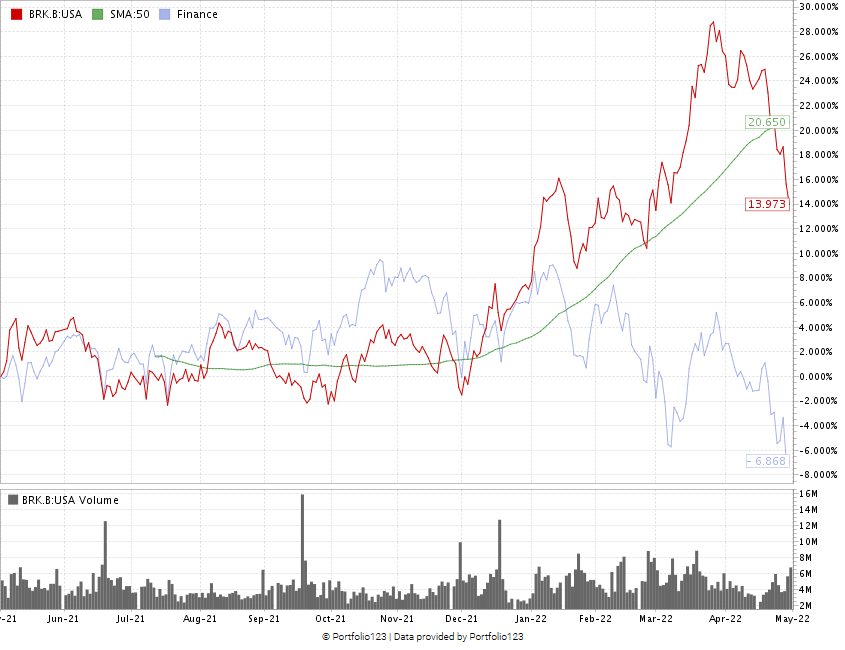

BRK.B Is a Solid Stock

Matt: Let’s start off by looking at Berkshire Hathaway Inc. (NYSE: BRK.B). Here’s that stock chart.

BRK.B Wasn’t Immune to the Sell-Off

The stock (red line) reached a 52-week high back in March. It’s dropped a little bit, but it’s up around 14% over the last 12 months. It’s still beating the pants off the broader finance sector (blue line).

The stock is trading below its 50-day simple moving average, but I think a lot of that has to do with the big run-up it had into March and then the subsequent market headwinds.

Berkshire Hathaway rates a 95 overall in on our Stock Power Ratings system.

We’ve got a 94 on momentum, as we saw that big uptick leading into the March 52-week high. Volatility is at 97 because the stock moves without a lot of bounce.

Charles: That’s part of the appeal of Berkshire Hathaway. This stock is rock solid, with a balance sheet that is unassailable. It’s a company that should survive the apocalypse… If Russia finally hits the button and nukes us, it’s going to be a world of cockroaches, rats and Berkshire Hathaway.

Matt: What an interesting party to be a part of.

BRK.B rates a 95 on our quality metric and an 89 on growth. Value’s at an 81. I think that’s going to come back up a little bit after this backslide of the stock.

Size is a 1. This is a massive company, so it’s to be expected. We can kind of discount size, especially when BRK.B scores that well on other factors.

So Berkshire is a strong stock, and I agree with you. I think it’s going to maintain that strength going forward.

Now let’s look at how its portfolio has shifted in recent months.

Berkshire’s Biggest Bet: Energy

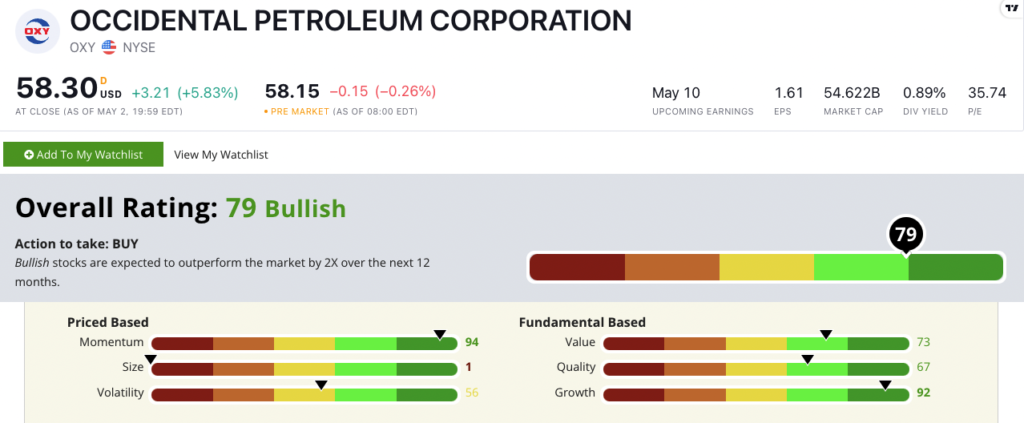

Matt: I want to start with probably the biggest two stocks that Berkshire Hathaway added shares of. The first one being the oil and gas company, Occidental Petroleum Corp. (NYSE: OXY).

