I’ve spilt a lot of ink parsing Warren Buffett’s comments from the Berkshire Hathaway annual meeting over the weekend — and with good reason. The man’s track record speaks for itself. Not too many people can claim their portfolio is up 3.6 million percent.

Believe it or not, as much as I respect Buffett, I don’t recommend we copy his investing moves verbatim. His reasons for buying may not align with our own. Remember: He’s running an institutional portfolio for an insurance conglomerate, not a personal IRA account!

That said, I do believe that Buffett’s portfolio is a nice starting point for further research.

A Buffett-Backed Dividend: Chevron Corp.

Let’s dive in and give energy supermajor Chevron Corp. (NYSE: CVX) a closer look.

Chevron is a top-ten holding for Buffett, and Berkshire Hathaway owns a whopping 38 million shares worth north of $25 billion at this point.

At current prices, Chevron sports a dividend yield of 3.6%, making it one of the highest yielders in the S&P 500. And the stock has hiked its dividend for 35 years in a row … and counting!

Buffett isn’t the only guru that sees value in Chevron. My friend Adam O’Dell wrote favorably about the stock back in March, pointing to its fantastic score in his proprietary Stock Power Ratings System.

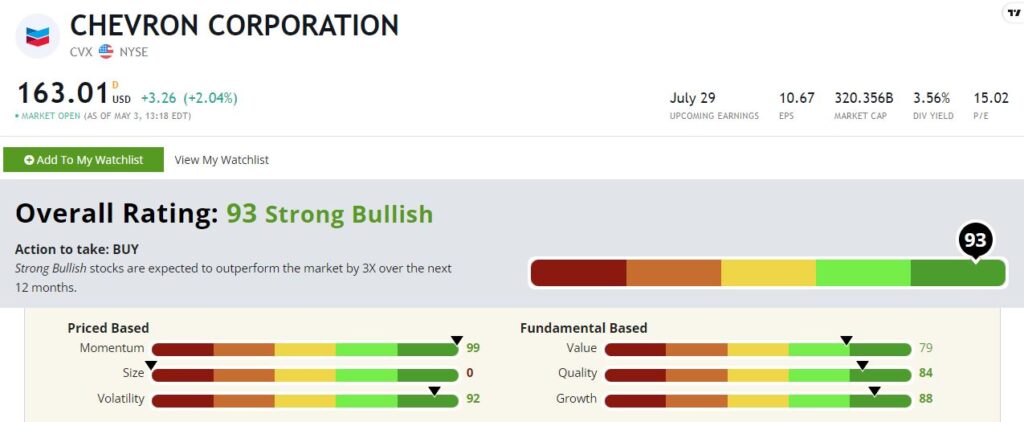

And Chevron looks even better today than it did back then! It’s now boasting a 93 overall in Stock Power Ratings.

Let’s dig deeper.

Chevron’s Stock Power Rating

Momentum — Chevron rates highest on momentum, with a factor score of 99.

The stock market is in the midst of a nasty correction, and tech stocks (measured by the Nasdaq) are well into bear market territory. Energy has been a rare bright spot in an otherwise very difficult market. CVX is up around 37% year to date, while the Nasdaq is down 20% in comparison.

Volatility — The stock also rates well on our volatility factor, with a score of 92. That means it’s less volatile than 92% of the more than 8,000 stocks we rate.

Energy stocks can be wildly volatile as the past decade has made clear. But Chevron’s diversified business model helps here. As an integrated major, Chevron does everything from exploration to operating retail pumps. This diversification helps it weather difficult conditions … and the past decade has been a string of difficult situations.

Growth — Chevron’s high growth factor of 88 is impressive when you consider just how difficult the conditions of the past decade have been for the oil and gas industry. Chevron’s size and scope were key here. While weaker rivals struggled, Chevron managed to grow due to its financial strength.

Quality — Crude oil is a commodity. My oil is no different than yours. One barrel of West Texas Intermediate is as good as another.

Yet despite the lack of differentiation, Chevron has managed to post a solid quality factor rating of 84.

Profitability carries the most weight here, which in turn is influenced by branding and competitive position. Chevron’s strong showing here is all the more impressive when you consider just how unremarkable its product is.

Value — Chevron isn’t as cheap as it was several months ago. But with a value factor rating of 79, it still looks pretty darn cheap. So don’t be put off by the stock’s recent run-up. It has a lot further to run before I’d start to worry about valuation.

Size — Chevron is a massive company with a market cap just under $320 billion. It’s no surprise that CVX’s size rating rounds down to zero.

That’s OK. In the energy patch, bigger is better.

Bottom line: We shouldn’t automatically buy something just because Warren Buffett does. But if the Oracle likes it, we should at least give it a good look and try to figure out why.

I turned to our Stock Power Ratings system — and in this case, it seems that we’re singing from the same songbook as Buffett!

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.