I’m not sure exactly the percentage that Berkshire increased its stake, but it was significant enough to draw out the financial media.

If we look at Occidental right now, in terms of our Stock Power Ratings system, it’s a 79. We’re “Bullish” on it.

It’s set to beat the market by at least two times over the next 12 months.

OXY has strong momentum and growth, both rating in the 90s. It’s another big company, so size is going to take a hit here. Value and quality are kind of in that middle range, but still strong.

Volatility is kind of in that neutral area.

That’s because we’ve seen energy stocks move quite a bit lately. Especially with the Russian invasion of Ukraine and higher inflation.

Look at the stock chart here:

OXY’s Huge Jump Higher

Occidental is up about 123% over the last 12 months, while the broader energy sector is up about 54%.

So Occidental is very strong, especially compared to its peers.

Charles: Before I talk about the stock, I want to get a bit more of the big picture.

Our Stock Power Ratings system is divided between three technical indicators and three fundamental indicators. It’s half fundamental, half technical.

So we always assume Warren Buffett is the fundamental guy. He’s the valuation guy that doesn’t look at stock charts or do technical analysis.

That’s true to a degree.

Buffett is not a chart guy. He kind of dismisses that aspect. But he does focus on one aspect of technical analysis. Over his career, Buffett has had a pretty strong preference for low-volatility stocks.

What he figured out a long time ago was that you need to find good growth stocks that have a long runway in front of them. You buy them at a reasonable price and you focus on those that have lower volatility.

So that was Berkshire Hathaway’s and Buffett’s gig. He had this insurance float money to play with and he would kind of bet the farm on good growth stocks trading at a reasonable price that don’t move that much. That was his bread and butter trade there.

And Occidental basically fits that mold.

It’s funny. Buffett’s made a couple of significant pivots over the last couple of years. He made a big pivot to technology, which was something that he’s never really done at this scale.

And then secondly, over the last couple of years, he’s really pivoted hard to energy. I think the proof is in the pudding. That was a good move.

He’s done well on Occidental, and I don’t see him getting rid of it anytime soon.

Buffett’s Other Energy Bet: Chevron

Matt: And the other one here that drew some oohs and aahs a bit was his increased stake in Chevron Corp. (NYSE: CVX).

Managing Editor’s Note: To see if Chevron is a top stock to buy based on its Stock Power Rating, click here to read about it in Charles’ most recent Dividend of the Week piece.

Charles: You, myself, Adam O’Dell, we’ve been bullish on energy for a while. Apparently, we’re in elite company with Buffett.

Matt: Feeling pretty good about myself about that right now.

Charles: Feeling pretty good right now.

Yeah, nobody wanted to touch energy. And Buffett was one of the first big investors to jump in with both feet.

It goes to show that being independent and willing to look beyond the fears dominating the market today pays off. Look at the numbers, be objective and just keep a level head.

How Can We Emulate Buffett’s Temperament?

Charles: As individual investors, we can do boneheaded things.

Having a position size that’s too big is an easy one to do. If you have too much of your capital at risk in a single stock, it’s hard to stay emotionally detached and objective.

So if you want to be like Buffett, you want to be Cool Hand Luke here. Never let them see you sweat. I’m mixing metaphors, but you get the idea.

If you want to have that Buffett demeanor of not getting nervous or scared, the key is don’t overleverage your portfolio. Don’t have so much at risk that you start getting that feeling in your chest where you freak out.

Simply having that right portfolio size where you can sleep at night… That’s step one to being like Buffett.

A plan helps with this as well.

Buffett managed to become a legend because he had a plan and stuck with it. So find a good plan and do the same.

There are going to be times where it’s difficult, but stick with your plan and have discipline. Follow that plan and you will be successful. We can’t all be Buffett, but we can be successful.

Matt: And if you’re struggling with what that plan should look like, I encourage you to check out Green Zone Fortunes.

Again, Charles touched on it… Adam, Charles, myself and our entire team are bullish on energy, even before it was en vogue to be bullish on energy.

We’ve got a lot of great plays in the model portfolio right now and we provide you with that road map and stock analysis.

If you want to find out more, click here to watch Adam’s “Infinite Energy” presentation now.

Managing Editor’s Note: Click here to watch the rest of Investing With Charles. Matt and Charles look into two of Berkshire’s other biggest holdings, Apple Inc. (Nasdaq: AAPL) and Coca-Cola Co. (NYSE: KO) to see if they are solid buys right now.

Where to Find Us

Coming up this week, Matt will have more on The Bull & The Bear podcast, so stay tuned.  Don’t forget to check out our Ask Adam Anything video series, where Chief Investment Strategist Adam O’Dell answers your questions.

Don’t forget to check out our Ask Adam Anything video series, where Chief Investment Strategist Adam O’Dell answers your questions.

You can also catch Matt every week on his Marijuana Market Update. If you are into cannabis investing, you don’t want to miss Matt’s weekly insights.

Remember, you can email my team and me at Feedback@MoneyandMarkets.com — or leave a comment on YouTube. We love to hear from you! We may even feature your question or comment in a future edition of Investing With Charles.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.